8 min read

•Growing Low Carbon Solutions

- With our expertise in molecule management, we are positioned to scale a portfolio of lower emissions energy solutions through our Low Carbon Solutions (LCS) business.

- Our strategic focus on the U.S. Gulf Coast leverages the existing infrastructure and client base that makes the region an industrial powerhouse for cost-effective decarbonization.

- Supportive policy is critical to drive projects in this nascent industry, and a transition to market-forming policies is needed to help grow LCS in the long term.

8 min read

•Navigate to:

Accelerating the world’s paths to net zero by building a new business with new markets

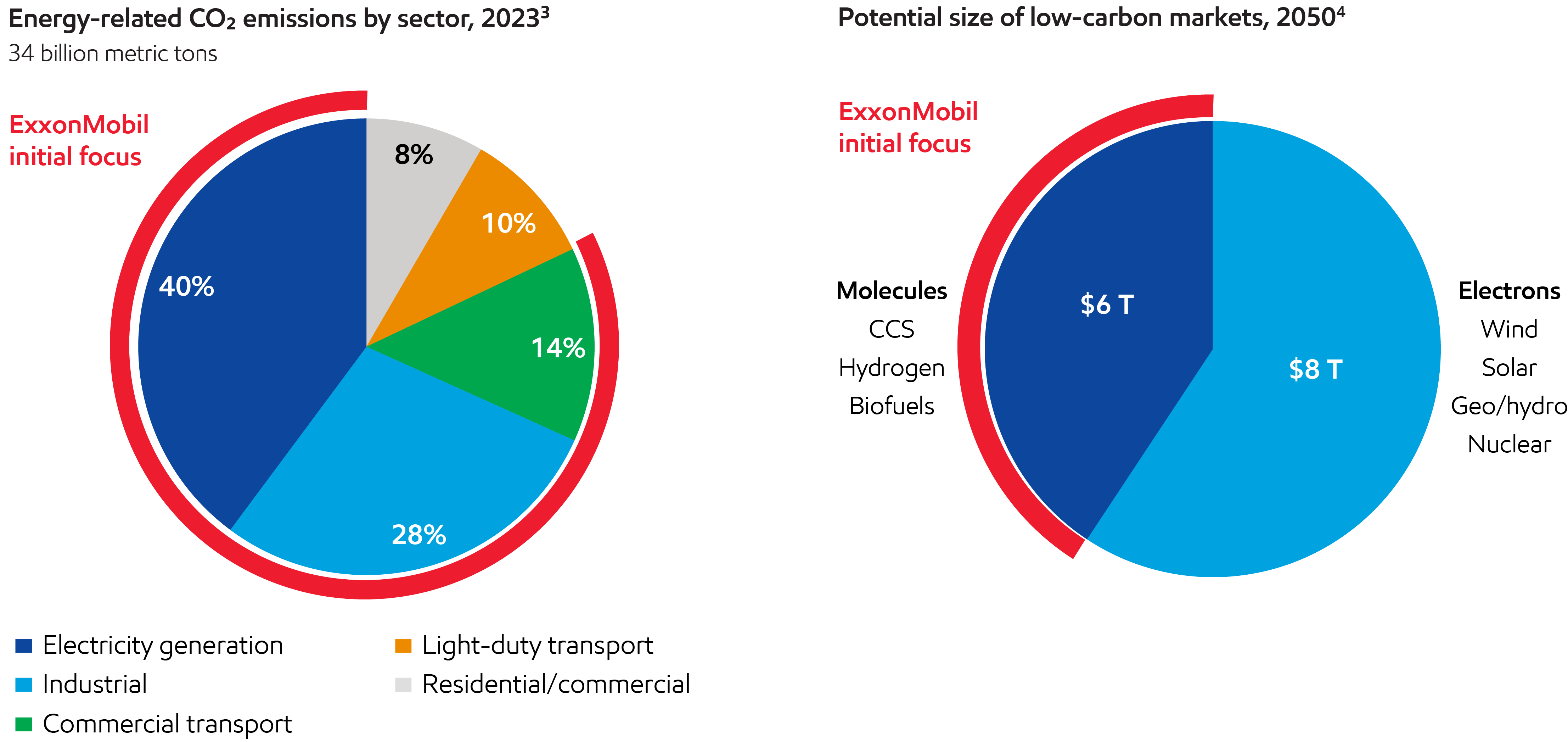

The world currently generates about 34 billion metric tons of energy-related CO2 emissions per year. Industrial activity, power generation, and commercial transportation together account for ~80% of those emissions.1

Emission-reduction markets in these hard-to-decarbonize sectors potentially represent a $6 trillion opportunity by 2050.2

This provides significant opportunities for our Low Carbon Solutions business, where we’re working to establish a competitively advantaged foundation that secures a leading position in these new markets.

Our work involves technologies to capture, transport, and store molecules; produce hydrogen from other molecules; and source and co-process lower-carbon-intensity molecules. All of these technologies align with the competitive advantages we’ve built in our traditional businesses.

We understand our role and the unique and important contributions we can make. Our customers, many governments, and strategic partners see how our experience, skills, and capabilities can meaningfully help reduce emissions for ourselves and others.

Our ability to manage molecules aligns with our core competencies in the low-carbon space. We have the necessary scale and infrastructure to bring these technologies to market, spurring innovation and reducing the cost of GHG emissions reduction.

Low Carbon Solutions potential revenue5

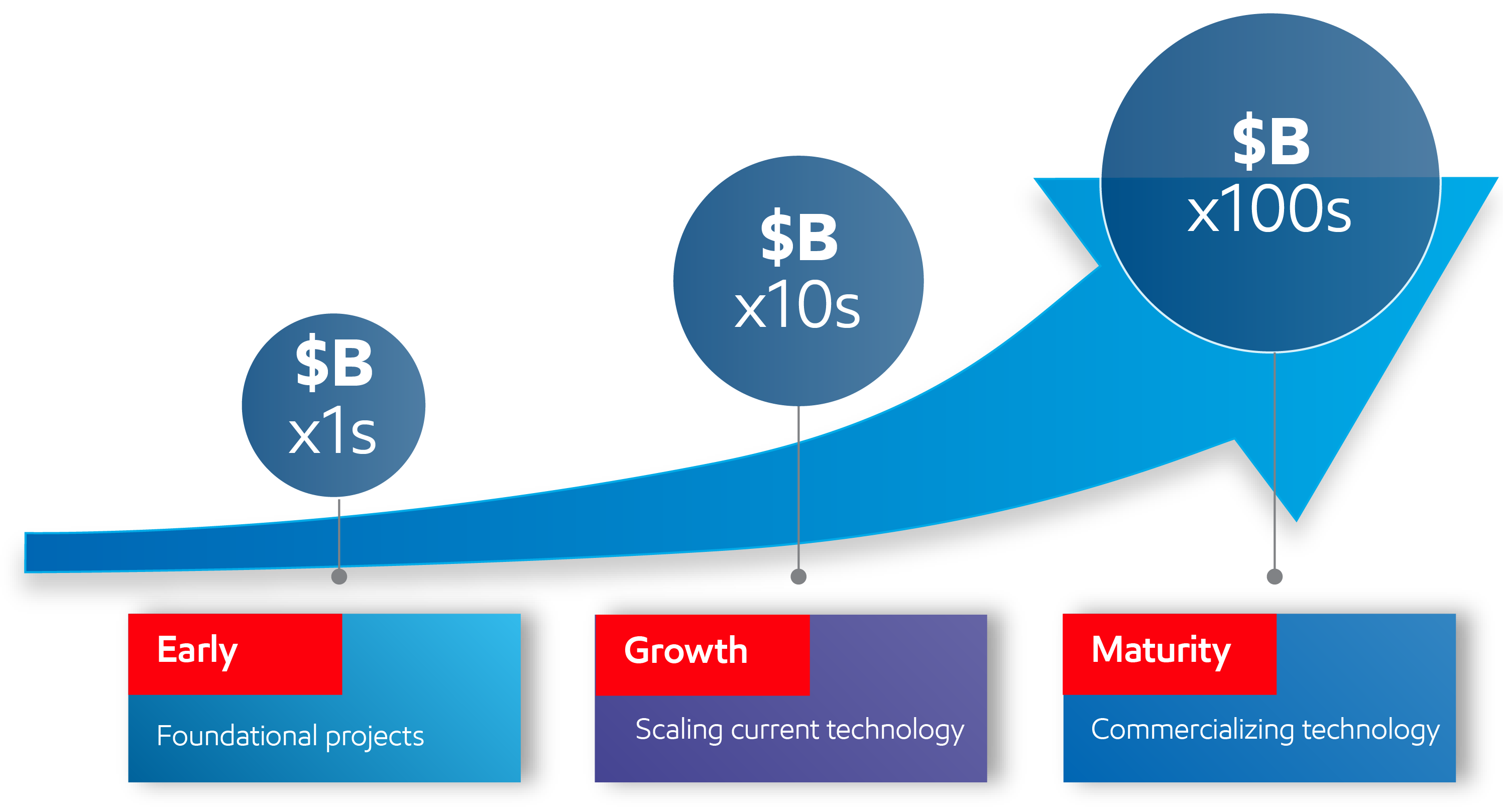

These technologies can be developed and deployed in three main phases:

