6 min read

•Advancing Climate Solutions Executive Summary

Progress Report 2025

6 min read

•Navigate to:

Solving the “and” equation - Meeting demand and reducing emissions

Climate change is real and stands as one of the major challenges facing the world today. But it’s not the only one.

Here’s another – the need to provide reliably affordable energy and critical products necessary to improve living standards around the world.

Some call this the “dual challenge.” But where some see challenges, we see solutions. The world doesn’t have to choose between higher living standards and lower emissions. We can do both. It is an “and” equation, and we’re bringing solutions to help solve it.

Energy poverty remains far too common. The policies that drive innovation are not advancing fast enough for the world to achieve its net-zero aspirations by 2050.

Both the United Nations and the International Energy Agency acknowledge the world is not on the path to meet the goals of the Paris Agreement.1,2

2024 Global Outlook

Pledges are not enough. The world needs a plan.

In this Advancing Climate Solutions report, we discuss how ExxonMobil has the right tools, technologies, and people to help the world bend the curve on emissions. We highlight our work to:

- Reduce our own emissions and others’.

- Achieve our 2030 emission-intensity reduction plans.3

- Apply our leading-edge capabilities to profitably grow our low-carbon business opportunities.

We also propose rational and constructive policies, focused on product-level carbon-intensity standards and a well-designed carbon-emissions accounting framework, that we believe will, if implemented, help the world speed up a thoughtful energy transition and still meet society’s needs for energy and products.

Key takeaways

- We’re pursuing up to $30 billion in lower-emission investments 2025-2030.4

- We’re on track to meet our 2030 emission-reduction plans.

- We’ve built a robust business that is positioned to grow in any future.

- We’re proposing policy solutions that we believe will bring emissions down more effectively and efficiently.

World-scale problems - Call for world-scale solutions

As the world works to meet demand for energy and products, it generates about 34 billion metric tons of energy-related CO2 emissions per year.5

Three sectors make up ~80% of that – commercial transportation, industrial activity, and power generation.

Energy-related emissions by sector (CO2 billion metric tons)

Getting to net zero requires very large-scale solutions.

Finding solutions that work will take new technology, rational and constructive policy, and competitive markets that drive innovation and pay for emission reductions. It will take sustained investments to:

- Meet society’s growing needs for reliable and affordable energy and products.

- Create economic growth, especially in developing countries.

- Develop new technologies that affordably reduce global emissions.

2050 global energy mix

2024 Global Outlook

Global energy demand

Quadrillion British thermal units

The opportunity - Transforming molecules to help solve the “and” equation

ExxonMobil has thrived for more than 140 years transforming the molecules that form the foundation of our physical world into solutions that meet society’s critical needs.

Examples of how we apply technology to transform molecules:

-

Capturing, transporting, and storing CO2.

The U.N. describes carbon capture and storage as a “critical” mitigation option. We have the world’s only large-scale end-to-end CCS system.8,9 -

Producing hydrogen from natural gas with CCS.

Working to develop the world’s largest hydrogen production facility to produce virtually carbon-free hydrogen (with ~98% of CO2 captured and stored).10 -

Liquifying gas to economically transport it around the world to power homes and industries.

Liquefied natural gas can eliminate up to 60% of GHG emissions when it replaces coal to generate electricity.11 -

Upgrading low-value molecules into valuable products that reduce carbon emissions.*

High-value carbon materials like ProxximaTM thermoset resins and certified-circular polymers can turn gasoline components and discarded plastic into value.

*“Reduce carbon emissions” applies to ProxximaTM. See footnote 21. Certified-circular polymers are virgin quality plastics that are accompanied by an ISCC PLUS “Sustainability Declaration” that matches the mass of virgin quality plastics that we sell to a corresponding amount of plastic waste that we transformed back into usable raw materials through advanced recycling. Certified-circular polymers do not represent specific amounts of GHG emissions or recycled content.

This unique combination of strengths forms the foundation of our company and drives our strategic priorities:

Leading performance

Industry leader in shareholder returns, earnings and cash-flow growth, safety, reliability, GHG emissions intensity, and cost and capital efficiency.

Essential partner

Create value through win-win solutions for our customers, partners and broader stakeholders, including the communities where we operate.

Advantaged portfolio

Portfolio of assets and products that outperform competition and grow value in a lower-emissions future; flexible portfolio of industry-leading, high-return investments that strengthens our competitive position in an evolving world.

Innovative solutions

Develop new products, approaches and technologies to improve competitiveness and accelerate large-scale deployment of solutions essential to modern life and a lower emissions future.

Meaningful development

A diverse and engaged organization that provides every individual unrivaled opportunities for personal and professional growth with impactful work meeting society’s evolving needs.

Increasing investments to lower emissions12- Our own and others’

Our investments in carbon capture, hydrogen, biofuels, and lithium have the potential to reduce third-party emissions by more than 50 million metric tons per year by 2030.13

Per the U.S. EPA, that’s equal to the CO2 emissions from nearly 10 million U.S. homes’ electricity use for one year.14 To put this in context, that’s nearly double the number of single-family homes in New York City, Houston, and Los Angeles combined.

Click to enlarge.

Getting the world to net-zero requires all technologies to be in the mix.

Here’s what we’re working on today to help lower emissions in hard-to-decarbonize sectors:

- Carbon capture and storage: We have the largest CO2 pipeline network in the United States, and we have agreements with major industrial customers to transport and store up to 8.7 million metric tons of direct CO2 emissions per year.15 We are on our way to 30 million metric tons per year under contract by 2030.16

- Hydrogen: We’re working to develop the world’s largest plant to produce virtually carbon-free hydrogen (with ~98% of CO2 captured and stored),17 with planned capacity that meets nearly 10% of the U.S. National Hydrogen Program Plan’s projected 10 million metric tons of hydrogen per year by 2030.18

- Liquefied natural gas (LNG): We expect to surpass 40 million metric tons of LNG sales per year by 2030 with large-scale projects in the United States, Papua New Guinea, Mozambique, and Qatar.

