8 min read

•Positioned for growth in a lower-emission future

- We’ve built a robust business and investment portfolio that is positioned to grow in any energy transition.

- Our company-wide transformation, focused on three core businesses and centralized organizations, is driving better environmental performance and earnings power.

- Our Upstream and Product Solutions businesses are growing production of energy and products people need every day, while working to lead the industry in lowering emissions intensity.

- As a technology company that transforms molecules, we’re advancing new technology-driven businesses with the potential to add ~$3 billion to our earnings by 2030.1

8 min read

•Navigate to:

ExxonMobil is a company with an unmatched combination of competitive advantages, which puts us in a unique position to help meet the world’s energy and product needs and reduce emissions – now and in the future.

We’re working to play a leading role regardless of how an energy transition unfolds. Across our portfolio of opportunities, we retain investment flexibility to maximize shareholder returns.

Our company-wide transformation has improved our earnings power, driving efficiencies that better leverage the scale of our integrated company. At the same time, we centralized our core functions and capabilities. This has improved our effectiveness and ability to allocate resources, drive continuous improvement, and grow value.

-

Our purpose

Create sustainable solutions that improve quality of life and meet society's evolving needs. -

Our vision

Lead industry in innovations that advance modern living and a net-zero future.

Core Businesses

Upstream produces the oil and natural gas that strengthen energy security, while focusing on achieving the lowest emissions intensity in the industry.

Product Solutions is developing high-value and innovative fuels, plastics, lubes, and other products and materials the world needs – with a refining circuit twice the size of other IOCs.

Low Carbon Solutions is investing in technologies to help reduce our own and society’s GHG emissions.

Upstream: Meeting energy demand and lowering emissions intensity

We are in a strong position to help meet the world’s demand for oil and natural gas over the next decade and beyond. With our industry-leading reliability and excellence in execution, we’re focused on growing value by increasing high-value production at a low cost of supply, reducing our emissions intensity, and driving additional structural cost savings.

We’ve identified more than 150 potential modifications to reduce GHG emissions across our upstream operated assets, including efficiency measures and equipment upgrades. Some examples include installing carbon capture and storage technologies at operations in the United States and Canada; electrifying our Permian operations; and replacing pneumatic devices to eliminate fugitive methane emissions.

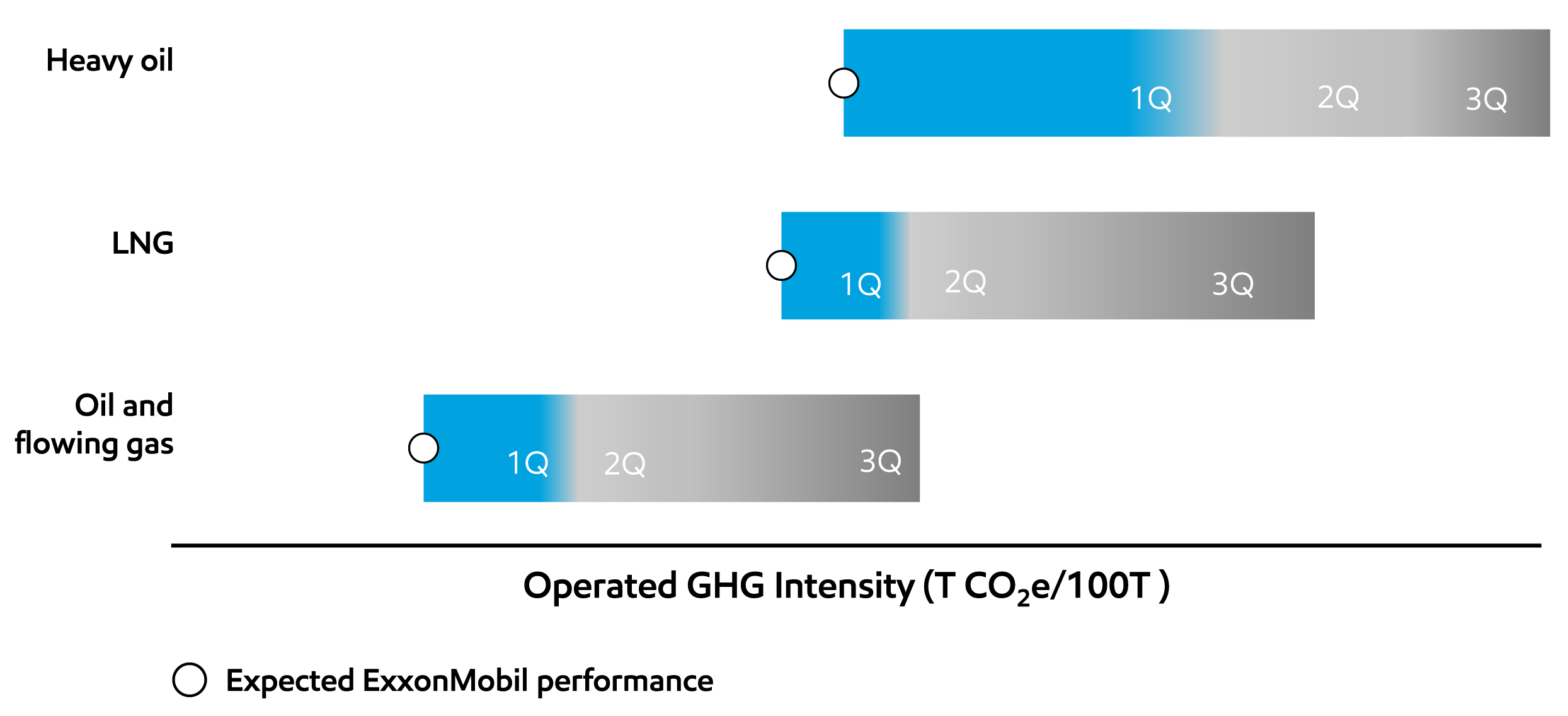

We expect that each of our asset classes will deliver top-quartile Scope 1 and 2 emissions intensity by 2030, as shown in the chart below.2

Unconventional operations

A few years ago, we announced industry-leading plans to achieve net-zero Scope 1 and 2 GHG emissions in 2030 for our operated unconventional assets in the Permian Basin. Last year, we acquired Pioneer Natural Resources. Following the merger, we maintained the net-zero plans for our heritage assets, while accelerating Pioneer’s net-zero goals in the basin from 2050 to 2035 – 15 years faster.

We eliminated routine flaring in our heritage operated assets in the Permian Basin in 2022 in line with the World Bank’s Zero Routine Flaring Initiative.4 We’re also making good progress to reduce methane intensity, electrify our operations, and use energy from renewable and lower-emission sources.

In 2024, our facilities in Poker Lake, New Mexico, received a Grade A from MiQ, an independent validator of methane management, for the fourth year in a row.

Emission-reduction roadmaps for our operations were completed in 2022. We’re now working to apply this process to Pioneer’s assets. This includes evaluating lower-emission energy, electrifying fracking operations, improving processes, reducing methane emissions, and eliminating routine flaring.