- Early phase: We are working with today’s policies, technology, and infrastructure to build foundational projects, and we’re making real progress. In this phase, we’re working to demonstrate their potential as attractive investments and as lower-emissions solutions.

- Growth phase: This phase will be shaped by additional policy that helps develop market-based solutions that make decarbonization affordable. It is also defined by cost reductions through deployment of new and existing technology. In this phase, we can leverage the breadth of our operations to develop economies of scale.

- Maturity phase: This represents the full transition to market forces. Progress will be bolstered by additional cost reductions through a continued focus on scaling new technology and the reuse of infrastructure.

Government policy can play a key role in building new markets, especially in the near term. Rational and constructive policies are needed to drive projects in the early stages. We have the expertise and network to bring this technology to the market.

We support legislation like the U.S. Inflation Reduction Act (IRA), which provides incentives for companies to be part of the solution. European policy is currently more prescriptive and limits solutions for hard-to-decarbonize sectors. At this early stage, constructive policy remains critical to enable emissions reductions, advance technology, and drive scale to lower costs. Ultimately, to achieve society’s net-zero ambitions, competitive markets for emissions reduction will need to develop.

We support a policy and regulatory framework for carbon capture and storage that would:

- Sustain long-term government support for research and development.

- Provide standards to ensure safe and secure CO2 storage.

- Allow for fit-for-purpose CO2 injection well design standards.

- Provide legal certainty for geologic storage ownership.

- Ensure a streamlined permitting process for carbon capture and storage facilities.

- Enable interstate CO2 pipeline expansion.

- Provide access to CO2 storage capacity owned or controlled by governments.

- Help develop carbon credits based on life cycle analysis of carbon-removal projects.

Investing in a lower-emission future

We’re pursuing up to $30 billion in lower-emission investments from 2025 through 2030, with about 65% directed toward reducing the emissions of other companies.6Carbon capture and storage

