6 min read

•Driving reductions in methane emissions

- We’ve cut methane emissions intensity by more than 60% since 2016 and are on track to achieve reductions of 70-80% by 2030.1

- Reducing methane leaks is smart business. Keeping more natural gas in the pipe means more to sell, and natural gas has been the biggest driver in cutting CO2 emissions from electricity generation in the U.S. in recent years.2

6 min read

•Navigate to:

We’re deploying leading-edge technology on the ground, in the air, and in space to mitigate, monitor, and measure methane emissions. Our Center for Operations and Methane Emissions Tracking (COMET) is a model for our other locations around the world.

From our model regulatory framework to collaborations with the Oil and Gas Methane Partnership (OGMP) 2.0 and others, we’re working to be a global leader in eliminating methane emissions.

Methane: The other GHG

Methane is a powerful molecule.

With just one carbon and four hydrogen atoms, it’s the principal component in natural gas. Methane has the high energy density needed to make natural gas a reliable and flexible energy source. Natural gas is doing more to meaningfully reduce CO2 emissions in the U.S. electricity sector than any other technology.3 It will remain a critical source of energy in a lower-emissions future. Our Global Outlook forecasts that natural gas will supply 20% of the world’s power generation needs in 2050.4

Why is natural gas such a good option?

- Natural gas-fired electricity generation can reduce CO2 emissions by up to 60% and produce fewer air pollutants when it replaces coal.5

- Natural gas is abundant in many places around the world and can be easily transported.

- Natural gas is versatile, used in everything from power to transportation to home use.

- Natural gas is reliable, backing up intermittent renewable power generation.

But, as with any form of energy, there are tradeoffs. For natural gas, fugitive or leaked methane is a challenge. Compared to CO2, methane exists for a short time in the atmosphere but has 30 times the global warming potential on a 100-year timespan.6

That’s why it’s important for us to keep methane contained and managed – in our pipelines, in our storage tanks, and in our processing equipment.

Managing methane is smart business. Keeping more natural gas in the pipe means we have more product to sell.

Methane at ExxonMobil

Flaring and methane intensity

Methane emissions in our industry come from four main sources:

- Flaring: the burning of excess natural gas for safety or other reasons.

- Venting: the release of excess methane to reduce pressure in pneumatic devices, storage tanks, dehydration units, and other components of our operations to help ensure safety.

- Fugitive emissions: unintentional leaks from equipment.

- Combustion slip: uncombusted methane in the exhaust of natural gas engines.

As reported in the data table, methane emissions at ExxonMobil were approximately 112,000 metric tons in 2024, about 4% of our total direct (Scope 1) operated emissions. Approximately 95% of our methane emissions come from our upstream operations.

What we've done |

What we're doing |

| • Cut operated methane emissions intensity by more than 60% from 2016-2024.9 | • On plan to reduce methane intensity versus 2016 across all operated assets 70%-80% by 2030.10 |

| • Eliminated routine flaring in heritage Permian Basin operated assets. | • On track to achieve zero routine flaring across all operated upstream assets by 2030, consistent with World Bank Zero Routine Flaring Initiative.11

|

| • Joined the U.N. Oil and Gas Methane Partnership (OGMP) 2.0. | • Deploying continuous monitoring platforms on all key heritage operated sites in the Permian Basin by the end of 2025. |

| • Eliminated pneumatics in our heritage Permian Basin assets, replacing all pneumatic devices (>6,000), and exploring options for recently acquired Pioneer assets. | • Executing methane emissions measurement consistent with OGMP 2.0 Gold Standard reporting requirements. |

| • Began monitoring our Bakken assets in North Dakota through our headquarters-based COMET. | |

| • Heritage Pioneer operations received Gold Standard Pathway recognition from OGMP 2.0 in 2024. |

Mitigating methane emissions

We’re taking a multilayered approach, using leading-edge technology to mitigate, monitor, and measure methane emissions.

We start with mitigation. Because when we eliminate potential sources of routine and non-routine methane leaks, we’re also reducing uncertainty. With fewer ways for methane to leak, we can keep it contained and focus our monitoring and measurement efforts where they’re most needed.

To reduce our methane intensity, we are evolving the designs of our facilities, improving our processes and protocols, and pursuing new technologies.

ExxonMobil's focus on methane emissions - from ground, air, and space

Aiming for zero

In March 2022, we joined others in our industry to launch the Aiming for Zero Methane Emissions Initiative to strive to reach near zero methane emissions from operated oil and gas assets by 2030. Our efforts support the goals of the Global Methane Pledge and the U.S. Methane Emissions Reduction Plan – as well as our own 2050 net-zero ambition.