Liquefied natural gas (LNG)

LNG is an important lower-emission option that can replace coal in power generation. We’re continuing to develop our low-cost-of-supply LNG portfolio, and we are on track to nearly double our global LNG supply to more than 40 million tons per year by 2030. We have projects in the United States, Papua New Guinea, Mozambique, and Qatar. Our operated LNG assets are expected to be among industry’s lowest in GHG intensity by 2030.5

Deepwater

Our deepwater oil and natural gas developments support our 2030 GHG emission-reduction plans.

Our Guyana developments, for example, are among the lowest emissions-intensity in our portfolio. Our FPSOs there have zero routine flaring – approximately 99% of the gas produced is used for fuel or reinjected. Our Prosperity FPSO and Liza Unity FPSO are two of the world’s first to earn the SUSTAIN-1 notation by the American Bureau of Shipping in recognition of their design, documentation, and operational procedures.

Product Solutions: Innovative products critical to modern society

Our Product Solutions business makes and sells products needed for modern life. And there is increasing demand for high-value products with lower life-cycle GHG emissions. Making these requires innovation in the design of our products and in our manufacturing processes.

Our refining and chemicals businesses each operate assets that are among the lowest in the industry for GHG intensity.6 Through 2030, we expect to more than offset emissions from new operated facilities needed to meet growing demand. Among other actions, our emission-reduction plans consider:

- Fuel switching to hydrogen.

- Carbon capture and storage projects in Texas and the Netherlands.

- Energy attribute certificates and long-term power-purchase agreements

- Energy efficiency projects.

- Conversions of select refineries to terminals.

Energy products

Our Global Outlook shows that demand for energy-dense, lower-emission fuels is expected to grow rapidly.8 This increase will be driven by the hard-to-decarbonize commercial transportation sector that includes aviation, marine, and heavy-duty trucking.

Across our portfolio, we have the flexibility to shift production to help meet this demand. Around 85% of our manufacturing capacity is co-located in large, integrated sites that can make this switch. As demand for conventional gasoline and diesel declines, we can repurpose assets to make other high-value products like chemicals, lubricants, and lower-emission fuels.

Chemical products

Cellphones, medical and hygiene supplies, diapers, packaging and storage to preserve food – all of these are needed for modern life. That’s why global chemical demand is growing.9

And all of these products are made from materials like those we make in our Chemicals business. We have world-class technology centers in Texas, Belgium, and China, where our scientists research the latest polymers, plastics, and products to meet the needs of tomorrow.

As population and prosperity keep rising around the world, demand for performance chemicals is expected to be strong. This includes the performance polyethylene and polypropylene that we make.

Our customers use these materials in products that improve quality of life – in a way that can also support their efficiency and emissions objectives. Many of the products in our Chemicals portfolio are used to advance sustainability benefits, such as agricultural films that increase crop yields and packaging films that extend shelf life and decrease food waste. And our VistamaxxTM performance polymers make different kinds of plastic more compatible so they can “mix in the melt” and don’t have to be separated for recycling.

We continue to grow the supply of performance chemicals through large, competitively advantaged investments such as:

- The Gulf Coast Growth Venture (GCGV) in Corpus Christi, which has been up and running since 2021, and now uses utility-scale solar power.10 GCGV has a 1.8 million-metric-ton-per-year ethane steam cracker, two polyethylene units that can produce up to 1.3 million metric tons per year, and a 1.1-million metric-ton-per-year monoethylene glycol unit.

- Our performance polypropylene project in Louisiana, which had its second full year of operations, added production capacity of 450,000 metric tons per year along the Gulf Coast.

- The Baytown, Texas, chemical expansion that started up in 2023, which will have the capacity to produce about 400,000 metric tons of VistamaxxTM polymers per year and about 350,000 metric tons of ElevexxTM linear alpha olefins per year.

- A lubricant manufacturing plant we’re building in India that will have capacity of 159,000 kiloliters of finished lubricants a year.

- The chemical complex we’re building in China that includes polyethylene and polypropylene units more than twice the size of U.S. units and a flexible feed steam cracker with a capacity of about 1.6 million metric tons per year. up

Key plan activities to grow high-value products11

Specialty products

We are rapidly advancing new businesses like ProxximaTM resin systems and carbon materials.

We’ve demonstrated the value-in-use for our ProxximaTM thermoset resin – a revolutionary material that is stronger, lighter, and more corrosion-resistant than conventional materials. The applications include everything from high-performance coatings and injection molding to areas where traditional thermoset resins struggle to compete, such as rebar, structural components for automobiles, and new high-strength EV battery cases.

In our Carbon Materials Venture, we see a massive opportunity in the market for synthetic graphite for EV battery anode materials. Our aim is to produce world-scale quantities of next-generation graphite, potentially providing up to a 30% improvement in EV battery range, as well as faster battery charging.

With our technology, we have the potential to become a large domestic supplier of yet another key component of EVs. That’s on top of our lithium and ProxximaTM offerings, as well as the plastics, lubricants, and cooling fluids that we provide today.

Demand for lubricants is expected to remain strong and grow in the industrial, aviation, and marine sectors. Our Singapore Resid Upgrade Project will turn bottom-of-the-barrel products into more valuable lubricant basestocks and fuels using an innovative technology application. This investment will position us to better meet demand growth in Asia while displacing higher carbon-intensity products in the marketplace.

See our 2024 Corporate Plan.

Innovative solutions to improve modern life

- Polyethylene (PE) plastic packaging has lower life cycle GHG emissions than most alternatives – in fact, the market mix of alternatives in the U.S. and EU results in 2-2.5 times more GHG emissions than PE plastic.12

- ExceedTM XP enables up to 30% thinner plastic packaging versus conventional plastics for equivalent performance.13

- ProxximaTM systems outperform alternatives in applications like concrete reinforcement, wind turbine blades, subsea pipeline coatings, and vehicle parts with significantly reduced emissions.14

Total vehicle product solutions improve transportation efficiency

- Plastics can enable lighter vehicles, and 6%-8% fuel efficiency improvement for every 10% reduction in vehicle weight.15

- Halobutyl rubber improves air retention in tires, which can increase electric vehicle range by up to 7%.16

- Mobil 1 ESP x2 0W-20 engine oil helps provide up to 4% fuel economy improvement.17

- Renewable diesel may reduce carbon emissions by up to 80% compared to conventional diesel.18

- Marine biofuel can reduce carbon emissions by up to 30% compared to conventional marine fuel.19

Reliable solutions for industrial efficiency

- Mobil DTE 10 ExcelTM Series provides up to 6% improvement in hydraulic pump efficiency vs. Mobil standard hydraulic fluids.20

- Mobil SHCTM 600 Series provides up to 3.6% energy efficiency gain vs. conventional mineral oils.21

- Mobil SHCTM Gear WT helps reduce oil consumption and maintenance costs through extended oil life and drain intervals.22

Testing the strength of our strategy and portfolio23,24

Our steadfast strategy is a bold blueprint to win, irrespective of pace and direction of the energy transition. We use the projections in our Global Outlook as the basis for our business planning, and using the lower-demand assumptions in extreme third-party scenarios like the International Energy Agency’s (IEA) Net Zero by 2050 scenario can demonstrate the strength of our portfolio and plans.