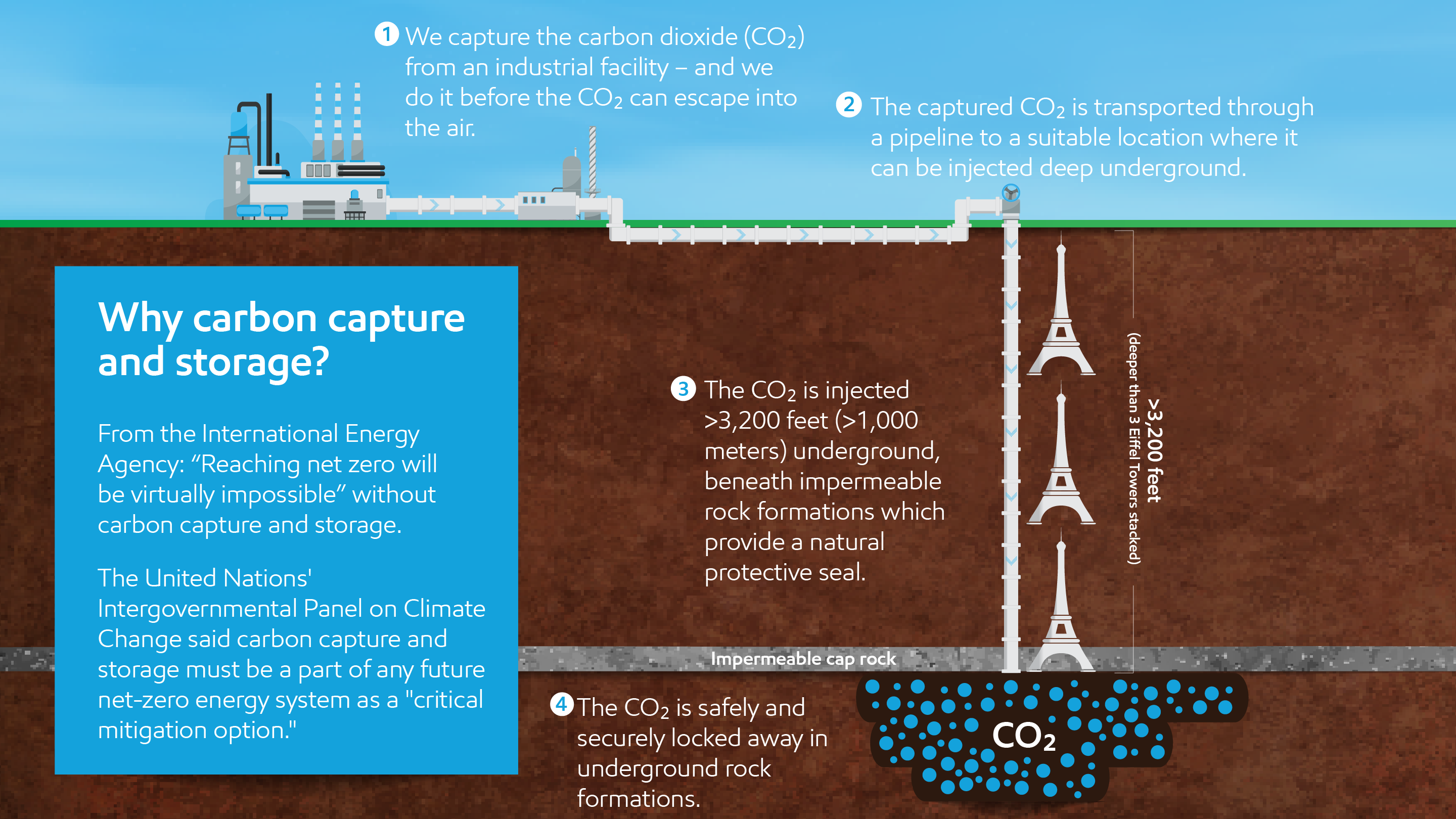

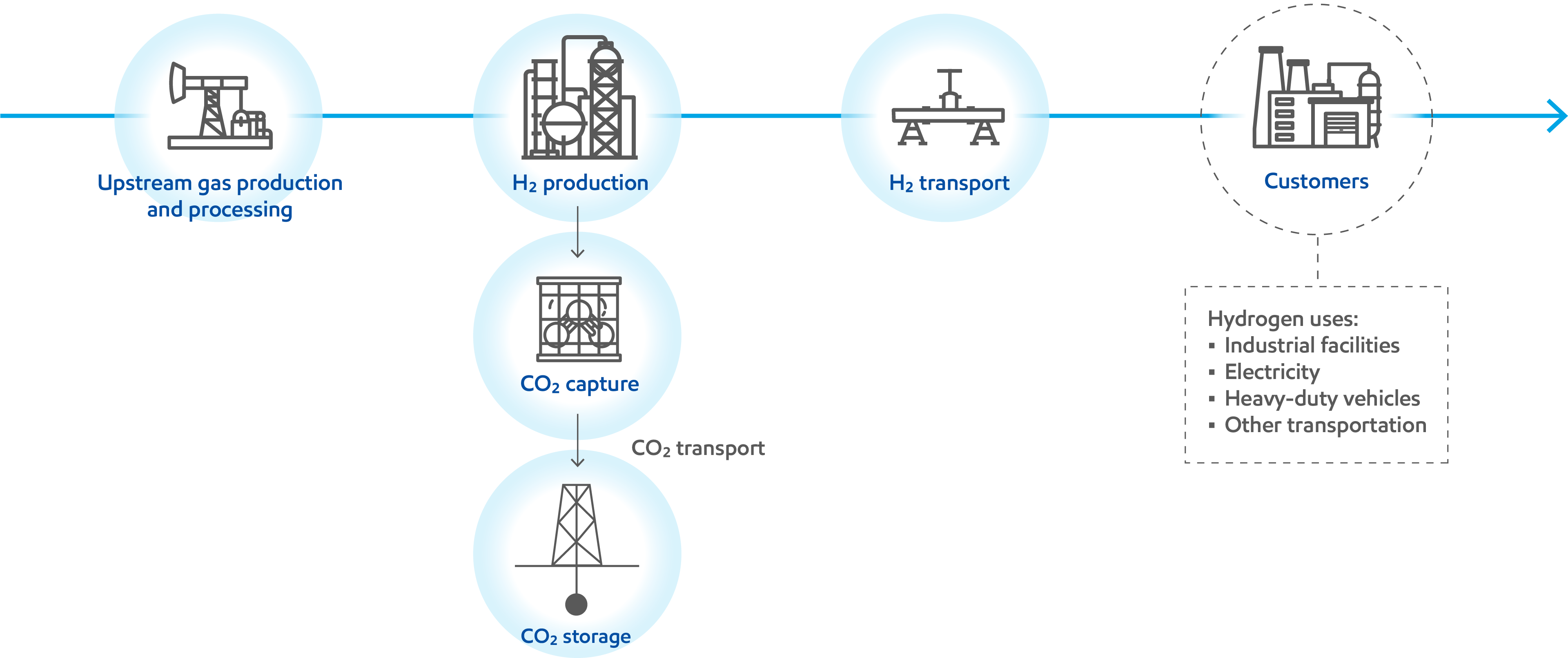

What it is

Carbon capture and storage is just what the term implies. Once CO2 is captured at factories or power plants, it is transported and injected it into geologic formations thousands of feet below the earth’s surface for safe and secure storage. The CO2 is held in place by thick, impermeable-seal rocks.

Carbon capture and storage, on its own or combined with hydrogen production, is one of the few proven technologies that could drive significant CO2 emission reductions from high-emitting and hard-to-decarbonize sectors. These include power generation, refining, steel, cement, and chemicals manufacturing. According to the Center for Climate and Energy Solutions, carbon capture and storage can capture more than 90% of CO2 emissions from power plants and industrial facilities.7

ExxonMobil is a global leader in carbon capture and storage

What respected third parties are saying about carbon capture and storage

Both the International Energy Agency (IEA) and the United Nations Intergovernmental Panel on Climate Change (IPCC) see carbon capture and storage as key to reaching global emissions goals.

The IEA NZE report concludes that more than 6 billion metric tons per year of CO₂ will need to be captured and stored by 2050 to reach a net-zero future.8 By comparison, the world’s current capture capacity is far below that at about 40 million metric tons of CO₂ per year.9 The agency has also said “reaching net zero will be virtually impossible” without carbon capture and storage.10

The IPCC estimates that the cost of achieving a 2°C outcome would more than double without carbon capture and storage.11

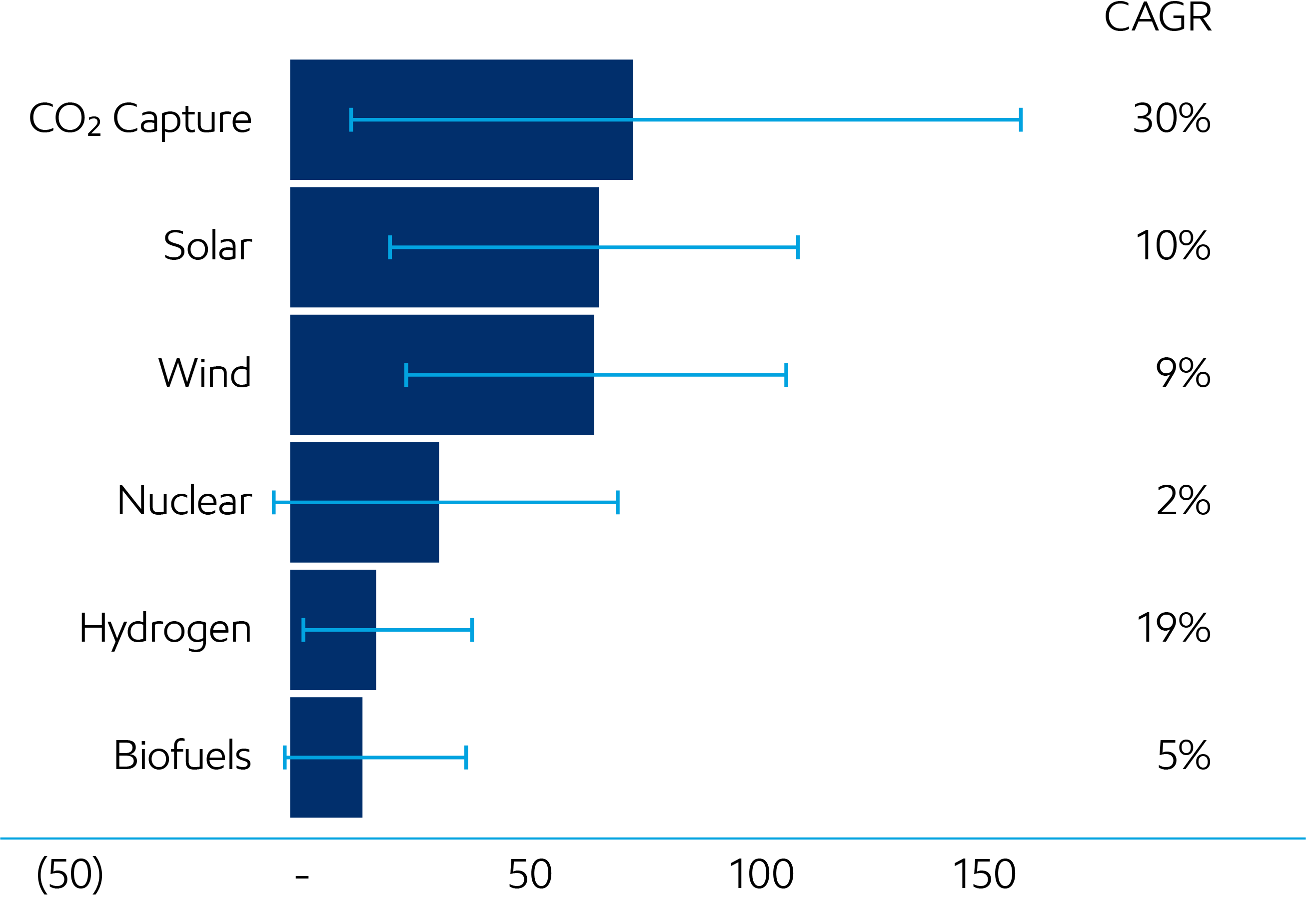

Growth of lower-carbon solutions between 2020 and 2050 in IPCC Likely <2°C scenarios12

We identify opportunities with concentrated streams of CO2 near sites with safe and secure storage space, and where we can use existing infrastructure to gain scale to offer cost-effective solutions to customers.

Leading now

We have the only large-scale end-to-end carbon capture and storage system in the world.13 With more than 1,300 miles of pipeline and more than 30 years of experience in carbon capture, we lead the industry in the successful deployment of this technology at scale. We are continuing to develop and expand our capacity for storing CO2 on a long-term basis.

Our initial CCS activity is focused on the U.S. Gulf Coast. This region has the critical drivers needed to provide a lower-cost decarbonization solution for industrial applications: a high concentration of emitters, geologic storage space, and existing transportation infrastructure. These drivers, strengthened by policy like the IRA, are helping us build a carbon capture and storage network that will help our industrial customers significantly reduce their emissions.