In 2024, flaring made up about 16% of methane emissions in our upstream operations.12 Flaring is the most visible source of methane emissions because the flame can be seen by the naked eye. It’s also a focus area for us, which is why we’ve eliminated all routine flaring in our heritage Permian Basin operations.13 We are on track to achieve zero routine flaring across all operated upstream assets by 2030 in line with the World Bank Zero Routine Flaring Initiative.14

Ongoing enhancements – large and small, complex and simple, proven and leading edge – are advancing our efforts to reduce or avoid methane emissions.

In some cases, we’re doing more with less, such as modifying designs or simply doing the same things, but better. For example, we continue to improve the seals on centrifugal compressors to prevent leaks and expand gas collection systems to capture and transport natural gas for processing.

In short, every feasible option is on the table as we work to safely and reliably mitigate methane emissions.

Certified natural gas

Our facilities in Poker Lake, New Mexico, and the Appalachian Basin have been certified annually for the last three years by MiQ, an independent, not-for-profit organization focused on reducing methane emissions. The certification verifies that the natural gas we produce has lower methane intensity. This helps our customers make more informed decisions about the environmental impact of the natural gas they purchase.

Replacing pneumatic devices

Pneumatic control devices have been used in our industry for more than a century. They operate valves that control liquid levels, pressure, temperature, and other parts of the production process.

They also emit methane. Each time a pneumatic device is used, a small amount of methane is vented. Multiply this by the number of devices at each site, and it can add up. That’s why we are working to eliminate natural-gas-driven pneumatic devices in our key U.S. unconventional operated assets. We have already replaced all pneumatic devices (>6,000) in our heritage Permian Basin unconventional operations. And we’re planning to do the same in the recently acquired Pioneer assets.

Unfortunately, there’s no one-size-fits-all solution to this challenge. In some cases, when there’s ready access to electricity, it’s as simple as installing an air compressor or a mechanical valve. In other cases, it means looking outside our industry, collaborating with others to enhance existing controllers and other technologies to mitigate or eliminate emissions.

It can even mean using existing equipment in new ways, such as substituting nitrogen, a gas with no global warming potential, in pneumatic devices. We have deployed this solution with more than 1,000 pneumatic devices in the Appalachian Basin.

And the benefits extend beyond each piece of equipment. When retrofitting our existing assets, we often replace the infrastructure, which improves reliability and can further reduce the chances of leaks and fugitive emissions.

We’re continuing to conduct trials to test emerging solutions as well. We’ll deploy the most promising ones and share what we learn to advance the ambition of near-zero methane emissions.

Setting the standard in the Permian Basin

In the Permian Basin, we’re making good progress on our industry-leading plans to achieve net zero by 2030 for Scope 1 and 2 GHG emissions from our heritage operated assets, even as our production continues to grow to help meet demand.

Reducing methane emissions is a key part of that plan. So far, in our heritage Permian Basin operations, we have:

- Eliminated all routine flaring.

- Replaced all natural-gas-driven pneumatic devices.

- Begun electrifying our natural gas compression units, eliminating methane slip.

- Electrified 100% of our drilling fleet.15

- Deployed our first electric fracturing unit.

We are working to accelerate similar milestones in our recently acquired Pioneer assets.

We have also focused on improving leak detection and response times. Remote operators now receive automated alerts 24/7 when an event is detected so they can quickly analyze the data and dispatch crews. Our work led to us being recognized as an industry leader by the Environmental Defense Fund.16

We are working to expand these continuous monitoring and response capabilities, as well as automate the collection and analysis of data through integrated operations support centers.

Monitoring and detection

Our detection and quantification work is improving the accuracy of the methane volumes and intensity data. This work also helps us assess the scale of the challenge and how effective our efforts are. The framework we’ve established and shared with regulators, trade groups, and others has helped in the development of consistent and comparable data which, along with improving field measurements, guide our mitigation efforts.

On the ground, in the air, and in space, the technology and processes we use to identify non-routine methane emissions give us a wide range of data points to inform and continuously improve our mitigation efforts. At this time, we’re advancing detection technologies across our global upstream operated assets.