- Biofuels: We’re building renewable diesel facilities at our majority-owned affiliate Imperial Oil’s Strathcona refinery, expected to start up in 2025 using locally sourced bio-feedstock.

- Lithium: We aim to become a substantial lithium supplier by producing low-cost lithium using a process that has far less environmental impact than traditional hard rock mining.20

- Carbon materials: We see opportunities to transform low-value, carbon-rich materials from refining and petrochemical processes to create high-value products for growing markets – including battery components for applications in EVs and beyond.

- ProxximaTM resin systems: We’re transforming low-value gasoline molecules into a high-value resin that is lighter weight, corrosion-resistant, and more durable than steel. This material also has less than half the GHG emissions of many traditional thermoset resins.21

- Direct air capture: Negative-emission solutions like direct air capture could play a big role in meeting the world’s net-zero goals. We’ve launched a pilot project using our own unique design that has the potential to significantly lower costs.

Our plans and progress - 2030 GHG emission-reduction plans and 2050 net-zero ambition

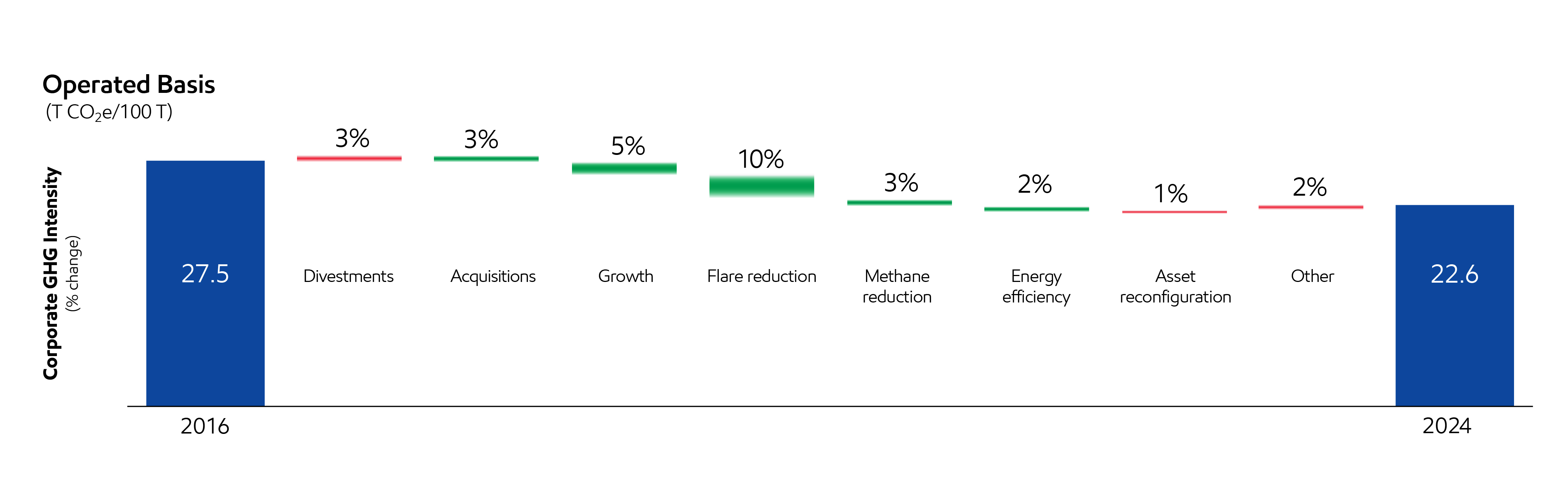

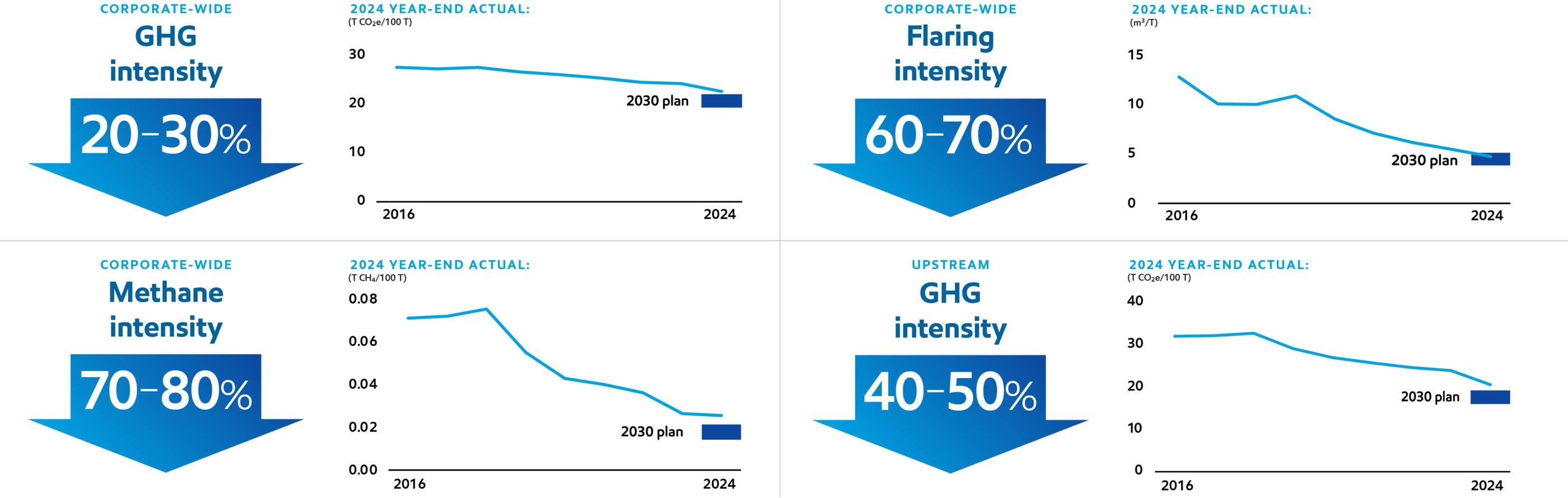

Since 2016, we’ve reduced our operated GHG emissions intensity by more than 15% driven by methane and flaring reductions, and improved energy efficiency.