The U.S. Gulf Coast has a large concentration of CO2 emissions – one third of all U.S. industrial emissions come from this region.14

This makes it a great strategic fit as about 70% of our CCS pipelines are located in the Gulf Coast states of Louisiana, Texas, and Mississippi. Our network will connect multiple CO2 emitters with CO2 storage locations that will improve operations reliability. This transport and storage network supports multiple low-carbon businesses – including carbon capture and storage, hydrogen, ammonia, and biofuels.

We continue to add suitable acreage onshore and offshore to expand our storage capacity, with 30 Mta per year expected by 2030.15 Building on our successful collaborations with host governments, we are also negotiating to gain access to nationally owned acreage that holds potential for CO₂ storage. We also continue to work with local jurisdictions on the appropriate permitting to store CO2, which will be essential to the success of these projects. We recently secured the largest offshore CO2 lease in the United States from the Texas General Land Office. With over 271,000 acres, the site is our newest asset on the U.S. Gulf Coast.

8.7 Mta of long-term CO2 offtake agreements with third parties

Another vital element of establishing a successful business is building a customer base, and we’re making great progress. Our customers include a major fertilizer company, an industrial gas producer, a leading steel manufacturer, and more:

- CF Industries: A leading global manufacturer of hydrogen and nitrogen products. They signed the largest-of-its-kind commercial agreement with us to capture and permanently store up to 2.5 million metric tons of CO2 emissions annually from their manufacturing complexes in Louisiana and Mississippi.

- Linde: One of the world's leading industrial gases and engineering companies. They entered into a long-term commercial agreement with us in which we plan to transport and permanently store up to 2.2 million metric tons of CO2 annually from Linde's new clean hydrogen production facility in Beaumont, Texas.

- Nucor Corp: North America’s largest steel and steel products producer. They entered into a long-term commercial agreement with us where we will capture, transport, and store up to 800,000 metric tons of CO2 annually from their manufacturing site in Convent, Louisiana.

- New Generation Gas Gathering (NG3): The first natural gas customer to use our CCS infrastructure. We have joined forces with the NG3 project to capture and store up to 1.2 million metric tons of carbon dioxide annually from their Louisiana facility.

- Calpine Corporation: The nation’s largest producer of electricity from natural gas. In April 2025, they entered into an agreement with us to transport and permanently store up to 2 million metric tons of CO2 annually from Calpine’s Baytown Energy Center, a cogeneration facility near Houston, Texas.

Advantaged U.S. Gulf Coast position16

What’s next

- Building our customer base: We continue to work with others in the industry to spur advances in technology to lower cost and further build our customer base. We see potential to reduce CO2 emissions across the Gulf Coast by more than 100 million metric tons per year.17

- Policy advocacy: Land access is critical to accelerating carbon capture project deployment – onshore and offshore. We continue to advocate for streamlined permitting and regulation for long-term CO2 storage.

- Studying storage: We are working with leading universities and other research organizations to advance knowledge in monitoring requirements and modeling of geologic storage. This work includes seal characterization for containment assessment,18 as well as optimal long-term monitoring of stored CO₂.

Hydrogen

What it is

When used for energy, hydrogen does not emit carbon, and it can generate the high temperatures needed to produce steel, cement, and refining and chemical products without carbon dioxide emissions. This means it could serve as an affordable and reliable source of energy for hard-to-decarbonize industrial processes.

What respected third parties are saying about hydrogen

In 2024, the National Petroleum Council (NPC) published “Harnessing Hydrogen: A key element for the U.S. Energy Future.” The study details deployment of low-carbon-intensity hydrogen at scale in the United States.

The NPC assembled a diverse team of more than 300 experts from over 100 organizations, 70% of which come from outside of the oil and natural gas industry. This study applied scenario-based modeling, partnering with Massachusetts Institute of Technology (MIT) Energy Initiative.

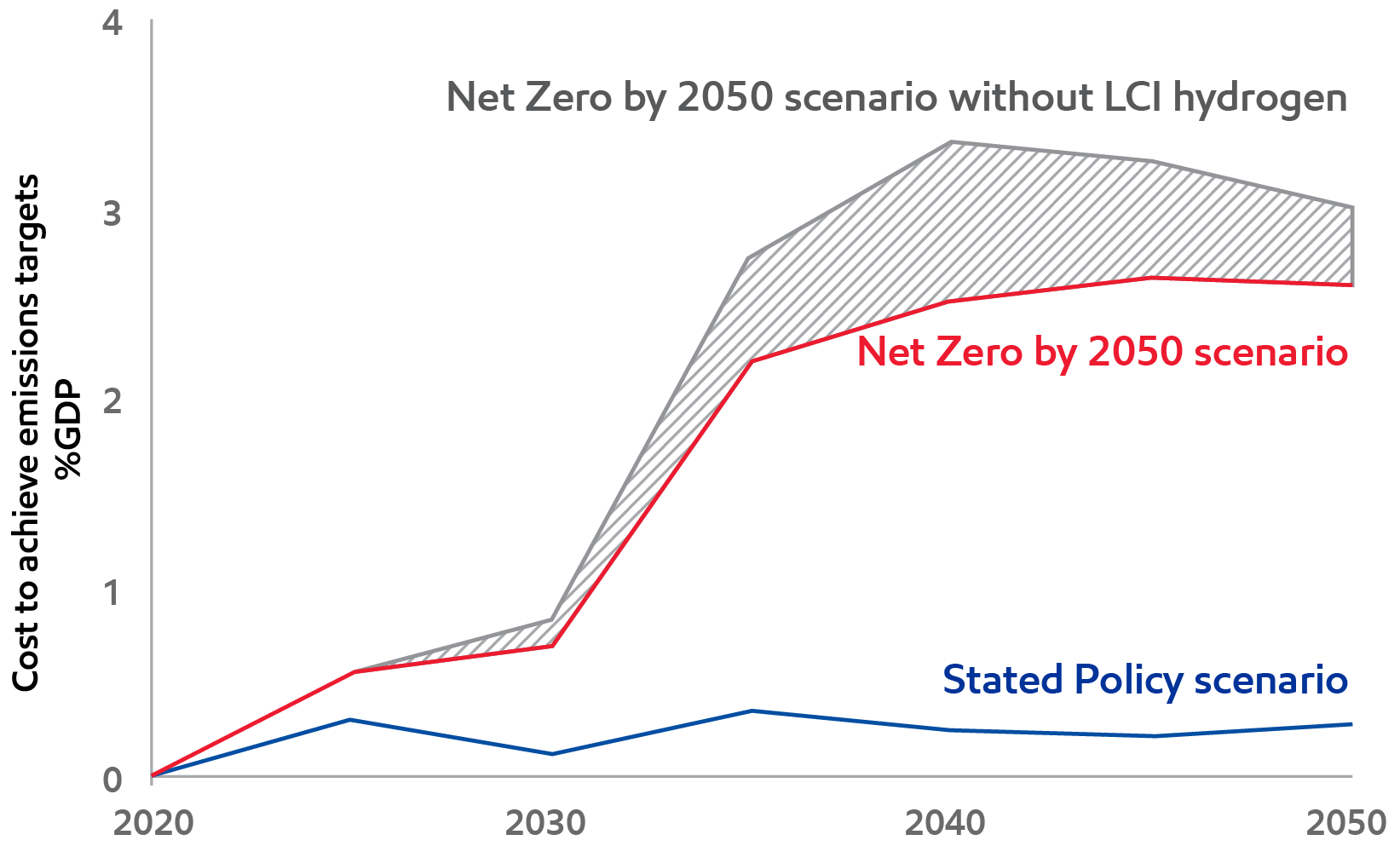

The key finding? Deploying lower-carbon hydrogen at scale in hard-to-abate sectors in the United States can lower the cost of reducing carbon emissions. In fact, under the MIT’s Net Zero by 2050 scenario, closely modeled on IEA’s NZE, achieving net zero would cost approximately 30% more without hydrogen.19

Low-carbon-intensity (LCI) hydrogen plays a key role in achieving emissions reduction at a lower cost to society20

Leading now

Just as we have a long history with carbon capture and storage, we have deep and broad experience with hydrogen. We use hydrogen in just about every one of our refining and chemical plants, and we’re looking to expand its use further.

In Baytown, Texas, we are working to develop the world’s largest low-carbon hydrogen production facility. This project is being designed to produce 1 billion standard cubic feet of hydrogen per day.21 The plant will also produce around 1 million metric tons of low-carbon ammonia per year.