We modeled a robust hypothetical business and investment portfolio based on the IEA NZE scenario, using the latest assumptions that would significantly impact our modeling outcomes. We enlisted an independent third party, Wood Mackenzie Inc., to audit our portfolio model.

Our modeling included:

- Existing operations – including our Upstream, and Product Solutions businesses and plastics production.

- The Denbury and Pioneer acquisitions.

- Future opportunities in oil, natural gas, fuels, lubricants, chemicals, lower-emission fuels, hydrogen, lithium, ProxximaTM; thermoset resins, carbon materials, and carbon capture and storage.

We used IEA NZE assumptions to inform our own demand and pricing assumptions in the model, including:

- Oil prices decline to $25 per barrel by 2050; natural gas prices decline to $2-$4.60 per million British thermal units depending on region (both in real terms, 2019 USD).

- Oil and natural gas demand declines from 53% of total primary energy in 2020 to 14% by 2050.

- Chemicals demand increases by 30% from 2020 to 2050, with 80% of production leveraging carbon capture and storage or hydrogen technology integration.

- Carbon prices increase to $250 per metric ton in advanced economies, $200 per metric ton in China, Russia, Brazil, and South Africa, and $55 per metric ton in other emerging markets and developing economies (real terms, 2019 USD).

- Carbon capture and storage volumes expand rapidly from 40 million metric tons in 2020 to more than 6 billion metric tons in 2050, supported by a range of measures to increase investment.

- Lower-emission fuels, in which the IEA includes liquid biofuels, biogas and biomethane, and hydrogen-based fuels, increase from 1% of global final energy demand in 2020 to 20% in 2050.

- Hydrogen production increases by a factor of six, from 87 million metric tons in 2020 to 528 million metric tons in 2050.

We assumed that current prices decline to conform to IEA published prices by 2030 and that the path is linear between the price assumptions that IEA provided by decade thereafter. The IEA NZE scenario did not provide assumed margins for our whole business, so we filled in the gaps:

- Traditional oil and gas: We assumed margins will decline to the lowest level needed to meet IEA NZE oil demand.

- Chemicals: We modeled margins to support investment necessary for demand growth, declining over time but partially offset by inflation.

- Low Carbon Solutions: Used IEA NZE Assumptions and assumed our investments would attract returns consistent with business projections.

We also assumed:

- Resulting market position for existing and new areas as a percentage of demand under IEA NZE is in line with our current market positions in existing businesses.

- Investment to abate estimated GHG emissions from our businesses by 2050.

- Annual inflation of 2.5%.

- Total capital expenditures through 2050 is sufficient investment to maintain market share.

Our testing shows a robust business through 2050, even under an extreme scenario

The chart illustrates potential changes to our business portfolio through 2050 from the modeling. It shows that we have flexibility to grow cash flows under the IEA NZE assumptions through less investment in oil and natural gas and more investment in chemicals, carbon capture and storage, lower-emission fuels, and hydrogen.

Through 2030, our modeling shows several considerations for our business under the IEA NZE scenario.

Upstream

- Focus on competitive resources: Prioritize assets with shorter production cycles (e.g., Permian) and lower cost of supply (e.g., Guyana).

- Cease exploration in new basins: Reduce spending on new developments if long-term decline in demand and pricing materializes.

- Optimize long-term production: Focus on cost-efficient, low GHG-emissions-intensity assets to meet global demand, which IEA NZE assumptions set at 24 million barrels of oil and 170 billion cubic feet of natural gas in 2050.

Product Solutions

- Reconfigure manufacturing: Shift sites to meet demand for non-combusted products and lower-emission fuels. Current examples include renewable diesel investments in Canada and Norway.

- Support chemicals demand: Invest in value-accretive projects (e.g., U.S. Gulf Coast, Singapore, China). Current examples include expansions underway in these regions.

- Additional integration: Carbon capture and storage and/or fuel switching with hydrogen technology would further accelerate lowering GHG emissions intensity, with less advantaged sites potentially closed or converted to terminals.

Low Carbon Solutions

- Capitalize on growth potential: Explore significant opportunities in lower-emission fuels, carbon capture and storage, new materials and products, and hydrogen.

- Leverage core capabilities: Utilize subsurface expertise, project scaling, existing assets, and skilled workforce to compete effectively.

- Increasing carbon price: Would support attractive investments, boosting cash flow in Low Carbon Solutions.

- Focus on key projects: Scale projects like lower-emission fuels, hydrogen, geologic storage for CO2, and new industrial clusters to advance infrastructure opportunities and position us as a partner of choice for potential customers.

Longer-term through 2050, the carbon price and demand for decarbonization options would continue to grow rapidly in this scenario, leading to a significant shift in our capital spend to further scale carbon capture and storage and hydrogen.

Since the initial release in 2021, the IEA has continued to make updates to its NZE scenario. The IEA also updates energy-related CO2 emission levels, as well as the critical technologies and clean energy investments it assumes necessary in net-zero pathways. Fundamentally, an update that increases improvements needed while shortening the time allowed means that each iteration of the NZE's methodology leads to assumptions that increase the importance of lower-carbon solutions. These scenario updates have not changed the outcome of our assessment.

Assessing potential impacts

The following is intended to address the potential impacts through 2050 to our proved reserves, resources, evaluation of asset impairments, and other measures, considering the discussed scenarios’ ranges of oil and natural gas demand.28

We took a portfolio approach and did not model individual assets. We believe taking a portfolio approach is the most appropriate way for ExxonMobil to provide transparency in our analysis of the potential impacts of an energy transition scenario, including the IEA NZE. For more information on scenarios that inform our plans, read our Global Outlook.

An energy transition will unfold at an uncertain pace, determined in part by variation in policy by region and advancements in technology. As an integrated company with assets around the world, we have seen that economic events and trends may have a negative effect on one asset and an offsetting positive effect on others, with a minimal net effect on the full portfolio. Additionally, the interplay among assets in the market and the optionality of assets in a specific region can be misinterpreted if assets are analyzed in isolation.

Every asset responds differently to economic signals, technology evolution, commodity prices, and other variables. Even where global benchmark prices are given, local prices, including differentials, are influenced by external factors that cannot be reliably predicted. Any disclosure that doesn’t account for the net effects of these variables or ignores macro factors like energy reliability and security wouldn’t be meaningful.

Other companies have different asset portfolios, strategies, markets, and regulatory realities. These lend themselves to different approaches and may lead to different results. Their results may not be comparable to ours, especially if they assume lower production or leaving oil and natural gas in the ground entirely.

We believe our approach is industry-leading, because it provides a clearer view of enterprise value of our company, expertise, and opportunities than hypothetical noncash accounting measures dependent on asset-specific assumptions not provided by the IEA NZE.

Use of sensitivity analysis

Sensitivity analysis provides greater perspective on how variations to our Global Outlook assumptions could affect projected energy supply and demand. Analyzing these sensitivities involves evaluating possible technology advancements and their potential impact on energy supply and demand. This results in a range of potential low- to high-demand outcomes for certain energy sources. The projections yielded by sensitivity analysis do not represent our viewpoint or the likelihood of these alternatives but can provide context.