Methods of detection

| Method | Technologies | Detection thresholds* | Considerations | ExxonMobil sites** |

| Manual detection |

|

|

Advantages: Precise location of emissions, using services already available in some locations. Limitations: Labor intensive, periodic, and subject to human error. Does not provide quantification. No access to difficult-to-reach locations. |

|

| Facility-scale, near-continuous monitoring |

|

Less than 1 kg/hr - 20 kg/hr |

Advantages: Stationary monitoring, offering near continuous coverage of an individual site. Continued research and innovation are increasing the likely accuracy and scalability.

|

|

| Facility-scale, periodic monitoring |

|

Less than 1kg/hr |

Advantages: Can cover multiple sites in their entirety, including areas unreachable by handheld devices.

|

|

| Aerial detection |

|

Less than 3 kg/hr - 50 kg/hr | Advantages: Can cover hundreds of sites per day. Limitations: Observations reflect only a snapshot in time. The effectiveness the survey can be limited by weather conditions. |

|

| Satellite detection |

|

Less than 100 kg/hr - 1,400 kg/hr | Advantages: Global coverage. Potentially lower cost. Limitations: High detection thresholds and sensitivity to environmental conditions. |

|

**Includes sites where these technologies have been piloted or deployed.

The technology to detect and quantify methane emissions keeps getting better. The current industry and regulatory approach on the ground is focused on manual leak detection. At the same time, we’re investing to develop and deploy technologies that increase the efficiency, precision, and coverage of our detection abilities.

We are rapidly advancing the development and deployment of near-continuous monitoring to enable real-time notification and mitigation of potential non-routine emission sources. We expect to deploy continuous monitoring platforms on all key heritage operated sites in the Permian Basin by the end of 2025. We are taking our learnings to develop plans for similar deployments for our recently acquired Pioneer assets and across our global upstream portfolio.

Periodic monitoring using airplanes or drones can further expand coverage to dozens of onshore sites per day, depending on local conditions and logistics. The moment-in-time observations provided by airplane surveys continue to be a valuable source of data – but we’re going even higher to enhance detection across larger areas on a more continuous basis. And, at the highest level, satellites have the potential to provide global, near-continuous data.

COMET: Bringing it all together in real time

Your home smoke detector serves an important purpose. When the alarm sounds, you know that it has sensed a problem. Whether it’s smoke or just a low battery, you know that you need to respond.