Our 2030 plans drive further reductions vs. 2016 – and we’re on track to meet them.23

Applies to Scope 1 and 2 GHG emissions from operated assets.

Our 2050 net-zero ambition

In January 2022, we announced a 2050 net-zero GHG ambition for our operated assets, which requires new advancements in technology and practical government policies.24

Since then, it’s become even clearer that supportive technology and stronger policies are critical to reach net-zero by 2050. Currently, society’s progress continues to lag in these areas.25 Without the right policies and the innovations they drive, net-zero by 2050 will remain out of reach – for society and ExxonMobil.

For our part, we’re planning to pursue up to $30 billion in lower-emission efforts between 2025 and 2030.26 We’re also on track with our 2030 emissions-intensity reduction plans, which we actively steward as part of our business plans.27

Potential GHG abatement options for ExxonMobil operated assets supporting 2030 Permian unconventional net-zero plan28

Our plans and progress - Building a business for the long term

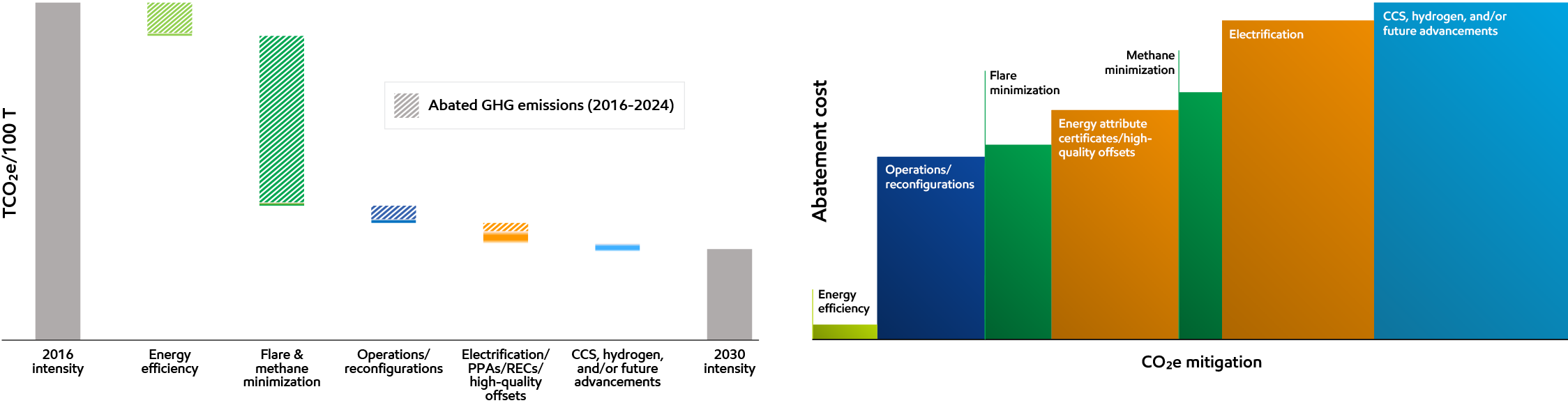

Informed by our Global Outlook, we update our business plans to advance our 2030 emission-intensity reduction objectives every year. The roadmap and abatement curve below help illustrate the potential pathways for achieving these goals.

Abatement options for operated assets to advance 2030 Scope 1 & 2 GHG emission-intensity reduction plans29

Our plans to reduce emissions through 2030 include:

- Achieving net-zero Scope 1 and 2 GHG emissions in our heritage Permian Basin unconventional operated assets.

- Advancing technologies, including satellite, aerial, and ground-sensor networks to detect and further reduce methane emissions.

- Eliminating routine flaring in our upstream operations in line with the World Bank Zero Routine Flaring Initiative.30

- Deploying carbon capture and storage, hydrogen, and lower-emission fuels in our operations.

- Electrification of equipment and integration of lower GHG energy sources.

- Improving energy efficiency in our businesses by evolving operational, maintenance, and design processes.

Well-positioned for a lower-emissions future

No single transition pathway can be reasonably predicted. There is still a wide range of uncertainties.

As a result, we assess the strength of our business and investment portfolio against a range of future scenarios, including the IEA Net Zero Emissions by 2050 (NZE) scenario. The NZE assumes net zero by 2050 and lays out what would have to occur for that to happen. Notably, even the IEA acknowledges that society is not on the NZE pathway.

Our modeling, using the extreme assumptions in the NZE, continues to demonstrate that our business is well positioned to generate growth and value even in such a remote scenario.

In this scenario and others, we see great potential for products in our portfolio critical to achieve society’s net-zero ambition, including chemicals, carbon capture and storage, hydrogen, lower-emission fuels, ProxximaTM systems, and carbon materials.

We have updated our NZE scenario modeling, which has been validated by a third party. Changes to the NZE have not changed the outcome of our assessments.

If our business is robust to such an extreme scenario, we have great confidence it is very well-positioned in more realistic pathways.

Our plans and progress - Spotlight on methane emissions

Methane is the principal component of natural gas.

What makes natural gas a valuable source of energy?

- It’s reliable, flexible, and transportable.

- It’s abundant in many places around the world.

- It reduces CO2 emissions by up to 60% when used to generate electricity vs. coal.32

But to fully realize the benefits of natural gas, methane must be managed, because it is a more potent GHG than CO2. That’s why it’s important for us to keep methane contained in our operations, including pipeline networks, storage tanks, and processing equipment.