Proved reserves

Each year, we assess our proved reserves and report them in our annual Form 10-K, following the rules set by the U.S. Securities and Exchange Commission. According to our 2024 production schedules, a substantial majority of our proved reserves at the end of 2024 are expected to be produced by 2050. The rest are generally linked to assets where most development costs are incurred before 2050. While these reserves might face more stringent climate-related policies in the future, advancements in technology and strategic investments could help reduce GHG emissions and associated costs. These mature assets generally have a lower risk profile due to the experience and technical knowledge gained over decades of production.

Resources

We have a large and diverse portfolio of undeveloped resources. These provide us the flexibility to develop new supplies to meet future demand. We work to enhance the quality of this resource base through:

- Successful exploration.

- Application of new technology.

- Acquisitions.

- Divestments.

- Development planning efforts.

- Appraisal activities.

The underlying economics of commercializing resources depend on factors we assess annually. Options include developing the resource, selling it, or exiting it. All investments are tested over a wide range of commodity price assumptions and market conditions, including scenarios like the IEA NZE.

It is impossible to know which specific assets will ultimately be developed, given the array of dynamic factors that influence governments’ diverse approaches to regulation and industry’s commercial decisions. Diverse, long-lived assets are a hedge against instability.

Some examples:

- Regional policies that constrain supply in one area could enhance returns in others.

- Under IEA NZE assumptions, some higher-cost assets could become disadvantaged without active portfolio management.

- Geopolitical conflict in one region could advantage resources in another.

We’re confident in our ability to apply high-impact technologies to position our portfolio to compete successfully in a broad range of scenarios.

Plastics

Lower-demand scenarios like the IEA NZE project growth in plastics.

Pew’s 2020 Breaking the Plastic Wave report introduces several scenarios for addressing plastic waste, including the System Change Scenario (SCS), their lowest demand scenario. Like the IEA NZE, it starts with an outcome and a timeframe and works backward from it to propose pathways to get there. And like the IEA NZE, society is not on the Pew SCS pathway.

The SCS covers only a subset of plastics,29 but using their assumptions for the full plastics market shows demand ranging between 20% growth and 10% decline from 2020 to 2040.30 Even at the low end, this puts plastics demand similar to what it was in 2017, when the average earnings of our Chemicals business were more than $3 billion.31

Plastics demand

MTA polyethylene and polypropylene

In the same report, Pew shares their Current Commitments Scenario, focused on public and private sector commitments made between 2016 and 2019. If all the included regulations, restrictions, and bans came to pass by 2040, global plastic demand would fall by less than 5%. Applying that reduction to our Chemicals Business earnings over the past five years would show a decrease in corporate earnings of less than 1%.

The energy transition is a global opportunity – and it will take significant investment32

There is no credible energy transition scenario that doesn’t include a role for oil and natural gas. Sustained investment will be needed to meet the world’s demand for oil and natural gas.

By 2050:

- Our Global Outlook shows a 15% increase in overall energy use vs. 2023 – with a 4% increase in oil demand and 39% increase in natural gas demand. This will be driven by population growth and rising living standards, nearly all of it in developing nations.

- The IEA Stated Policies Scenario (STEPS) projects global energy demand to average about 93 million barrels per day in 2050, not significantly lower than our Global Outlook projection of around 100 million barrels per day.

- The Intergovernmental Panel on Climate Change’s Likely Below 2°C scenarios show an average global oil demand drop to 60 million barrels per day.

- The International Energy Association’s Net’s Zero Emissions (IEA NZE) by 2050 scenario shows about 24 million barrels per day of oil demand.

The variations in these projections and scenarios come from the different approaches taken. Our Outlook models supply and demand dynamics, scientifically grounded in long-term market fundamentals. But the IEA NZE and many other scenarios start at the end with a target in mind, then work backward to propose pathways to get there.

The IEA acknowledges that the world is not on an NZE pathway. Even in that extreme scenario, however, investment of approximately $8 trillion through 2050 would be needed in oil and natural gas to meet the world’s energy demand. That’s just to offset the natural decline rate of oil production, which is needed to avoid supply shortages33 that would impact people’s lives and hamper global prosperity.

Even as economies grow and consume more energy, global carbon emissions are expected to fall for the first time by 2030. In fact, our Global Outlook projects carbon emissions declining through 2050 due to increases in efficiency, renewables, and lower-emission technologies.

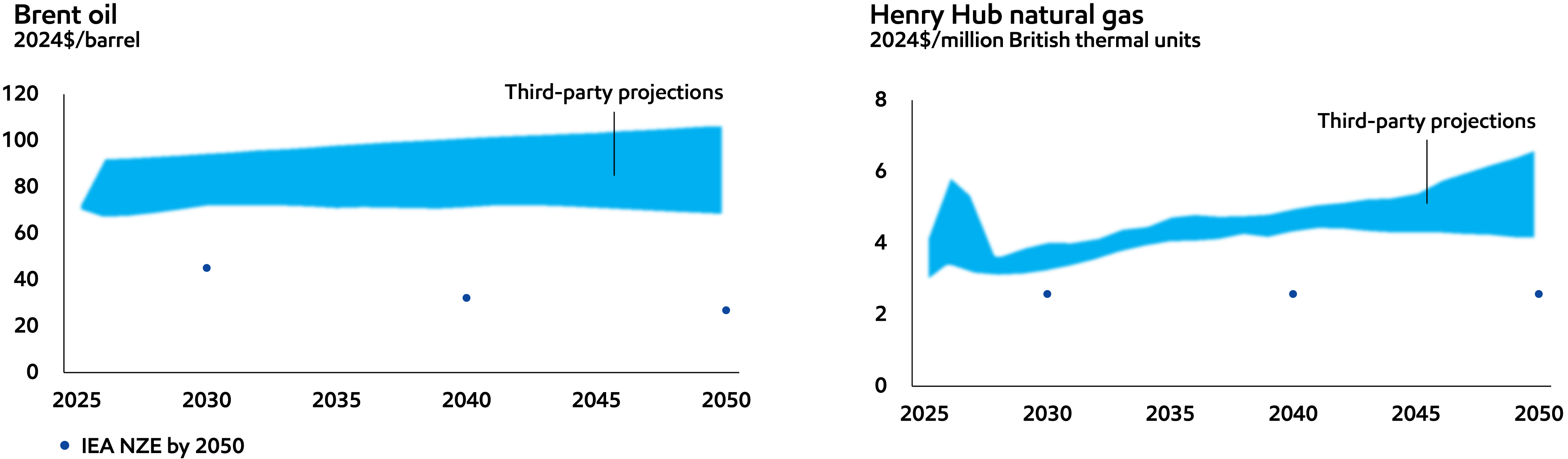

Pricing

Our near-term price assumptions for oil and natural gas are informed by market conditions. For mid-to longer-term, our prices are in the range of third-party projections published by reputable organizations with significant industry expertise. While our projections for prices are proprietary, they fall well within historical bands.35

IEA STEPS projects a 2050 price of crude of $83 per barrel and a U.S. natural gas price of $4.3 per million British thermal units (in 2023 U.S. dollars). The pricing in IEA NZE diverges significantly from these estimates.