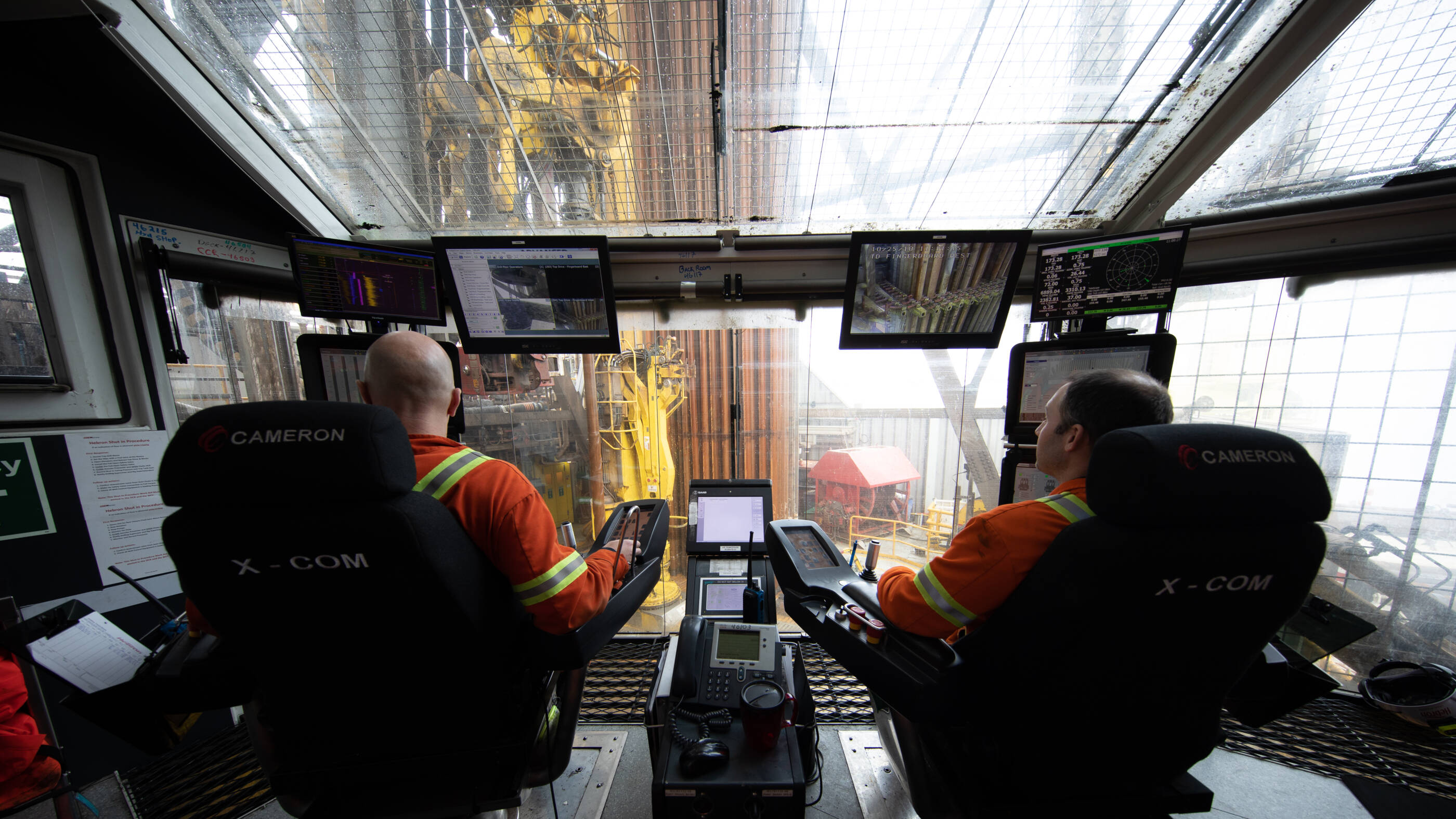

Our Center for Operations and Methane Emissions Tracking (COMET) operates much like a smoke detector in your home. Only we’ve scaled it to cover massive areas with diverse sources of data. When there’s a problem, our operators will know.

Launched in 2022, COMET continuously monitors and analyzes methane emissions data from sources across our heritage operations in the Permian Basin. The facility, located in our global headquarters in Houston, Texas, is staffed 24 hours a day, 7 days a week to enable rapid detection and mitigation.

COMET is a potential game changer for ExxonMobil and the industry, and we’re continuing to apply what we’ve learned. In early 2024, we began monitoring advanced process data from our Bakken assets in North Dakota. Proactive and continuous monitoring provides actionable data about unscheduled takeaway and mechanical issues that lead to flaring. These efforts have helped reduce average daily flaring in the Bakken by approximately 30% since 2023.

Measurement and reporting

We’ve publicly reported our methane emissions every year since 2014. Reporting is useful as we work with academia, industry peers, and other stakeholders to improve understanding of methane emissions and develop best practices.

Our data, past and present, is measured and reported based on internationally recognized methods and is compiled by determining emissions by source at each operated asset across our company. Using frameworks like Veritas and the Oil and Gas Methane Partnership, we’ve improved our reporting each year.

Reducing uncertainty in how we quantify methane emissions is an important part of our efforts. We’re advancing solutions that help to continuously monitor and more precisely measure methane emissions.

As technology develops, we’re making good progress with direct methane measurement, recognizing that in some cases, direct measurement and quantification may be difficult or impossible. In offshore locations, for example, water interferes with accurate satellite and aerial measurement. In other areas, airspace regulations may restrict drone use. Each location is different and presents unique challenges.

Oil & Gas Methane Partnership (OGMP) 2.0

We joined the OGMP 2.0 in January 2024 and are pursuing Gold Standard Pathway. Our heritage Pioneer assets received Gold Standard Pathway recognition in 2024. As part of OGMP 2.0, we plan to increase measurements at the emission source. This work will contribute to a better understanding of our absolute emissions and support continuous monitoring solutions.

Understanding emission factors

Consistent with industry practices, we use emission factors with observational and other data, to estimate average methane emissions. Classes of equipment, types of activities, or other variables are multiplied by the relevant emission factor, which provides a credible estimate for our emissions inventory. Consistent with regulatory reporting requirements, emission factors come from multiple sources, including the American Petroleum Institute and the U.S. EPA GHG Reporting Program. As direct measurement and detection technologies evolve, emission factors are expected to be improved or used less industry-wide.

Advocacy and collaboration

The energy industry is collaborative by nature. We work with industry partners and regulators around the world to advocate for strong and consistent measurement, reporting, and verification standards. We also collaborate with universities, industry groups, and others to advance the technologies and fundamental science related to methane emissions.

Supporting rational and constructive policy

The model regulatory framework we published in 2020 provides a blueprint for industry-wide regulation, urging stakeholders, policy makers, and governments to develop comprehensive rules for methane emissions.