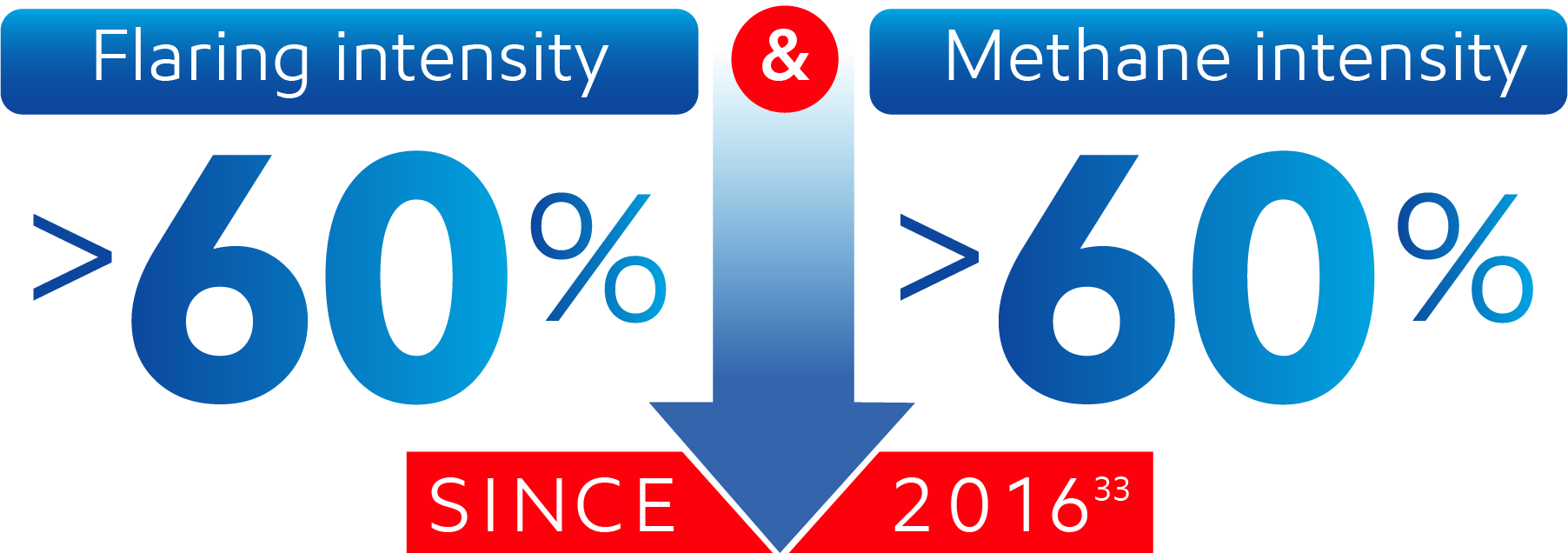

And we’re making good progress. Methane and flaring reductions made up the bulk of our more than 15% company-wide emissions-intensity reductions since 2016.

Finding methane leaks in diverse environments, across vast acreage, at every point in our operations isn’t easy. But we continue to develop and deploy technology for rapid detection, quantification, and mitigation of sources of methane at our operated assets.

Natural gas demand continues to grow, and our Global Outlook forecasts that it will be 25% of the global energy mix in 2050.

*includes biomass, biofuels, hydropower, geothermal

2024 Global Outlook

Our key collaborations:

Oil & Gas Decarbonization Charter as announced at COP28

- Industry wide ambition for net-zero Scope 1 and 2 emissions for owned assets by 2050.

- Plans for methane, including near-zero upstream methane emissions by 2030 and zero routine flaring by 2030.

- Advocacy for best practices and policies to accelerate net zero.

U.N. Oil & Gas Methane Partnership (OGMP) 2.0

- Participating companies detect, quantify, verify, and report on methane emissions.

Rational and constructive policy - Key to meeting demand for energy products and reducing carbon emissions

Policy can, and must, work hand-in-hand with technology to accelerate a thoughtful energy transition. Any policy that doesn’t help solve the “and” equation is neither rational nor just.

Today’s approach is too narrowly focused on reducing supply, even as global demand continues to rise. That can lead to shortages, higher prices for essential products, and a world in which energy poverty remains far too common.

There’s a better way.

We propose product-level carbon-intensity standards that are underpinned by a uniform, accurate, and broadly applied method of direct carbon-emissions accounting (CEA) based on the principles of chemistry and finance.

- Chemistry: Understanding how and when CO2 emissions are created, reduced, or emitted.

- Accounting: When the emissions from each product and service are counted, the total must equal the total CO2 emitted into the atmosphere.

Product-level carbon-intensity standards are proven. They are adjustable. And they allow for the most cost-effective solutions for consumers. There are many successful examples of product standards that have reduced or eliminated pollutants in diesel, marine fuel, refrigerants, and gasoline. The same principles can be applied to emissions intensity.

That’s how society can bend the curve on emissions while meeting people’s needs.

Publications

Explore more

Rational and constructive policy

5 min read

•

Research and development

4 min read

•

Positioned for growth in a lower-emission future

8 min read

•

Growing Low Carbon Solutions

8 min read

•

Driving reductions in methane emissions

6 min read

•

Our risk management approach

4 min read

•

FOOTNOTES:

- IPCC, 2023: Summary for Policymakers. In: Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, pp. 1-34, doi: 10.59327/IPCC/AR6-9789291691647.001: https://www.ipcc.ch/report/ar6/syr/downloads/report/IPCC_AR6_SYR_SPM.pdf.

- IEA (2023), Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach, IEA, Paris https://www.iea.org/reports/net-zero-roadmap-a-global-pathway-to-keep-the-15-0c-goal-in-reach, Licence: CC BY 4.0IEA.

- Based on Scope 1 and Scope 2 emissions from operated assets. Intensity is calculated as emissions per metric ton of throughput/production. ExxonMobil-reported emissions, reductions, and avoidance performance data are based on a combination of measured and estimated emissions data using reasonable efforts and collection methods. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the Company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure and address greenhouse gas emissions. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

- Lower-emissions cash capex includes cash capex attributable to carbon capture and storage, hydrogen, lithium, biofuels, ProxximaTM systems, carbon materials, and activities to lower ExxonMobil’s emissions and/or third party (3P) emissions. Planned spend is from 2025-2030: https://d1io3yog0oux5.cloudfront.net/_55ef03a4ca6327454ca16bd9d75cb53a/exxonmobil/db/2261/22349/file/Corporate_Plan_Update_and_Upstream_Spotlight_Press_Release_Final.pdf.

- ExxonMobil 2024 Global Outlook.