Third-party price projections versus IEA NZE34

Policy impact

Our Global Outlook seeks to identify how climate-related policies might affect global energy demand. We use various tools and assumptions, including a proxy cost of carbon, to estimate these impacts.

We also use proprietary greenhouse gas pricing where we operate and invest. Where existing policies provide greenhouse gas pricing, we follow them to evaluate investments and estimate costs where appropriate, for specific greenhouse gas emissions sources.

International accords and underlying regional and national regulations covering greenhouse gas emissions continue to evolve with uncertain timing, outcome, and potential business impact. Where no such policies exist, we assume a price informed by our Global Outlook.

GHG emissions pricing where ExxonMobil operates or invests

| World Bank36 Carbon prices |

EM GHG Emissions Prices |

IEA WEO STEPS37 CO2 prices |

||

| ($ metric ton CO2 - 2024$ Real) |

2024-2050 | 2030 | 2050 | |

| Advanced economies |

2-108 | 8-150 | <144 | <163 |

| Emerging economies |

1-13 | 3-100 | <40 | <54 |

Ranges provided for jurisdictions where ExxonMobil operates or invests.

ExxonMobil’s GHG emissions pricing for 2024-2030 is based on currently stated existing or anticipated policies; pricing for 2030-2050 reflects presumed regional policies for both advanced and emerging economies.

ExxonMobil’s GHG emissions pricing is in 2024 USD and has not been adjusted for future inflation.

For 2024 and 2025, we have not applied GHG emission prices to our operations or investments in countries where there is no existing GHG emission price. We do apply anticipated prices within the range identified in the table in those countries beginning in 2026.

ExxonMobil’s GHG emissions prices include CO2 and other GHGs (e.g., methane), where appropriate.

Publications

Explore more

Rational and constructive policy

5 min read

•

Research and development

4 min read

•

Growing Low Carbon Solutions

8 min read

•

Advancing Climate Solutions Executive Summary

6 min read

•

Driving reductions in methane emissions

6 min read

•

Our risk management approach

4 min read

•FOOTNOTES:

- $3 billion by 2030 subject to additional investment by ExxonMobil, final 45V regulations for hydrogen production credits, and receipt of government permitting for carbon capture and storage projects.

- Existing ExxonMobil operated facilities; excludes startup phase of major new facilities. Projected emission intensity includes Scope 1 and 2 emissions of ExxonMobil operated assets as compared to available benchmark. Reduction estimates provided herein have a high degree of uncertainty, and are subject to change based on potential future conditions. 2030 first quartile projection based on comparison of available peer performance data, publicly available announcements, third-party sources (Rystad for oil and flowing gas, Alberta Government for heavy oil, Phillip Townsend and Associates Inc. for LNG), and ExxonMobil analysis.

- Ibid.

- References to routine flaring herein are consistent with the World Bank’s Zero Routine Flaring by 2030 Initiative/Global Flaring & Methane Reduction (GFMR) Partnership principle of routine flaring, and excludes safety and non-routine flaring.

- ExxonMobil existing facilities. First quartile operated performance based on Phillip Townsend and Associates Inc. industry benchmarking analysis for operating year 2020.

- Aggregate based on Scope 1 and 2 emissions of ExxonMobil operated assets. Refining performance results based on ExxonMobil analysis of 2022 Solomon Associates’ proprietary Carbon Emissions Index; Chemicals performance results based on ExxonMobil analysis of key competitors’ publicly available information, annual data (2016-2023). Benchmarking is updated regularly as new data sources become available.

- Total demand through 2030 – ExxonMobil 2024 Global Outlook. Chemicals based on ExxonMobil 2024 Global Outlook for Energy chemical feedstock projected demand excluding direct ethane from Upstream operations.

- ExxonMobil 2024 Global Outlook.

- Global economy - ExxonMobil's 2024 Global Outlook; Chemicals growth - IHS Markit Report, Global (Polyethylene, Polypropylene, and Paraxylene), 2023 edition: Fall 2023 update.

- The utility-scale solar farm is owned and operated by Lightsource bp with power supplied to GCGV under a long-term contract: https://www.gcgv.com/our-impact/2023-sustainability-report/sr-environmental-stewardship/advancing-climate-solutions.

- May not reflect final investment decisions made by the company. Individual opportunities may advance based on a number of factors, including availability of supportive policy, technology for cost-effective abatement, and alignment with our partners and other stakeholders. The company may refer to these opportunities as projects in external disclosures at various stages throughout their progression.

- EM analysis based on: Elizabeth Avery, Experience Nduagu, Eric Vozzola, Timothee W. Roux, Rafael Auras, Polyethylene packaging and alternative materials in the United States: A life cycle assessment, Science of The Total Environment, Volume 961, 2025, 178359,ISSN 0048-9697, https://doi.org/10.1016/j.scitotenv.2024.178359. Manfred Tacker, Tasja Hafner-Kuhn, Andrin Gstöhl, Experience Nduagu, Eric Vozzola, Timothee W. Roux, Rafael Auras, Life cycle assessment of polyethylene packaging and alternatives on the European market, Cleaner Environmental Systems, Volume 17, 2025,100270, ISSN 2666-7894, https://doi.org/10.1016/j.cesys.2025.100270.

- Based on performance of specific ExxonMobil Exceed™ XP grades versus conventional polyethylene in flexible packaging applications.

- Comparative Carbon Footprint of Product - ExxonMobil’s Proxxima™ Resin System to Alternative Resin Systems, June 2023, prepared by Sphera Solutions, Inc. for ExxonMobil Technology and Engineering Company. The study was confirmed to be conducted according to and in compliance with ISO 14067:2018 by an independent third party critical review panel.

- Department of Energy statements at https://www.energy.gov/eere/vehicles/lightweight-materials-cars-and-trucks.

- Based on ExxonMobil analysis: https://www.exxonmobilchemical.com/en/resources/library/library-detail/91254/properly_inflated_tires_affect_energy_consumption_en.

- Provides up to 4% fuel economy improvement when changing from a higher viscosity 5W-30 engine oil. Based on ExxonMobil analysis when compared to conventional mineral oils: https://www.mobil.com/en-be/passenger-vehicle-lube/pds/eu-xx-mobil-1-esp-x2-0w-20.

- Based on ExxonMobil analysis using Argonne National Labs’ GREET2023 model and published fuel carbon intensity from California LCFS regulations. Argonne National Laboratory GREET model: https://greet.anl.gov/, California Air Resources Board Low Carbon Fuel Standard Regulation: https://ww2.arb.ca.gov/our-work/programs/low-carbon-fuel-standard/lcfs-regulation.

- Based on ExxonMobil analysis using Argonne National Labs’ GREET2022 model versus conventional fuel oil. Argonne National Laboratory GREET model: https://greet.anl.gov/ Performance dependent on blend rates and bio components used.

- Based on ExxonMobil analysis; performance profile https://www.mobil.com/en-us/industrial/pds/na-xx-mobil-dte-10-excel-series.