We work with the European Commission Directorate-General for Environment and United States agencies such as the Environmental Protection Agency, the Bureau of Land Management, the Pipeline and Hazardous Materials Safety Administration, among others, to encourage practical and effective regulation of methane emissions. In the United States alone, there are half a dozen agencies doing important work on methane rules. If not well coordinated, this could lead to overlapping and potentially conflicting regulations. This is why we’re focused on rational and constructive policy that supports the deployment of technology and builds on successful industry efforts.

In recent years, the commentary and guidance we’ve offered regulators includes:

- Comment letters to the U.S. EPA in November 2019, January 2022, and February 2023 related to new source performance standards.

- A joint comment letter about continuous monitoring to the U.S. EPA, co-signed with five other companies in the energy, power, and aviation industries.

- Our comment letter to the Pipeline and Hazardous Materials Safety Administration on their proposed rules for leak detection.

- Testimony at the U.S. EPA Methane Detection Technology Workshop.

- Our submission to the European Union Commission’s Methane Emissions Stakeholder Meeting.

Teaming up to reduce methane emissions

We know we can’t go it alone. Collaboration is vital. By working with a wide range of universities, academic consortiums, environmental groups, and more, we’re helping to advance leading-edge research and pilot new technologies.

Among others, we’re members of (*ExxonMobil is a founding member):

- Oil and Gas Methane Partnership 2.0: A United Nations Environmental Programme (UNEP) partnership of more than 140 companies across more than 70 countries focused on improving the accuracy and transparency of methane emissions measurement and reporting in the oil and gas industry.

- Oil and Gas Decarbonization Charter: A unique collaboration to accelerate the decarbonization of the global oil and gas sector by fostering inclusive industry cooperation and knowledge sharing

- Oil and Gas Climate Initiative: A CEO-led initiative of 12 of the world’s leading energy companies, which celebrated its tenth year of collective action in 2024.

- Stanford Natural Gas Initiative*: A collaboration of more than 40 research groups from multiple disciplines working with industry partners and others to maximize the social, economic, and environmental benefits of natural gas.

- Project Astra*: A partnership to monitor emissions across the Permian Basin with a first-of-its-kind sensor network, led by The University of Texas at Austin and bringing us together with the Environmental Defense Fund, Chevron, and GTI Energy, a research organization focused on energy solutions.

- Veritas: GTI Energy’s Methane Emissions Measurement and Verification Initiative, pursuing credible, comparable methane emissions measurement and accelerating actions that reduce methane emissions.

- The Environmental Partnership*: A collaboration among U.S. oil and natural gas companies of all sizes to take action on environmental performance, transfer knowledge, and foster collaboration among stakeholders.

Thought leadership

We share what we learn through peer-reviewed publications either co-authored by ExxonMobil or funded in part by the company. Since 2016, dozens of articles have been published in academic and trade journals. Topics covered include tiered leak detection and repair programs, global to point-source methane emissions quantification, next-generation imaging, satellite capabilities, region-specific life-cycle greenhouse gas emissions of oil and natural gas, and much more.

Our work has been shared in technical briefings at venues like the American Geophysical Union and European Geophysical Union annual meetings, the American Petroleum Institute’s Environmental Partnership meetings, and Stanford University’s Methane Emissions Technology Alliance.

Publications

Explore more

Rational and constructive policy

5 min read

•

Research and development

4 min read

•

Positioned for growth in a lower-emission future

8 min read

•

Growing Low Carbon Solutions

8 min read

•

Advancing Climate Solutions Executive Summary

6 min read

•

Our risk management approach

4 min read

•FOOTNOTES:

- ExxonMobil’s 2030 GHG emission reduction plans: https://corporate.exxonmobil.com/news/news-releases/2021/1201_exxonmobil-announces-plans-to-2027-doubling-earnings-and-cash-flow-potential-reducing-emissions. ExxonMobil’s 2030 plans are expected to result in a 20%-30% reduction in corporate-wide greenhouse gas intensity, including reductions of 40%-50% in upstream intensity, 70%-80% in corporate-wide methane intensity, and 60%-70% in corporate-wide flaring intensity. Based on Scope 1 and 2 emissions of ExxonMobil operated assets (versus 2016). ExxonMobil’s reported emissions, reductions, and avoidance performance data are based on a combination of measured and estimated emissions data using reasonable efforts and collection methods. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with emissions, reductions, and avoidance performance data due to variation in processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to performance data may be reported as part of the company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure, and address greenhouse gas emissions.