The Baytown facility's access to the certified lower-emission natural gas we produce in the Permian Basin and nearby CCS and hydrogen infrastructure are key advantages. Industry peers and major players have recognized this and joined the project:

- Air Liquide: Air Liquide's project centers around building, owning, and operating four Large Modular Air separation units (LMAs) to produce and supply 9,000 metric tons of oxygen and up to 6,500 metric tons of nitrogen daily to the facility. The agreement would leverage Air Liquide’s existing pipeline infrastructure to foster the development of low-carbon hydrogen.

- ADNOC: ADNOC entered the Baytown project with a 35% equity stake. This investment will support both companies’ net-zero ambitions, accelerate decarbonization of hard-to-abate sectors, and meet rising demand for low-carbon hydrogen and ammonia.

We’re getting our foundational project in Baytown ready, but we need the right policy and necessary regulatory permits to make it a reality. Our Baytown project meets nearly 10% of the U.S. Department of Energy Hydrogen Program Plan’s projected 10 million metric tons of hydrogen per year by 2030.22 We expect to capture and store approximately 98% of the CO2, or about 7.5 million metric tons per year, associated with producing this hydrogen.23 The new plant could supply Gulf Coast industrial customers, as well as our own facilities in the Baytown area, with clean-burning hydrogen fuel for process operations. Front-end engineering is underway.

What’s next

- Policy advocacy: Advocate for policies that advance hydrogen and ammonia projects, as well as broader policies that create a market for carbon abatement.

- Research and development: We are working with universities to expand understanding of the end-to-end carbon emissions from different technologies, including hydrogen. For example, the life-cycle tool we helped to develop as part of the MIT Energy Initiative is being used by policymakers and others as they consider policies to reduce global emissions at the lowest cost to society.24

Lower-emission fuels

What they are

These fuels generate fewer GHG emissions over their life-cycle than the traditional fuels they replace. They include biofuels made from renewable sources like plants and waste, biomass and synthetics made from hydrogen, and captured CO2 to form methanol. Lower-emission fuels have the high energy density required to move heavy trucks, airplanes, trains, and ships. Renewable diesel may reduce life-cycle carbon emissions by up to 80% compared to conventional diesel.25 Demand for these fuels is expected to grow rapidly. Our Global Outlook projects the global transportation sector will use nearly 9 million barrels of biofuels per day by 2050, more than four times 2021 levels.26

Our Product Solutions business is working to grow lower-emission fuels by applying technology and infrastructure. At the same time, our Low Carbon Solutions business is working to develop lower-emission fuels, underpinned by our other low-carbon businesses.

We’re exploring the combination of biomass-based fuel production with carbon capture and storage. This opportunity could open the door to very low- or negative-carbon intensity fuel production. Low-emission fuels can utilize existing distribution infrastructure, lowering the cost of deployment.

We’re also looking at how we can efficiently transform natural gas into methanol-based fuels. And, we already have the capability to convert methanol to multiple end-use fuels, such as marine and jet fuel. This ability could enable a range of lower-emission fuels.

Leading now

- Canada: We are building renewable diesel facilities at our majority-owned affiliate Imperial Oil’s Strathcona refinery. The facility is expected to be the largest of its kind in Canada and capable of producing up to 20,000 barrels a day.

- France: Our affiliate Esso France began producing SAF in November 2023. We’re targeting production of more than 3,000 barrels per day of biofuels – including sustainable aviation fuel – at the Gravenchon facility in 2025.

What’s next

- Co-processing: Critically needed to expand the production of biofuels, co-processing is the ability to process biofeed and conventional feedstock together. Where policy allows, we are conducting co-processing trials in our facilities to produce lower-emission fuels, including SAF. With constructive policy, co-processing would enable faster, lower-cost delivery of these fuels to customers versus constructing new facilities.

- Maritime goals: We support the International Maritime Organization’s GHG emission-reduction goals, and we are working to help our customers determine the best ways to meet them. For example, we have supplied ExxonMobil bio marine fuel oil blends in Singapore and Amsterdam-Rotterdam-Antwerp bunkering hubs.

- Testing with Toyota: Toyota and ExxonMobil recently conducted public road tests using our innovative lower-GHG-emission fuels in Toyota’s advanced engines and vehicles. So far, the program has demonstrated that these research fuels can be compatible with today’s vehicles and have the potential to use existing infrastructure.

- New jet fuel technology: We announced a new technology that can produce jet fuel using renewable methanol as the feedstock.27 This renewable methanol has a lower carbon intensity and can be derived from processes that use biofeeds (e.g., wood waste) or low-carbon hydrogen. We expect this process to provide a higher yield of jet fuel than other techniques, using feeds derived from gasification and captured CO2 and hydrogen, which has the additional potential to be used to make other fuels or chemicals.

Lithium

What it is

Lithium is a key component of battery technology. Batteries account for over 80% of global lithium use, and EVs rely on lithium for their rechargeable batteries. EVs can play a key role in reducing emissions in transportation, and lithium demand is expected to triple by 2030.28

Leading now

In 2023, we announced plans to produce lithium carbonate for use in EV battery manufacturing by employing direct lithium extraction (DLE) technology in southern Arkansas. By applying technology to separate the lithium from deep brine reservoirs, we’re working to produce this critical mineral more efficiently and with fewer environmental impacts than traditional hard rock mining. We believe our existing skills in subsurface exploration, drilling, refining, and chemicals will allow us to bring meaningful scale to this technology and provide auto battery manufacturers with a more reliable, lower-carbon lithium supply option.29