- Based on ExxonMobil analysis; performance profile at https://www.mobil.com/en-us/industrial/pds/na-xx-mobil-shc-600-series.

- Based on ExxonMobil analysis; performance profile at https://www.mobil.com/en-us/industrial/pds/gl-xx-mobilshc-gear-320-wt.

- The Use of Scenario Analysis in Disclosure of Climate-related Risks and Opportunities – TCFD Knowledge https://www.fsb-tcfd.org/.

- The statements and figures contained in this section are hypothetical in nature, do not constitute a forecast of future company performance and are based on assumptions from International Energy Agency (2021), Net Zero by 2050, IEA, Paris, including updates released by IEA in successive Net Zero reports that were deemed to have a significant impact on the outcomes.

- Forward price and margin assumptions used in IEA NZE modeling; historical values provided for context. (Click to enlarge charts).

- ExxonMobil analysis, IEA NZE by 2050 (2021). Supplemental information for non-GAAP and other measures. This chart mentions modeled operating cash flow in comparing different businesses over time in a future scenario. Historic operating cash flow is defined as net income, plus depreciation, depletion and amortization for consolidated and equity companies, plus noncash adjustments related to asset retirement obligations plus proceeds from asset sales. The Company’s long-term portfolio modeling estimates operating cash flow as revenue or margins less cash expenses, taxes and abandonment expenditures plus proceeds from asset sales before portfolio capital expenditures. The Company believes this measure can be helpful in assessing the resiliency of the business to generate cash from different potential future markets. The performance data presented in the publication and its associated supplement, including on emissions, is not financial data and is not GAAP data.

- ExxonMobil analysis, IEA NZE by 2050 (2021).

- For the purposes of this report, “proved reserves” means estimated year-end 2024 proved oil and gas reserves for consolidated subsidiaries and equity companies which was reported in the Corporation’s 2024 Annual Report on Form 10-K. Proved oil and gas reserves are determined in accordance with Securities and Exchange Commission (SEC) requirements. Proved reserves are those quantities of oil and gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible under existing economic and operating conditions and government regulations. Proved reserves are determined using the average of first-of-month oil and natural gas prices during the reporting year. For the purposes of this disclosure, resources are total remaining estimated quantities of discovered oil and gas that are expected to be ultimately recoverable. The resource base includes proved reserves and quantities of oil and gas that are not yet classified as proved reserves.

- Report developed by the Pew Charitable Trusts and SYSTEMIQ, “Breaking the Plastic Wave: A Comprehensive Assessment of Pathways Towards Stopping Ocean Plastic Pollution": https://www.pewtrusts.org/-/media/assets/2020/10/breakingtheplasticwave_mainreport.pdf.

- Third-party projections and scenarios include: (1) Chemical Market Analytics (CMA) Circular Plastics Service, August 2024, by OPIS, A Dow Jones Company, Base Case and Green Case scenarios; (2) McKinsey & Company, How plastics-waste recycling could transform the chemical industry (December 12, 2018), (3) OECD, Global Plastics Outlook: Policy Scenarios to 2060 (June 21, 2022), Baseline and Regional Action scenarios; (4) Pew Breaking the Plastic Wave, 2020 Report Business as Usual and Pew System Change scenarios; and (5) International Energy Agency (IEA), Net Zero Roadmap: A Global Pathway to Keep the 1.5C Goal in Reach (2023 Update). The discussion of these third-party scenarios in this document does not reflect the likelihood or probability of any scenario occurring, the likelihood of the average of these scenarios occurring, or the adoption of any of these scenarios or their average by ExxonMobil for planning purposes or otherwise. The third-party scenarios reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil. ExxonMobil recognizes that considerable uncertainty exists in all future scenarios. Third-party projections and scenario reporting has varying product and timing granularity. ExxonMobil technical experts have made assumptions to bring all data onto a consistent basis. Where there is no split of plastics products provided by third-parties, CMA and OECD splits are assumed. IEA net zero primary chemicals demand assumed to be sum of primary chemicals production and primary chemicals savings, and growth assumed to be consistent across chemical products. Third-party growth rates are applied to normalized historic data. Data plotted in 10 year increments. Where decade end data points not available, they are estimated based on growth rates. The high end of the range on the chart of the Pew Report’s System Change Scenario assumes growth of durable plastics equal to the Pew Report’s Business-as-Usual scenario. The low end of the range on the chart of the Pew Report’s System Change Scenario assumes durable plastics follow the same trend as municipal solid waste (~non-durable) plastics in the System Change Scenario. MTA is an abbreviation of millions of tonnes per annum.

- See our website at corporate.exxonmobil.com/news/news-releases for February 2025, release of 4Q 2024 earnings: https://d1io3yog0oux5.cloudfront.net/_55ef03a4ca6327454ca16bd9d75cb53a/exxonmobil/db/2288/22354/earnings_release/4Q24+Earnings+Press+Release+Website.pdf

- IEA World Energy Outlook 2023, ExxonMobil analysis, ExxonMobil 2023 Global Outlook, IPCC Sixth Assessment Report, Likely Below 2°C scenarios refers to Category C3.

- ExxonMobil analysis based on IEA (2023), World Energy Outlook 2023, IEA, Paris https://www.iea.org/reports/world-energy-outlook-2023, Licence: CC BY 4.0 (report); CC BY NC SA 4.0 (Annex A).

- IEA NZE by 2050 (2023). Third-party oil price range includes projections from Wood Mackenzie, IHS Markit, S&P Platts, Rystad Energy and the U.S. EIA, and is based on their most current publications as of December 2024. Third-party gas price range includes projections from Wood Mackenzie, IHS Markit, S&P Platts, Rystad Energy, Facts Global Energy, and the U.S. EIA, and is based on their most current publications as of December 2024.

- For example, from 2010 to 2024, annual Brent crude prices ranged from $112 a barrel to $42 a barrel. For the same period, annual Henry Hub natural gas price ranged between $6.45/mmbtu and $2.03/mmbtu. Source: U.S. EIA Brent and Henry Hub Annual Spot Price (nominal dollars).

- World Bank: State and Trends of Carbon Pricing 2024, https://openknowledge.worldbank.org/entities/publication/b0d66765-299c-4fb8-921f-61f6bb979087. Reference World Bank ranges are consistent with existing carbon pricing for those jurisdictions as of April 1, 2024.

- IEA World Energy Outlook 2024. IEA ranges have been adjusted for 2024$ Real.

FORWARD-LOOKING STATEMENT WARNING

Images or statements of future ambitions, aims, aspirations, plans, goals, events, projects, projections, opportunities, expectations, performance, or conditions in the publications, including plans to reduce, abate, avoid or enable avoidance of emissions or reduce emissions intensity, sensitivity analyses, expectations, estimates, the development of future technologies, business plans, and sustainability efforts are dependent on future market factors, such as customer demand, continued technological progress, stable policy support and timely rule-making or continuation of government incentives and funding, and represent forward-looking statements. Similarly, emission-reduction roadmaps to drive toward net zero and similar roadmaps for emerging technologies and markets, and water management roadmaps to reduce freshwater intake and/or manage disposal, are forward-looking statements. These statements are not guarantees of future corporate, market or industry performance or outcomes for ExxonMobil or society and are subject to numerous risks and uncertainties, many of which are beyond our control or are even unknown.