- IEA (2023), Tracking Clean Energy Progress 2023, IEA, Paris https://www.iea.org/reports/tracking-clean-energy-progress-2023, Licence: CC BY 4.0.

- IEA (2024), Renewables 2024, IEA, Paris https://www.iea.org/reports/renewables-2024, Licence: CC BY 4.0.

- IPCC, 2022: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [P.R. Shukla, J. Skea, R. Slade, A. Al Khourdajie, R. van Diemen, D. McCollum, M. Pathak, S. Some, P. Vyas, R. Fradera, M. Belkacemi, A. Hasija, G. Lisboa, S. Luz, J. Malley, (eds.)]. Cambridge University Press, Cambridge, UK and New York, NY, USA. doi: 10.1017/9781009157926.

- “End-to-end CCS system” entails CO2 capture as well as transportation and storage of CO2. Based on contracts to move up to 8.7 MTA CO2, subject to additional investment by ExxonMobil and receipt of government permitting for carbon capture and storage projects.

- References to virtually carbon-free hydrogen pertain to hydrogen expected to be produced at ExxonMobil's Baytown, TX facility, where approximately 98% of CO2 is removed and permanently stored.

- Based on ExxonMobil analysis for power plant use including EIA U.S. electricity net generation and resulting CO2 emissions: https://www.eia.gov/tools/faqs/faq.php?id=74&t=11. Reductions may vary based on regional differences and other variables.

- Lower emissions cash capex includes cash capex attributable to carbon capture and storage, hydrogen, lithium, biofuels, ProxximaTM systems, carbon materials, and activities to lower ExxonMobil’s emissions and/or third party (3P) emissions. Planned spend is from 2025-2030: https://d1io3yog0oux5.cloudfront.net/_55ef03a4ca6327454ca16bd9d75cb53a/exxonmobil/db/2261/22349/file/Corporate_Plan_Update_and_Upstream_Spotlight_Press_Release_Final.pdf.

- We see the opportunity to help other essential industries and customers achieve their goals to lower emissions. Estimates of GHG emissions are on a life cycle basis and include avoided and abated emissions from hydrogen, lower emission fuels, and carbon capture and storage. For example, customers could avoid up to 25 MTA of their GHG emissions if all of ExxonMobil’s projected 2030 supply to the market of lower-emission fuels displaces conventional fuel refined from crude oil. Calculation is an ExxonMobil analysis illustrating the general benefits of lower-emission fuels based on estimated fuel carbon intensity (CI) from various third-party sources (such as Argonne National Labs’ GREET model) as compared against its conventional fuel alternate on a life cycle basis. Calculation is an estimate that represents a range of potential outcomes that are based on certain assumptions. Estimates are based on the potential implementation of projects or opportunities that are at various stages of maturity. Individual projects or opportunities may advance to a final investment decision by the company based on a number of factors, including availability of supportive policy and permitting, technology and infrastructure for cost-effective abatement, and alignment with our partners and other stakeholders. Actual avoided and abated emissions may differ.

- EPA’s greenhouse gas equivalencies calculator: Carbon dioxide or CO2 equivalent converted to a U.S. home’s electricity use for one year: https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator#results.

- Based on contracts to move up to 8.7 MTA CO2, subject to additional investment by ExxonMobil and receipt of government permitting for carbon capture and storage projects.

- 30 million metric tons of CO2 captured and stored by 2030 subject to additional investment by ExxonMobil, receipt of government permitting for carbon capture and storage projects, and start up of low-carbon hydrogen project in Baytown, TX.

- The Baytown hydrogen project is pre-FID. Final investment decision anticipated in 2025 subject to final 45V regulations for hydrogen production credits.

- U.S. Department of Energy’s National Hydrogen Program Plan: https://www.hydrogen.energy.gov/docs/hydrogenprogramlibraries/pdfs/hydrogen-program-plan-2024.pdf?sfvrsn=bfc739dd_1.

- Information shown is approximate (e.g., storage / pipeline location) and has potential to change as projects are developed and implemented. CO2 storage includes Class VI Permit Application and GLO Storage Site Access.

- Expected smaller footprint of lithium mining and expected lower carbon and water impacts: EM analysis of external sources and third party life-cycle analyses. a) Vulcan Energy, 2022 https://v-er.eu/app/uploads/2023/11/LCA.pdf, Minviro publication. Grant, A., Deak, D., & Pell, R. (2020). b) The CO2 Impact of the 2020s Battery Quality Lithium Hydroxide Supply Chain-Jade Cove Partners. https://www.jadecove.com/research/liohco2impact. Kelly, J. C., Wang, M., Dai, Q., & Winjobi, O. (2021). c) Energy, greenhouse gas, and water life cycle analysis of lithium carbonate and lithium hydroxide monohydrate from brine and ore resources and their use in lithium ion battery cathodes and lithium ion batteries. Resources, Conservation and Recycling, 174, 105762.

- EM estimate calculated based on volumetric displacement of epoxy resin on a cradle to gate basis. Source: Comparative Carbon Footprint of Product ExxonMobil’s ProxximaTM Resin System to Alternative Resin Systems, June 2023 , prepared by Sphera Solutions , Inc. for ExxonMobil Technology and Engineering Company. The study was confirmed to be conducted according to and in compliance with ISO 14067: 2018 by an independent third party critical review panel materia-inc.com/what-do-we-do/our-products/creating-sustainable-solutions/lca-executive-summary.

- ExxonMobil’s reported emissions, reductions, and avoidance performance data are based on a combination of measured and estimated emissions data using reasonable efforts and collection methods. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure, and address greenhouse gas emissions. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

- Based on Scope 1 and Scope 2 emissions from operated assets. Intensity is calculated as emissions per metric ton of throughput/production. ExxonMobil reported emissions, reductions, and avoidance performance data are based on a combination of measured and estimated emissions data using reasonable efforts and collection methods. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the Company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure and address greenhouse gas emissions. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

- See our website at corporate.exxonmobil.com/news/news-releases for January 18, 2022, release of Scope 1 and Scope 2 net-zero ambition for operated assets by 2050.