Other solutions

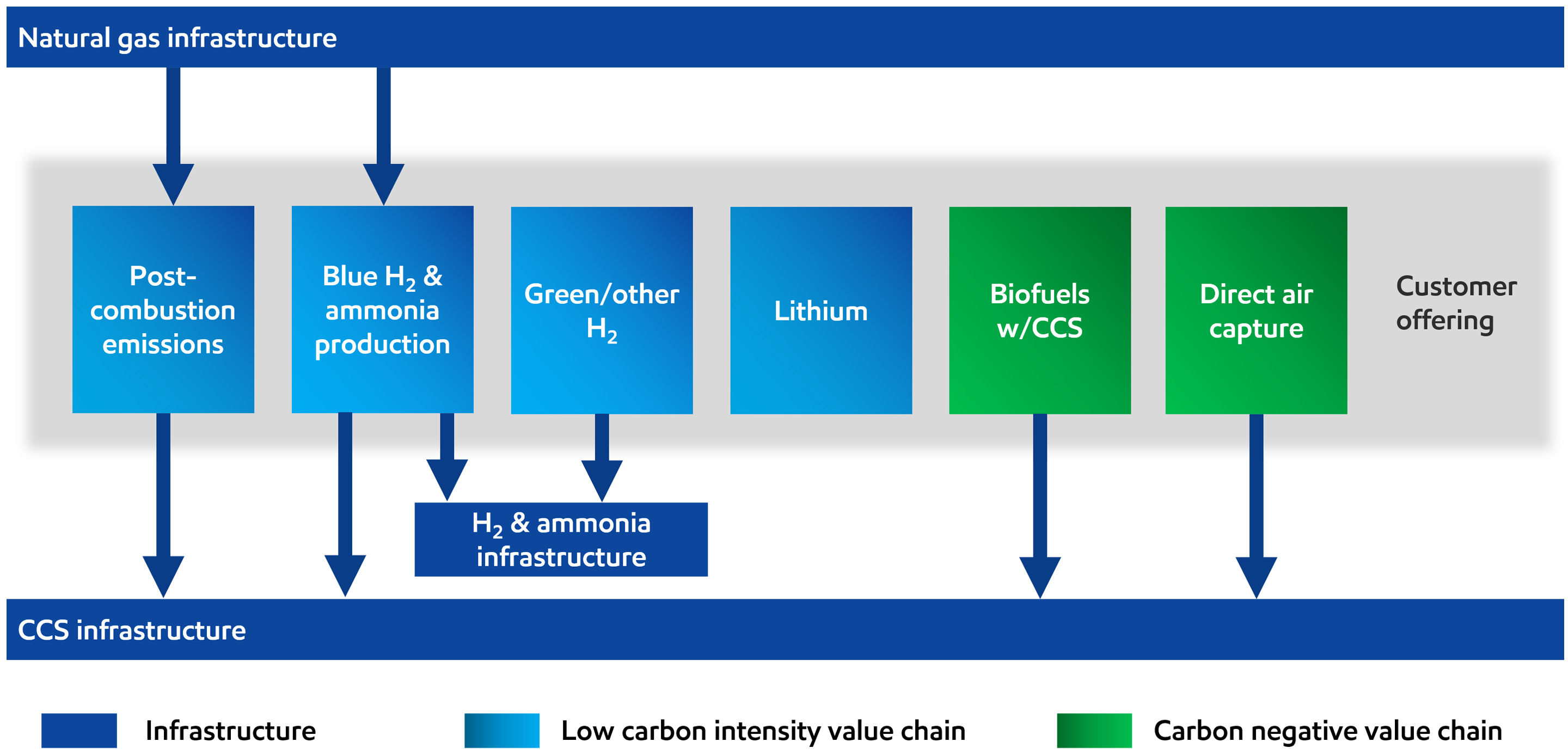

Expanding our advantage through integrated value chains

Carbon capture and storage, hydrogen, lower-emission fuels, and lithium are far from the only emission-reduction technologies in the world. We are always looking for opportunities that fit our strengths, capabilities, and businesses.

For example, many of our natural gas and LNG customers have significant post-combustion emissions that they’d like to reduce. We offer a “one-stop shop” for CO2 capture, transportation, and storage that will help these customers reduce their emissions.

We also see a growing opportunity in the market for carbon materials to become a large domestic supplier of yet another key component of electric vehicles. Synthetic graphite in EV batteries can potentially provide up to a 30% improvement in range, as well as faster charges.

We’re building on our technology, scale, project execution, and integration advantages to establish an attractive new business. We believe this new business complements our traditional businesses and will underpin the company’s growth and returns for decades to come.

Publications

Explore more

Rational and constructive policy

5 min read

•

Research and development

4 min read

•

Positioned for growth in a lower-emission future

8 min read

•

Advancing Climate Solutions Executive Summary

6 min read

•

Driving reductions in methane emissions

6 min read

•

Our risk management approach

4 min read

•FOOTNOTES:

- ExxonMobil 2024 Global Outlook.

- Total addressable market for carbon capture and storage, wind, solar, hydrogen, nuclear, biofuels, geothermal, and hydropower based on ExxonMobil analysis of the IPCC’s Sixth Assessment Report Scenarios Database hosted by IIASA. Secondary energy demand and prices in 2050 in the Likely Below 2°C scenarios (Category C3) were used, where available, to calculate an estimate of potential market revenue. Carbon capture and storage estimate includes both CCS and Direct Air Capture and used price of carbon for pricing estimate. Biofuels estimate used liquids pricing for pricing estimate. Total addressable market for lithium reflects ExxonMobil analysis of Benchmark Minerals industry data and IEA critical minerals explorer database scenarios. 2020 dollars. “Molecules” includes carbon capture and storage, low-carbon hydrogen, biofuels, and lithium. “Electrons” includes wind, solar, geothermal, hydro, and nuclear power.

- Ibid.

- Total addressable market based on ExxonMobil analysis of the IPCC’s Sixth Assessment Report Scenarios Database hosted by IIASA for carbon capture and storage, wind, solar, hydrogen, nuclear, biofuels, geothermal, and hydropower. Secondary energy demand and prices in 2050 in the Likely Below 2°C scenarios (Category C3) were used, where available, to calculate an estimate of potential market revenue. Carbon capture and storage estimate includes both CCS and direct air capture and used price of carbon for pricing estimate. Biofuels estimate used liquids pricing for pricing estimate. 2020 dollars.

- Exponential revenue growth potential assumes double-digit returns and scale of business activity materializes consistent with supporting conditions, which include supportive government policies, technology breakthroughs to lower abatement costs, deployment of necessary technologies, and the ability to repurpose and build infrastructure at large scale.

- Lower emissions cash capex includes cash capex attributable to carbon capture and storage, hydrogen, lithium, biofuels, ProxximaTM systems, carbon materials, and activities to lower ExxonMobil’s emissions and/or third party (3P) emissions. Planned spend is from 2025-2030, https://corporate.exxonmobil.com/news/news-releases/2024/1211_exxonmobil-announces-plans-to-2030-that-build-on-its-unique-advantages.

- Center for Climate and Energy Solutions, https://www.c2es.org/content/carbon-capture/.

- IEA (2023), World Energy Outlook 2023, IEA, Paris https://www.iea.org/reports/world-energy-outlook-2023, Licence: CC BY 4.0 (report); CC BY NC SA 4.0 (Annex A).

- IEA (2022), World Energy Outlook 2022, IEA, Paris https://www.iea.org/reports/world-energy-outlook-2022, Licence: CC BY 4.0 (report); CC BY NC SA 4.0 (Annex A).

- IEA (2020), CCUS in Clean Energy Transitions, IEA, Paris https://www.iea.org/reports/ccus-in-clean-energy-transitions, Licence: CC BY 4.0.

- O. Edenhofer et al., Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change: https://www.ipcc.ch/site/assets/uploads/2018/02/ipcc_wg3_ar5_full.pdf.

- ExxonMobil 2024 Global Outlook.

- “End-to-end CCS system” entails integration of CO2 capture, transportation, and storage. Based on contracts to move up to 8.7 MTA CO2, subject to additional investment by ExxonMobil and receipt of government permitting for carbon capture and storage projects.

- United States Environmental Protection Agency, GHGRP Emissions by Location (2023): https://www.epa.gov/ghgreporting/ghgrp-emissions-location.

- 30 million metric tons of CO2 captured and stored by 2030 subject to additional investment by ExxonMobil, receipt of government permitting for carbon capture and storage projects, and start up of low-carbon hydrogen project in Baytown, TX.

- Information shown is approximate (e.g., storage / pipeline location) and has potential to change as projects are developed and implemented. CO2 storage includes Class VI Permit Application and GLO Storage Site Access.

- Market potential for emission reduction opportunity based on ExxonMobil analysis of CO2 pipeline routes, current and potential capacity, potential emitters in the U.S. Gulf Coast market, and potential infrastructure upgrades. Subject to additional investment by ExxonMobil, customer commitments, supportive policy, and permitting for carbon capture and storage projects.

- D. Tapriyal, F. Haeri, D. Crandall, W. Horn, L. Lun, A. Lee, A. Goodman, Caprock Remains Water Wet Under Geologic CO2 Storage Conditions, Geophysical Research Letters 51 (2024).

- The chart shows the cost to society as a percent of GDP for achieving the current or Stated Policy scenario (which includes the IRA) and a U.S. aspirational target of Net Zero by 2050 scenario. The modeling for this study estimates that reaching net zero would cost about 3% GDP. However, if LCI hydrogen is not deployed, the cost of achieving net zero could increase the cost by 0.5-1% of GDP. Assuming a GDP of $38 trillion in 2050, a 3% cost to society equates to $1.1 trillion. The impact of not deploying LCI hydrogen to achieve emission targets changes by year, ranging $160 – 260 billion between 2035 and 2050: https://harnessinghydrogen.npc.org/

- Ibid.

- The Baytown hydrogen project is pre-FID. Final investment decision anticipated in 2025 subject to final 45V regulations for hydrogen production credits.

- U.S. Department of Energy Hydrogen Program Plan: https://www.hydrogen.energy.gov/docs/hydrogenprogramlibraries/pdfs/hydrogen-program-plan-2024.pdf?sfvrsn=bfc739dd_1.

- The Baytown hydrogen project is pre-FID. Final investment decision anticipated in 2025 subject to final 45V regulations for hydrogen production credits.

- E. Gencer, S. Torkamani, I. Miller, T. Wu, F. O’Sullivan, Sustainable energy system analysis modeling environment: analyzing life-cycle emissions of the energy transition, Applied Energy 277 (2020) 115550

- Based on ExxonMobil analysis using Argonne National Labs’ GREET2023 model and published fuel carbon intensity from California LCFS regulations. Argonne National Laboratory GREET model: https://greet.anl.gov/, California Air Resources Board Low Carbon Fuel Standard Regulation: https://ww2.arb.ca.gov/our-work/programs/low-carbon-fuel-standard/lcfs-regulation.