Actual future results, including the achievement of ambitions to reach Scope 1 and 2 net zero from operated assets by 2050, to reach Scope 1 and 2 net zero in heritage Permian Basin unconventional operated assets by 2030, and in Pioneer Permian assets by 2035, to eliminate routine flaring in-line with World Bank Zero Routine Flaring, to reach near zero methane emissions from operated assets and other methane initiatives to meet ExxonMobil’s greenhouse gas emission reduction plans and goals, divestment and start-up plans, and associated project plans as well as technology advances, including in the timing and outcome of projects to capture, transport and store CO2, produce hydrogen and ammonia, produce lower-emission fuels, produce ProxximaTM systems, produce carbon materials, produce lithium, and use plastic waste as feedstock for advanced recycling; future debt levels and credit ratings; business and project plans, timing, costs, capacities and profitability; resource recoveries and production rates; planned Denbury and Pioneer integrated benefits; obtain data on detection, measurement and quantification of emissions including reporting of that data or updates to previous estimates and progress in sustainability focus areas could vary depending on a number of factors, including global or regional changes in oil, gas, petrochemicals, or feedstock prices, differentials, seasonal fluctuations, or other market or economic conditions affecting the oil, gas, and petrochemical industries and the demand for our products; new market products and services; future cash flows; our ability to execute operational objectives on a timely and successful basis; the ability to realize efficiencies within and across our business lines; new or changing government policies for lower carbon and new market investment opportunities, or policies limiting the attractiveness of investments such as European taxes on energy and unequal support for different methods of carbon capture; developments or changes in local, national, or international treaties, laws, regulations, taxes, trade sanctions, trade tariffs, and incentives affecting our business, including those related to greenhouse gas emissions, plastics, carbon storage and carbon costs; timely granting of governmental permits and certifications; uncertain impacts of deregulation on the legal and regulatory environment; evolving reporting standards for these topics and evolving measurement standards for reported data; trade patterns and the development and enforcement of local, national and regional mandates; unforeseen technical or operational difficulties; the outcome of research efforts and future technology developments, including the ability to scale projects and technologies such as electrification of operations, advanced recycling, carbon capture and storage, hydrogen and ammonia production, ProxximaTM systems, carbon materials or direct lithium extraction on a commercially competitive basis; the development and competitiveness of alternative energy and emission reduction technologies; unforeseen technical or operating difficulties, including the need for unplanned maintenance; availability of feedstocks for lower-emission fuels, hydrogen, or advanced recycling; changes in the relative energy mix across activities and geographies; the actions of co-venturers competitors; changes in regional and global economic growth rates and consumer preferences including willingness and ability to pay for reduced emissions products; actions taken by governments and consumers resulting from a pandemic; changes in population growth, economic development or migration patterns; timely completion of construction projects; war, civil unrest, attacks against the Company or industry, and other political or security disturbances, including disruption of land or sea transportation routes; decoupling of economies, realignment of global trade and supply chain networks, and disruptions in military alliances; and other factors discussed here and in Item 1A. Risk Factors of our Annual Report on Form 10-K and under the heading “Factors affecting future results” available under the “Earnings” tab through the “Investors” page of our website at www.exxonmobil.com. The Advancing Climate Solutions Report includes 2024 greenhouse gas emissions performance data as of March 1, 2025, and Scope 3 Category 11 estimates for full year 2024 as of February 19, 2025. The greenhouse gas intensity and greenhouse gas emission estimates include Scope 2 market-based emissions. The Sustainability Report, the Advancing Climate Solutions Report, and corresponding Executive Summaries were issued on April 30, 2025. The content and data referenced in these publications focus primarily on our operations from Jan. 1, 2024 – Dec. 31, 2024, unless otherwise indicated. Tables on our “Metrics and data” page were updated to reflect full year 2024 data. Information regarding some known events or activities in 2025 and historical initiatives from prior years are also included. No party should place undue reliance on these forward-looking statements, which speak only as of the dates of these publications. All forward-looking statements are based on management’s knowledge and reasonable expectations at the time of publication. ExxonMobil assumes no duty to update these statements or materials as of any future date, and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of these figures or statements as of any future date. Any future update will be provided only through a public disclosure indicating that fact.

See “ABOUT THE ADVANCING CLIMATE SOLUTIONS AND SUSTAINABILITY REPORTS” at the end of this document for additional information on these reports and the use of non-GAAP and other financial measures.

ABOUT THE ADVANCING CLIMATE SOLUTIONS AND SUSTAINABILITY REPORTS

The Advancing Climate Solutions Report contains terms used by the TCFD, as well as information about how the disclosures in this report are consistent with the recommendations of the TCFD. In doing so, ExxonMobil is not obligating itself to use any terms in the way defined by the TCFD or any other party, nor is it obligating itself to comply with any specific recommendation of the TCFD or to provide any specific disclosure. For example, with respect to the term “material,” individual companies are best suited to determine what information is material, under the long-standing U.S. Supreme Court definition, and whether to include this information in U.S. Securities and Exchange Act filings. In addition, the ISSB is evaluating standards that provide their interpretation of TCFD which may or may not be consistent with the current TCFD recommendations. The Sustainability Report and Advancing Climate Solutions Report are each a voluntary disclosure and are not designed to fulfill any U.S., foreign, or third-party required reporting framework.

Forward-looking and other statements regarding environmental and other sustainability efforts and aspirations are not intended to communicate any material investment information under the laws of the United States or represent that these are required disclosures. These publications are not intended to imply that ExxonMobil has access to any significant non-public insights on future events that the reader could not independently research. In addition, historical, current, and forward-looking environmental and other sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future, including future laws and rulemaking. Forward-looking and other statements regarding environmental and other sustainability efforts and aspirations are for informational purposes only and are not intended as an advertisement for ExxonMobil’s equity, debt, businesses, products, or services and the reader is specifically notified that any investor-requested disclosure or future required disclosure is not and should not be construed as an inducement for the reader to purchase any product or services. The statements and analysis in these publications represent a good faith effort by the Company to address these investor requests despite significant unknown variables and, at times, inconsistent market data, government policy signals, and calculation, methodologies, or reporting standards.

Actions needed to advance ExxonMobil’s 2030 greenhouse gas emission-reductions plans are incorporated into its medium-term business plans, which are updated annually. The reference case for planning beyond 2030 is based on the Company’s Global Outlook research and publication. The Global Outlook is reflective of the existing global policy environment and an assumption of increasing policy stringency and technology improvement to 2050. However, the Global Outlook does not attempt to project the degree of required future policy and technology advancement and deployment for the world, or ExxonMobil, to meet net zero by 2050. As future policies and technology advancements emerge, they will be incorporated into the GIobal Outlook, and the Company’s business plans will be updated as appropriate. References to projects or opportunities may not reflect investment decisions made by the corporation or its affiliates. Individual projects or opportunities may advance based on a number of factors, including availability of stable and supportive policy, permitting, technological advancement for cost-effective abatement, insights from the Company planning process, and alignment with our partners and other stakeholders. Capital investment guidance in lower-emission and other new investments is based on our corporate plan; however, actual investment levels will be subject to the availability of the opportunity set, stable public policy support, other factors, and focused on returns.