- IEA (2024), World Energy Outlook 2024, IEA, Paris https://www.iea.org/reports/world-energy-outlook-2024, Licence: CC BY 4.0 (report); CC BY NC SA 4.0 (Annex A); IPCC: AR6 Scenarios Database hosted by International Institute for Applied Systems Analysis (IIASA) release 1.0 average. IPCC C3: "Likely Below 2°C" scenarios.

- Lower-emissions cash capex includes cash capex attributable to carbon capture and storage, hydrogen, lithium, biofuels, ProxximaTM systems, carbon materials, and activities to lower ExxonMobil’s emissions and/or third party (3P) emissions. Planned spend is from 2025-2030: https://d1io3yog0oux5.cloudfront.net/_55ef03a4ca6327454ca16bd9d75cb53a/exxonmobil/db/2261/22349/file/Corporate_Plan_Update_and_Upstream_Spotlight_Press_Release_Final.pdf.

- Based on Scope 1 and Scope 2 emissions from operated assets. Intensity is calculated as emissions per metric ton of throughput/production. ExxonMobil reported emissions, reductions, and avoidance performance data are based on a combination of measured and estimated emissions data using reasonable efforts and collection methods. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the Company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure and address greenhouse gas emissions. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

- This chart illustrates potential greenhouse gas abatement options for Scope 1 and 2 greenhouse gas emissions. These options are not all-inclusive and are subject to change as a result of a number of factors, including abatement reduction magnitude, implementation timing, abatement cost, portfolio changes, policy developments, technology advancements, and as annual company plans are updated. Includes energy attribute certificates, such as renewable energy certificates (RECs) and guarantees of origin (GOOs).

- These charts illustrate historical reductions and potential greenhouse gas abatement options for Scope 1 and 2 greenhouse gas emissions. The abatement options are not all-inclusive and are subject to change as a result of a number of factors, including abatement reduction magnitude, implementation timing, abatement cost, portfolio changes, policy developments, technology advancements, and as annual company plans are updated. Includes energy attribute certificates, such as renewable energy certificates (RECs) and guarantees of origin (GOOs). Historical reductions and potential abatement options have been normalized to exclude the impacts of divestments, acquisitions, and growth. Analysis as of April 2024.

- References to routine flaring herein are consistent with the World Bank’s Zero Routine Flaring by 2030 Initiative/Global Flaring & Methane Reduction (GFMR) Partnership principle of routine flaring, and excludes safety and non-routine flaring.

- See our website at corporate.exxonmobil.com/news/news-releases for May 3, 2024, release announcing the completion of the Pioneer Natural Resources Company acquisition.

- Based on ExxonMobil analysis for power plant use including EIA U.S. electricity net generation and resulting CO2 emissions: https://www.eia.gov/tools/faqs/faq.php?id=74&t=11. Reductions may vary based on regional differences and other variables.

- Emission metrics are based on assets operated by ExxonMobil, using the latest performance and plan data available as of 3/1/2025. Methane intensity is calculated as metric tons CH4 per 100 metric tons of throughput or production. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the Company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure and address greenhouse gas emissions. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

- Science, Vol. 385, No. 6711, Climate policies that achieved major emission reductions: Global evidence from two decades: https://www.science.org/doi/10.1126/science.adl6547.

FORWARD-LOOKING STATEMENT WARNING

Images or statements of future ambitions, aims, aspirations, plans, goals, events, projects, projections, opportunities, expectations, performance, or conditions in the publications, including plans to reduce, abate, avoid or enable avoidance of emissions or reduce emissions intensity, sensitivity analyses, expectations, estimates, the development of future technologies, business plans, and sustainability efforts are dependent on future market factors, such as customer demand, continued technological progress, stable policy support and timely rule-making or continuation of government incentives and funding, and represent forward-looking statements. Similarly, emission-reduction roadmaps to drive toward net zero and similar roadmaps for emerging technologies and markets, and water management roadmaps to reduce freshwater intake and/or manage disposal, are forward-looking statements. These statements are not guarantees of future corporate, market or industry performance or outcomes for ExxonMobil or society and are subject to numerous risks and uncertainties, many of which are beyond our control or are even unknown.