- ExxonMobil 2024 Global Outlook.

- EM Press Release (June 2023): https://www.exxonmobil.com/en/aviation/knowledge-library/resources/mtj-a-new-route-to-saf.

- U.S. Geological Survey, 2024, Mineral commodity summaries 2024: U.S. Geological Survey, 212 p., https://doi.org/10.3133/mcs2024. ISSN: 0076-8952 (print). IEA 2024; Critical Minerals Data Explorer, https://www.iea.org/data-and-statistics/data-tools/critical-minerals-data-explorer, License: CC BY 4.0.

- Expected smaller footprint of lithium mining and expected lower carbon and water impacts vs traditional mining: EM analysis of external sources and third party life-cycle analyses. a) Vulcan Energy, 2022 https://v-er.eu/app/uploads/2023/11/LCA.pdf, Minviro publication. Grant, A., Deak, D., & Pell, R. (2020). b) The CO2 Impact of the 2020s Battery Quality Lithium Hydroxide Supply Chain-Jade Cove Partners. https://www.jadecove.com/research/liohco2impact. Kelly, J. C., Wang, M., Dai, Q., & Winjobi, O. (2021). c) Energy, greenhouse gas, and water life cycle analysis of lithium carbonate and lithium hydroxide monohydrate from brine and ore resources and their use in lithium ion battery cathodes and lithium ion batteries. Resources, Conservation and Recycling, 174, 105762.

FORWARD-LOOKING STATEMENT WARNING

Images or statements of future ambitions, aims, aspirations, plans, goals, events, projects, projections, opportunities, expectations, performance, or conditions in the publications, including plans to reduce, abate, avoid or enable avoidance of emissions or reduce emissions intensity, sensitivity analyses, expectations, estimates, the development of future technologies, business plans, and sustainability efforts are dependent on future market factors, such as customer demand, continued technological progress, stable policy support and timely rule-making or continuation of government incentives and funding, and represent forward-looking statements. Similarly, emission-reduction roadmaps to drive toward net zero and similar roadmaps for emerging technologies and markets, and water management roadmaps to reduce freshwater intake and/or manage disposal, are forward-looking statements. These statements are not guarantees of future corporate, market or industry performance or outcomes for ExxonMobil or society and are subject to numerous risks and uncertainties, many of which are beyond our control or are even unknown.

Actual future results, including the achievement of ambitions to reach Scope 1 and 2 net zero from operated assets by 2050, to reach Scope 1 and 2 net zero in heritage Permian Basin unconventional operated assets by 2030, and in Pioneer Permian assets by 2035, to eliminate routine flaring in-line with World Bank Zero Routine Flaring, to reach near zero methane emissions from operated assets and other methane initiatives to meet ExxonMobil’s greenhouse gas emission reduction plans and goals, divestment and start-up plans, and associated project plans as well as technology advances, including in the timing and outcome of projects to capture, transport and store CO2, produce hydrogen and ammonia, produce lower-emission fuels, produce ProxximaTM systems, produce carbon materials, produce lithium, and use plastic waste as feedstock for advanced recycling; future debt levels and credit ratings; business and project plans, timing, costs, capacities and profitability; resource recoveries and production rates; planned Denbury and Pioneer integrated benefits; obtain data on detection, measurement and quantification of emissions including reporting of that data or updates to previous estimates and progress in sustainability focus areas could vary depending on a number of factors, including global or regional changes in oil, gas, petrochemicals, or feedstock prices, differentials, seasonal fluctuations, or other market or economic conditions affecting the oil, gas, and petrochemical industries and the demand for our products; new market products and services; future cash flows; our ability to execute operational objectives on a timely and successful basis; the ability to realize efficiencies within and across our business lines; new or changing government policies for lower carbon and new market investment opportunities, or policies limiting the attractiveness of investments such as European taxes on energy and unequal support for different methods of carbon capture; developments or changes in local, national, or international treaties, laws, regulations, taxes, trade sanctions, trade tariffs, and incentives affecting our business, including those related to greenhouse gas emissions, plastics, carbon storage and carbon costs; timely granting of governmental permits and certifications; uncertain impacts of deregulation on the legal and regulatory environment; evolving reporting standards for these topics and evolving measurement standards for reported data; trade patterns and the development and enforcement of local, national and regional mandates; unforeseen technical or operational difficulties; the outcome of research efforts and future technology developments, including the ability to scale projects and technologies such as electrification of operations, advanced recycling, carbon capture and storage, hydrogen and ammonia production, ProxximaTM systems, carbon materials or direct lithium extraction on a commercially competitive basis; the development and competitiveness of alternative energy and emission reduction technologies; unforeseen technical or operating difficulties, including the need for unplanned maintenance; availability of feedstocks for lower-emission fuels, hydrogen, or advanced recycling; changes in the relative energy mix across activities and geographies; the actions of co-venturers competitors; changes in regional and global economic growth rates and consumer preferences including willingness and ability to pay for reduced emissions products; actions taken by governments and consumers resulting from a pandemic; changes in population growth, economic development or migration patterns; timely completion of construction projects; war, civil unrest, attacks against the Company or industry, and other political or security disturbances, including disruption of land or sea transportation routes; decoupling of economies, realignment of global trade and supply chain networks, and disruptions in military alliances; and other factors discussed here and in Item 1A. Risk Factors of our Annual Report on Form 10-K and under the heading “Factors affecting future results” available under the “Earnings” tab through the “Investors” page of our website at www.exxonmobil.com. The Advancing Climate Solutions Report includes 2024 greenhouse gas emissions performance data as of March 1, 2025, and Scope 3 Category 11 estimates for full year 2024 as of February 19, 2025. The greenhouse gas intensity and greenhouse gas emission estimates include Scope 2 market-based emissions. The Sustainability Report, the Advancing Climate Solutions Report, and corresponding Executive Summaries were issued on April 30, 2025. The content and data referenced in these publications focus primarily on our operations from Jan. 1, 2024 – Dec. 31, 2024, unless otherwise indicated. Tables on our “Metrics and data” page were updated to reflect full year 2024 data. Information regarding some known events or activities in 2025 and historical initiatives from prior years are also included. No party should place undue reliance on these forward-looking statements, which speak only as of the dates of these publications. All forward-looking statements are based on management’s knowledge and reasonable expectations at the time of publication. ExxonMobil assumes no duty to update these statements or materials as of any future date, and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of these figures or statements as of any future date. Any future update will be provided only through a public disclosure indicating that fact.

See “ABOUT THE ADVANCING CLIMATE SOLUTIONS AND SUSTAINABILITY REPORTS” at the end of this document for additional information on these reports and the use of non-GAAP and other financial measures.

ABOUT THE ADVANCING CLIMATE SOLUTIONS AND SUSTAINABILITY REPORTS

The Advancing Climate Solutions Report contains terms used by the TCFD, as well as information about how the disclosures in this report are consistent with the recommendations of the TCFD. In doing so, ExxonMobil is not obligating itself to use any terms in the way defined by the TCFD or any other party, nor is it obligating itself to comply with any specific recommendation of the TCFD or to provide any specific disclosure. For example, with respect to the term “material,” individual companies are best suited to determine what information is material, under the long-standing U.S. Supreme Court definition, and whether to include this information in U.S. Securities and Exchange Act filings. In addition, the ISSB is evaluating standards that provide their interpretation of TCFD which may or may not be consistent with the current TCFD recommendations. The Sustainability Report and Advancing Climate Solutions Report are each a voluntary disclosure and are not designed to fulfill any U.S., foreign, or third-party required reporting framework.

Forward-looking and other statements regarding environmental and other sustainability efforts and aspirations are not intended to communicate any material investment information under the laws of the United States or represent that these are required disclosures. These publications are not intended to imply that ExxonMobil has access to any significant non-public insights on future events that the reader could not independently research. In addition, historical, current, and forward-looking environmental and other sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future, including future laws and rulemaking. Forward-looking and other statements regarding environmental and other sustainability efforts and aspirations are for informational purposes only and are not intended as an advertisement for ExxonMobil’s equity, debt, businesses, products, or services and the reader is specifically notified that any investor-requested disclosure or future required disclosure is not and should not be construed as an inducement for the reader to purchase any product or services. The statements and analysis in these publications represent a good faith effort by the Company to address these investor requests despite significant unknown variables and, at times, inconsistent market data, government policy signals, and calculation, methodologies, or reporting standards.