Energy demand modeling aims to replicate system dynamics of the global energy system, requiring simplifications. The reference to any scenario or any pathway for an energy transition, including any potential net-zero scenario, does not imply ExxonMobil views any particular scenario as likely to occur. In addition, energy demand scenarios require assumptions on a variety of parameters. As such, the outcome of any given scenario using an energy demand model comes with a high degree of uncertainty. For example, the IEA describes its NZE scenario as extremely challenging, requiring unprecedented innovation, unprecedented international cooperation, and sustained support and participation from consumers, with steeper reductions required each year since the scenario’s initial release. Third-party scenarios discussed in these reports reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use or inclusion herein is not an endorsement by ExxonMobil of their underlying assumptions, likelihood, or probability. Investment decisions are made on the basis of ExxonMobil’s separate planning process but may be secondarily tested for robustness or resiliency against different assumptions, including against various scenarios. These reports contain information from third parties. ExxonMobil makes no representation or warranty as to the third-party information. Where necessary, ExxonMobil received permission to cite third-party sources, but the information and data remain under the control and direction of the third parties. ExxonMobil has also provided links in this report to third-party websites for ease of reference. ExxonMobil’s use of the third-party content is not an endorsement or adoption of such information.

ExxonMobil reported emissions, including reductions and avoidance performance data, are based on a combination of measured and estimated data. We assess our performance to support continuous improvement throughout the organization using our Environmental Performance Indicator (EPI) manual. The reporting guidelines and indicators in the Ipieca, the American Petroleum Institute (API), the International Association of Oil and Gas Producers Sustainability Reporting Guidance for the Oil and Gas Industry (4th edition, 2020, revised February 2023) and key chapters of the GHG Protocol inform the EPI and the selection of the data reported. Emissions reported are estimates only, and performance data depends on variations in processes and operations, the availability of sufficient data, the quality of those data and methodology used for measurement and estimation. Emissions data is subject to change as methods, data quality, and technology improvements occur, and changes to performance data may be updated. Emissions, reductions, abatements and enabled avoidance estimates for non-ExxonMobil operated facilities are included in the equity data and similarly may be updated as changes in the performance data are reported. ExxonMobil’s plans to reduce emissions are good-faith efforts based on current relevant data and methodology, which could be changed or refined. ExxonMobil works to continuously improve its approach to estimate, detect, measure, and address emissions. ExxonMobil actively engages with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

Any reference to ExxonMobil’s support of, work with, or collaboration with a third-party organization within these publications do not constitute or imply an endorsement by ExxonMobil of any or all of the positions or activities of such organization. ExxonMobil participates, along with other companies, institutes, universities and other organizations, in various initiatives, campaigns, projects, groups, trade organizations, and other collaborations among industry and through organizations like the United Nations that express various ambitions, aspirations and goals related to climate change, emissions, sustainability, and the energy transition. ExxonMobil’s participation or membership in such collaborations is not a promise or guarantee that ExxonMobil’s individual ambitions, future performance or policies will align with the collective ambitions of the organizations or the individual ambitions of other participants, all of which are subject to a variety of uncertainties and other factors, many of which may be beyond ExxonMobil’s control, including government regulation, availability and cost-effectiveness of technologies, and market forces and other risks and uncertainties. Such third parties’ statements of collaborative or individual ambitions and goals frequently diverge from ExxonMobil’s own ambitions, plans, goals, and commitments. ExxonMobil will continue to make independent decisions regarding the operation of its business, including its climate-related and sustainability-related ambitions, plans, goals, commitments, and investments. ExxonMobil’s future ambitions, goals and commitments reflect ExxonMobil’s current plans, and ExxonMobil may unilaterally change them for various reasons, including adoption of new reporting standards or practices, market conditions; changes in its portfolio; and financial, operational, regulatory, reputational, legal and other factors.

References to “resources,” “resource base,” “recoverable resources” and similar terms refer to the total remaining estimated quantities of oil and natural gas that are expected to be ultimately recoverable. The resource base includes quantities of oil and natural gas classified as proved reserves, as well as quantities that are not yet classified as proved reserves, but that are expected to be ultimately recoverable. The term “resource base” is not intended to correspond to SEC definitions such as “probable” or “possible” reserves. For additional information, see the “Frequently Used Terms” on the Investors page of the Company’s website at www.exxonmobil.com under the header “Modeling Toolkit.” References to “oil” and “gas” include crude, natural gas liquids, bitumen, synthetic oil, and natural gas. The term “project” as used in these publications can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

Exxon Mobil Corporation has numerous affiliates, many with names that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For convenience and simplicity, those terms and terms such as “Corporation,” “company,” “our,” “we,” and “its” are sometimes used as abbreviated references to one or more specific affiliates or affiliate groups. Abbreviated references describing global or regional operational organizations, and global or regional business lines are also sometimes used for convenience and simplicity. Nothing contained herein is intended to override the corporate separateness of affiliated companies. Exxon Mobil Corporation’s goals do not guarantee any action or future performance by its affiliates or Exxon Mobil Corporation’s responsibility for those affiliates’ actions and future performance, each affiliate of which manages its own affairs. For convenience and simplicity, words like venture, joint venture, partnership, co-venturer and partner are used to indicate business relationships involving common activities and interests, and those words may not indicate precise legal relationships. These publications cover Exxon Mobil Corporation’s owned and operated businesses and do not address the performance or operations of our suppliers, contractors or partners unless otherwise noted. In the case of certain joint ventures for which ExxonMobil is the operator, we often exercise influence but not control. Thus, the governance, processes, management and strategy of these joint ventures may differ from those in these reports. At the time of publication, ExxonMobil has completed the acquisitions of Denbury Inc. and Pioneer Natural Resources Company. These reports and the data therein do not speak of these companies’ pre-acquisition governance, risk management, strategy approaches, or emissions or sustainability performance unless specifically referenced.

These reports or any material therein are not to be used or reproduced without the permission of Exxon Mobil Corporation. All rights reserved.

SUPPLEMENTAL INFORMATION FOR NON-GAAP AND OTHER MEASURES

The Positioned for Growth in a Lower-Emission Future section of the Advancing Climate Solutions Report mentions modeled operating cash flow in comparing different businesses over time in a future scenario. Historic operating cash flow is defined as net income, plus depreciation, depletion and amortization for consolidated and equity companies, plus noncash adjustments related to asset retirement obligations plus proceeds from asset sales. The Company’s long-term portfolio modeling estimates operating cash flow as revenue or margins less cash expenses, taxes and abandonment expenditures plus proceeds from asset sales before portfolio capital expenditures. The Company believes this measure can be helpful in assessing the resiliency of the business to generate cash from different potential future markets. The performance data presented in the Advancing Climate Solutions Report and Sustainability Report, including on emissions, is not financial data and is not GAAP data.