Actual future results, including the achievement of ambitions to reach Scope 1 and 2 net zero from operated assets by 2050, to reach Scope 1 and 2 net zero in heritage Permian Basin unconventional operated assets by 2030, and in Pioneer Permian assets by 2035, to eliminate routine flaring in-line with World Bank Zero Routine Flaring, to reach near zero methane emissions from operated assets and other methane initiatives to meet ExxonMobil’s greenhouse gas emission reduction plans and goals, divestment and start-up plans, and associated project plans as well as technology advances, including in the timing and outcome of projects to capture, transport and store CO2, produce hydrogen and ammonia, produce lower-emission fuels, produce ProxximaTM systems, produce carbon materials, produce lithium, and use plastic waste as feedstock for advanced recycling; future debt levels and credit ratings; business and project plans, timing, costs, capacities and profitability; resource recoveries and production rates; planned Denbury and Pioneer integrated benefits; obtain data on detection, measurement and quantification of emissions including reporting of that data or updates to previous estimates and progress in sustainability focus areas could vary depending on a number of factors, including global or regional changes in oil, gas, petrochemicals, or feedstock prices, differentials, seasonal fluctuations, or other market or economic conditions affecting the oil, gas, and petrochemical industries and the demand for our products; new market products and services; future cash flows; our ability to execute operational objectives on a timely and successful basis; the ability to realize efficiencies within and across our business lines; new or changing government policies for lower carbon and new market investment opportunities, or policies limiting the attractiveness of investments such as European taxes on energy and unequal support for different methods of carbon capture; developments or changes in local, national, or international treaties, laws, regulations, taxes, trade sanctions, trade tariffs, and incentives affecting our business, including those related to greenhouse gas emissions, plastics, carbon storage and carbon costs; timely granting of governmental permits and certifications; uncertain impacts of deregulation on the legal and regulatory environment; evolving reporting standards for these topics and evolving measurement standards for reported data; trade patterns and the development and enforcement of local, national and regional mandates; unforeseen technical or operational difficulties; the outcome of research efforts and future technology developments, including the ability to scale projects and technologies such as electrification of operations, advanced recycling, carbon capture and storage, hydrogen and ammonia production, ProxximaTM systems, carbon materials or direct lithium extraction on a commercially competitive basis; the development and competitiveness of alternative energy and emission reduction technologies; unforeseen technical or operating difficulties, including the need for unplanned maintenance; availability of feedstocks for lower-emission fuels, hydrogen, or advanced recycling; changes in the relative energy mix across activities and geographies; the actions of co-venturers competitors; changes in regional and global economic growth rates and consumer preferences including willingness and ability to pay for reduced emissions products; actions taken by governments and consumers resulting from a pandemic; changes in population growth, economic development or migration patterns; timely completion of construction projects; war, civil unrest, attacks against the Company or industry, and other political or security disturbances, including disruption of land or sea transportation routes; decoupling of economies, realignment of global trade and supply chain networks, and disruptions in military alliances; and other factors discussed here and in Item 1A. Risk Factors of our Annual Report on Form 10-K and under the heading “Factors affecting future results” available under the “Earnings” tab through the “Investors” page of our website at www.exxonmobil.com. The Advancing Climate Solutions Report includes 2024 greenhouse gas emissions performance data as of March 1, 2025, and Scope 3 Category 11 estimates for full year 2024 as of February 19, 2025. The greenhouse gas intensity and greenhouse gas emission estimates include Scope 2 market-based emissions. The Sustainability Report, the Advancing Climate Solutions Report, and corresponding Executive Summaries were issued on April 30, 2025. The content and data referenced in these publications focus primarily on our operations from Jan. 1, 2024 – Dec. 31, 2024, unless otherwise indicated. Tables on our “Metrics and data” page were updated to reflect full year 2024 data. Information regarding some known events or activities in 2025 and historical initiatives from prior years are also included. No party should place undue reliance on these forward-looking statements, which speak only as of the dates of these publications. All forward-looking statements are based on management’s knowledge and reasonable expectations at the time of publication. ExxonMobil assumes no duty to update these statements or materials as of any future date, and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of these figures or statements as of any future date. Any future update will be provided only through a public disclosure indicating that fact.

See “ABOUT THE ADVANCING CLIMATE SOLUTIONS AND SUSTAINABILITY REPORTS” at the end of this document for additional information on these reports and the use of non-GAAP and other financial measures.

ABOUT THE ADVANCING CLIMATE SOLUTIONS AND SUSTAINABILITY REPORTS

The Advancing Climate Solutions Report contains terms used by the TCFD, as well as information about how the disclosures in this report are consistent with the recommendations of the TCFD. In doing so, ExxonMobil is not obligating itself to use any terms in the way defined by the TCFD or any other party, nor is it obligating itself to comply with any specific recommendation of the TCFD or to provide any specific disclosure. For example, with respect to the term “material,” individual companies are best suited to determine what information is material, under the long-standing U.S. Supreme Court definition, and whether to include this information in U.S. Securities and Exchange Act filings. In addition, the ISSB is evaluating standards that provide their interpretation of TCFD which may or may not be consistent with the current TCFD recommendations. The Sustainability Report and Advancing Climate Solutions Report are each a voluntary disclosure and are not designed to fulfill any U.S., foreign, or third-party required reporting framework.

Forward-looking and other statements regarding environmental and other sustainability efforts and aspirations are not intended to communicate any material investment information under the laws of the United States or represent that these are required disclosures. These publications are not intended to imply that ExxonMobil has access to any significant non-public insights on future events that the reader could not independently research. In addition, historical, current, and forward-looking environmental and other sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future, including future laws and rulemaking. Forward-looking and other statements regarding environmental and other sustainability efforts and aspirations are for informational purposes only and are not intended as an advertisement for ExxonMobil’s equity, debt, businesses, products, or services and the reader is specifically notified that any investor-requested disclosure or future required disclosure is not and should not be construed as an inducement for the reader to purchase any product or services. The statements and analysis in these publications represent a good faith effort by the Company to address these investor requests despite significant unknown variables and, at times, inconsistent market data, government policy signals, and calculation, methodologies, or reporting standards.

Actions needed to advance ExxonMobil’s 2030 greenhouse gas emission-reductions plans are incorporated into its medium-term business plans, which are updated annually. The reference case for planning beyond 2030 is based on the Company’s Global Outlook research and publication. The Global Outlook is reflective of the existing global policy environment and an assumption of increasing policy stringency and technology improvement to 2050. However, the Global Outlook does not attempt to project the degree of required future policy and technology advancement and deployment for the world, or ExxonMobil, to meet net zero by 2050. As future policies and technology advancements emerge, they will be incorporated into the GIobal Outlook, and the Company’s business plans will be updated as appropriate. References to projects or opportunities may not reflect investment decisions made by the corporation or its affiliates. Individual projects or opportunities may advance based on a number of factors, including availability of stable and supportive policy, permitting, technological advancement for cost-effective abatement, insights from the Company planning process, and alignment with our partners and other stakeholders. Capital investment guidance in lower-emission and other new investments is based on our corporate plan; however, actual investment levels will be subject to the availability of the opportunity set, stable public policy support, other factors, and focused on returns.

Energy demand modeling aims to replicate system dynamics of the global energy system, requiring simplifications. The reference to any scenario or any pathway for an energy transition, including any potential net-zero scenario, does not imply ExxonMobil views any particular scenario as likely to occur. In addition, energy demand scenarios require assumptions on a variety of parameters. As such, the outcome of any given scenario using an energy demand model comes with a high degree of uncertainty. For example, the IEA describes its NZE scenario as extremely challenging, requiring unprecedented innovation, unprecedented international cooperation, and sustained support and participation from consumers, with steeper reductions required each year since the scenario’s initial release. Third-party scenarios discussed in these reports reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use or inclusion herein is not an endorsement by ExxonMobil of their underlying assumptions, likelihood, or probability. Investment decisions are made on the basis of ExxonMobil’s separate planning process but may be secondarily tested for robustness or resiliency against different assumptions, including against various scenarios. These reports contain information from third parties. ExxonMobil makes no representation or warranty as to the third-party information. Where necessary, ExxonMobil received permission to cite third-party sources, but the information and data remain under the control and direction of the third parties. ExxonMobil has also provided links in this report to third-party websites for ease of reference. ExxonMobil’s use of the third-party content is not an endorsement or adoption of such information.