Actions needed to advance ExxonMobil’s 2030 greenhouse gas emission-reductions plans are incorporated into its medium-term business plans, which are updated annually. The reference case for planning beyond 2030 is based on the Company’s Global Outlook research and publication. The Global Outlook is reflective of the existing global policy environment and an assumption of increasing policy stringency and technology improvement to 2050. However, the Global Outlook does not attempt to project the degree of required future policy and technology advancement and deployment for the world, or ExxonMobil, to meet net zero by 2050. As future policies and technology advancements emerge, they will be incorporated into the GIobal Outlook, and the Company’s business plans will be updated as appropriate. References to projects or opportunities may not reflect investment decisions made by the corporation or its affiliates. Individual projects or opportunities may advance based on a number of factors, including availability of stable and supportive policy, permitting, technological advancement for cost-effective abatement, insights from the Company planning process, and alignment with our partners and other stakeholders. Capital investment guidance in lower-emission and other new investments is based on our corporate plan; however, actual investment levels will be subject to the availability of the opportunity set, stable public policy support, other factors, and focused on returns.

Energy demand modeling aims to replicate system dynamics of the global energy system, requiring simplifications. The reference to any scenario or any pathway for an energy transition, including any potential net-zero scenario, does not imply ExxonMobil views any particular scenario as likely to occur. In addition, energy demand scenarios require assumptions on a variety of parameters. As such, the outcome of any given scenario using an energy demand model comes with a high degree of uncertainty. For example, the IEA describes its NZE scenario as extremely challenging, requiring unprecedented innovation, unprecedented international cooperation, and sustained support and participation from consumers, with steeper reductions required each year since the scenario’s initial release. Third-party scenarios discussed in these reports reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use or inclusion herein is not an endorsement by ExxonMobil of their underlying assumptions, likelihood, or probability. Investment decisions are made on the basis of ExxonMobil’s separate planning process but may be secondarily tested for robustness or resiliency against different assumptions, including against various scenarios. These reports contain information from third parties. ExxonMobil makes no representation or warranty as to the third-party information. Where necessary, ExxonMobil received permission to cite third-party sources, but the information and data remain under the control and direction of the third parties. ExxonMobil has also provided links in this report to third-party websites for ease of reference. ExxonMobil’s use of the third-party content is not an endorsement or adoption of such information.

ExxonMobil reported emissions, including reductions and avoidance performance data, are based on a combination of measured and estimated data. We assess our performance to support continuous improvement throughout the organization using our Environmental Performance Indicator (EPI) manual. The reporting guidelines and indicators in the Ipieca, the American Petroleum Institute (API), the International Association of Oil and Gas Producers Sustainability Reporting Guidance for the Oil and Gas Industry (4th edition, 2020, revised February 2023) and key chapters of the GHG Protocol inform the EPI and the selection of the data reported. Emissions reported are estimates only, and performance data depends on variations in processes and operations, the availability of sufficient data, the quality of those data and methodology used for measurement and estimation. Emissions data is subject to change as methods, data quality, and technology improvements occur, and changes to performance data may be updated. Emissions, reductions, abatements and enabled avoidance estimates for non-ExxonMobil operated facilities are included in the equity data and similarly may be updated as changes in the performance data are reported. ExxonMobil’s plans to reduce emissions are good-faith efforts based on current relevant data and methodology, which could be changed or refined. ExxonMobil works to continuously improve its approach to estimate, detect, measure, and address emissions. ExxonMobil actively engages with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

Any reference to ExxonMobil’s support of, work with, or collaboration with a third-party organization within these publications do not constitute or imply an endorsement by ExxonMobil of any or all of the positions or activities of such organization. ExxonMobil participates, along with other companies, institutes, universities and other organizations, in various initiatives, campaigns, projects, groups, trade organizations, and other collaborations among industry and through organizations like the United Nations that express various ambitions, aspirations and goals related to climate change, emissions, sustainability, and the energy transition. ExxonMobil’s participation or membership in such collaborations is not a promise or guarantee that ExxonMobil’s individual ambitions, future performance or policies will align with the collective ambitions of the organizations or the individual ambitions of other participants, all of which are subject to a variety of uncertainties and other factors, many of which may be beyond ExxonMobil’s control, including government regulation, availability and cost-effectiveness of technologies, and market forces and other risks and uncertainties. Such third parties’ statements of collaborative or individual ambitions and goals frequently diverge from ExxonMobil’s own ambitions, plans, goals, and commitments. ExxonMobil will continue to make independent decisions regarding the operation of its business, including its climate-related and sustainability-related ambitions, plans, goals, commitments, and investments. ExxonMobil’s future ambitions, goals and commitments reflect ExxonMobil’s current plans, and ExxonMobil may unilaterally change them for various reasons, including adoption of new reporting standards or practices, market conditions; changes in its portfolio; and financial, operational, regulatory, reputational, legal and other factors.

References to “resources,” “resource base,” “recoverable resources” and similar terms refer to the total remaining estimated quantities of oil and natural gas that are expected to be ultimately recoverable. The resource base includes quantities of oil and natural gas classified as proved reserves, as well as quantities that are not yet classified as proved reserves, but that are expected to be ultimately recoverable. The term “resource base” is not intended to correspond to SEC definitions such as “probable” or “possible” reserves. For additional information, see the “Frequently Used Terms” on the Investors page of the Company’s website at www.exxonmobil.com under the header “Modeling Toolkit.” References to “oil” and “gas” include crude, natural gas liquids, bitumen, synthetic oil, and natural gas. The term “project” as used in these publications can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

Exxon Mobil Corporation has numerous affiliates, many with names that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For convenience and simplicity, those terms and terms such as “Corporation,” “company,” “our,” “we,” and “its” are sometimes used as abbreviated references to one or more specific affiliates or affiliate groups. Abbreviated references describing global or regional operational organizations, and global or regional business lines are also sometimes used for convenience and simplicity. Nothing contained herein is intended to override the corporate separateness of affiliated companies. Exxon Mobil Corporation’s goals do not guarantee any action or future performance by its affiliates or Exxon Mobil Corporation’s responsibility for those affiliates’ actions and future performance, each affiliate of which manages its own affairs. For convenience and simplicity, words like venture, joint venture, partnership, co-venturer and partner are used to indicate business relationships involving common activities and interests, and those words may not indicate precise legal relationships. These publications cover Exxon Mobil Corporation’s owned and operated businesses and do not address the performance or operations of our suppliers, contractors or partners unless otherwise noted. In the case of certain joint ventures for which ExxonMobil is the operator, we often exercise influence but not control. Thus, the governance, processes, management and strategy of these joint ventures may differ from those in these reports. At the time of publication, ExxonMobil has completed the acquisitions of Denbury Inc. and Pioneer Natural Resources Company. These reports and the data therein do not speak of these companies’ pre-acquisition governance, risk management, strategy approaches, or emissions or sustainability performance unless specifically referenced.

These reports or any material therein are not to be used or reproduced without the permission of Exxon Mobil Corporation. All rights reserved.

SUPPLEMENTAL INFORMATION FOR NON-GAAP AND OTHER MEASURES

The Positioned for Growth in a Lower-Emission Future section of the Advancing Climate Solutions Report mentions modeled operating cash flow in comparing different businesses over time in a future scenario. Historic operating cash flow is defined as net income, plus depreciation, depletion and amortization for consolidated and equity companies, plus noncash adjustments related to asset retirement obligations plus proceeds from asset sales. The Company’s long-term portfolio modeling estimates operating cash flow as revenue or margins less cash expenses, taxes and abandonment expenditures plus proceeds from asset sales before portfolio capital expenditures. The Company believes this measure can be helpful in assessing the resiliency of the business to generate cash from different potential future markets. The performance data presented in the Advancing Climate Solutions Report and Sustainability Report, including on emissions, is not financial data and is not GAAP data.