ExxonMobil reported emissions, including reductions and avoidance performance data, are based on a combination of measured and estimated data. We assess our performance to support continuous improvement throughout the organization using our Environmental Performance Indicator (EPI) manual. The reporting guidelines and indicators in the Ipieca, the American Petroleum Institute (API), the International Association of Oil and Gas Producers Sustainability Reporting Guidance for the Oil and Gas Industry (4th edition, 2020, revised February 2023) and key chapters of the GHG Protocol inform the EPI and the selection of the data reported. Emissions reported are estimates only, and performance data depends on variations in processes and operations, the availability of sufficient data, the quality of those data and methodology used for measurement and estimation. Emissions data is subject to change as methods, data quality, and technology improvements occur, and changes to performance data may be updated. Emissions, reductions, abatements and enabled avoidance estimates for non-ExxonMobil operated facilities are included in the equity data and similarly may be updated as changes in the performance data are reported. ExxonMobil’s plans to reduce emissions are good-faith efforts based on current relevant data and methodology, which could be changed or refined. ExxonMobil works to continuously improve its approach to estimate, detect, measure, and address emissions. ExxonMobil actively engages with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

Any reference to ExxonMobil’s support of, work with, or collaboration with a third-party organization within these publications do not constitute or imply an endorsement by ExxonMobil of any or all of the positions or activities of such organization. ExxonMobil participates, along with other companies, institutes, universities and other organizations, in various initiatives, campaigns, projects, groups, trade organizations, and other collaborations among industry and through organizations like the United Nations that express various ambitions, aspirations and goals related to climate change, emissions, sustainability, and the energy transition. ExxonMobil’s participation or membership in such collaborations is not a promise or guarantee that ExxonMobil’s individual ambitions, future performance or policies will align with the collective ambitions of the organizations or the individual ambitions of other participants, all of which are subject to a variety of uncertainties and other factors, many of which may be beyond ExxonMobil’s control, including government regulation, availability and cost-effectiveness of technologies, and market forces and other risks and uncertainties. Such third parties’ statements of collaborative or individual ambitions and goals frequently diverge from ExxonMobil’s own ambitions, plans, goals, and commitments. ExxonMobil will continue to make independent decisions regarding the operation of its business, including its climate-related and sustainability-related ambitions, plans, goals, commitments, and investments. ExxonMobil’s future ambitions, goals and commitments reflect ExxonMobil’s current plans, and ExxonMobil may unilaterally change them for various reasons, including adoption of new reporting standards or practices, market conditions; changes in its portfolio; and financial, operational, regulatory, reputational, legal and other factors.

References to “resources,” “resource base,” “recoverable resources” and similar terms refer to the total remaining estimated quantities of oil and natural gas that are expected to be ultimately recoverable. The resource base includes quantities of oil and natural gas classified as proved reserves, as well as quantities that are not yet classified as proved reserves, but that are expected to be ultimately recoverable. The term “resource base” is not intended to correspond to SEC definitions such as “probable” or “possible” reserves. For additional information, see the “Frequently Used Terms” on the Investors page of the Company’s website at www.exxonmobil.com under the header “Modeling Toolkit.” References to “oil” and “gas” include crude, natural gas liquids, bitumen, synthetic oil, and natural gas. The term “project” as used in these publications can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

Exxon Mobil Corporation has numerous affiliates, many with names that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For convenience and simplicity, those terms and terms such as “Corporation,” “company,” “our,” “we,” and “its” are sometimes used as abbreviated references to one or more specific affiliates or affiliate groups. Abbreviated references describing global or regional operational organizations, and global or regional business lines are also sometimes used for convenience and simplicity. Nothing contained herein is intended to override the corporate separateness of affiliated companies. Exxon Mobil Corporation’s goals do not guarantee any action or future performance by its affiliates or Exxon Mobil Corporation’s responsibility for those affiliates’ actions and future performance, each affiliate of which manages its own affairs. For convenience and simplicity, words like venture, joint venture, partnership, co-venturer and partner are used to indicate business relationships involving common activities and interests, and those words may not indicate precise legal relationships. These publications cover Exxon Mobil Corporation’s owned and operated businesses and do not address the performance or operations of our suppliers, contractors or partners unless otherwise noted. In the case of certain joint ventures for which ExxonMobil is the operator, we often exercise influence but not control. Thus, the governance, processes, management and strategy of these joint ventures may differ from those in these reports. At the time of publication, ExxonMobil has completed the acquisitions of Denbury Inc. and Pioneer Natural Resources Company. These reports and the data therein do not speak of these companies’ pre-acquisition governance, risk management, strategy approaches, or emissions or sustainability performance unless specifically referenced.

These reports or any material therein are not to be used or reproduced without the permission of Exxon Mobil Corporation. All rights reserved.

SUPPLEMENTAL INFORMATION FOR NON-GAAP AND OTHER MEASURES

The Positioned for Growth in a Lower-Emission Future section of the Advancing Climate Solutions Report mentions modeled operating cash flow in comparing different businesses over time in a future scenario. Historic operating cash flow is defined as net income, plus depreciation, depletion and amortization for consolidated and equity companies, plus noncash adjustments related to asset retirement obligations plus proceeds from asset sales. The Company’s long-term portfolio modeling estimates operating cash flow as revenue or margins less cash expenses, taxes and abandonment expenditures plus proceeds from asset sales before portfolio capital expenditures. The Company believes this measure can be helpful in assessing the resiliency of the business to generate cash from different potential future markets. The performance data presented in the Advancing Climate Solutions Report and Sustainability Report, including on emissions, is not financial data and is not GAAP data.