- Based on U.S. Energy Information Administration, Monthly Energy Review, December 2024 Edition: eia.gov/totalenergy/data/monthly/archive/00352412.pdf and IEA CO2 Emissions Report in 2023: https://iea.blob.core.windows.net/assets/33e2badc-b839-4c18-84ce-f6387b3c008f/CO2Emissionsin2023.pdf.

- International Energy Agency, CO2 Emissions 2023, Page 14: https://iea.blob.core.windows.net/assets/33e2badc-b839-4c18-84ce-f6387b3c008f/CO2Emissionsin2023.pdf.

- ExxonMobil 2024 Global Outlook.

- H. Khutal, K. Kirchner-Ortiz, M. Blackhurst, N. Willems, H. S. Matthews, S. Rai,G. Yanai, K. Chivukula, Priyadarshini, M. B. Jamieson, T. J. Skone, "Life Cycle Analysis of Natural Gas Extraction and Power Generation: U.S. 2020 Emissions Profile," National Energy Technology Laboratory, Pittsburgh, December 2024.

- IPCC AR6 Report, Chapter 7: The Earth’s Energy Budget, Climate Feedbacks and Climate Sensitivity (Table 7.15): https://www.ipcc.ch/report/ar6/wg1/downloads/report/IPCC_AR6_WGI_Chapter07.pdf.

- Emission metrics are based on assets operated by ExxonMobil, using the latest performance and plan data available as of 3/1/2025. Flaring intensity is calculated as m3 per metric ton of throughput or production. Methane intensity is calculated as metric tons CH4 per 100 metric tons of throughput or production. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the Company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure and address greenhouse gas emissions. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

- ExxonMobil methane emissions estimates as of year-end 2024.

- Emission metrics are based on assets operated by ExxonMobil, using the latest performance and plan data available as of 3/1/2025. Methane intensity is calculated as metric tons CH4 per 100 metric tons of throughput or production. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the Company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure and address greenhouse gas emissions. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

- Based on Scope 1 and 2 emissions of operated assets (versus 2016).

- References to routine flaring herein are consistent with the World Bank’s Zero Routine Flaring by 2030 Initiative/Global Gas Flaring & Methane Reduction (GFMR) Reduction Partnership principle of routine flaring, and excludes safety and non-routine flaring.

- Emission metrics are based on assets operated by ExxonMobil, using the latest performance and plan data available as of 3/1/2025. Flaring intensity is calculated as m3 per metric ton of throughput or production. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the Company’s annual publications as new or updated data and/or emission methodologies become available. We are working to continuously improve our performance and methods to detect, measure and address greenhouse gas emissions. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

- References to routine flaring herein are consistent with the World Bank’s Zero Routine Flaring by 2030 Initiative/Global Gas Flaring & Methane Reduction (GFMR) Reduction Partnership principle of routine flaring, and excludes safety and non-routine flaring.

- Ibid.

- Fleet utilizes grid electricity when available.

- https://blogs.edf.org/energyexchange/wp-content/blogs.dir/38/files/2022/11/PermianMAPFinalReport.pdf

FORWARD-LOOKING STATEMENT WARNING

Images or statements of future ambitions, aims, aspirations, plans, goals, events, projects, projections, opportunities, expectations, performance, or conditions in the publications, including plans to reduce, abate, avoid or enable avoidance of emissions or reduce emissions intensity, sensitivity analyses, expectations, estimates, the development of future technologies, business plans, and sustainability efforts are dependent on future market factors, such as customer demand, continued technological progress, stable policy support and timely rule-making or continuation of government incentives and funding, and represent forward-looking statements. Similarly, emission-reduction roadmaps to drive toward net zero and similar roadmaps for emerging technologies and markets, and water management roadmaps to reduce freshwater intake and/or manage disposal, are forward-looking statements. These statements are not guarantees of future corporate, market or industry performance or outcomes for ExxonMobil or society and are subject to numerous risks and uncertainties, many of which are beyond our control or are even unknown.

Actual future results, including the achievement of ambitions to reach Scope 1 and 2 net zero from operated assets by 2050, to reach Scope 1 and 2 net zero in heritage Permian Basin unconventional operated assets by 2030, and in Pioneer Permian assets by 2035, to eliminate routine flaring in-line with World Bank Zero Routine Flaring, to reach near zero methane emissions from operated assets and other methane initiatives to meet ExxonMobil’s greenhouse gas emission reduction plans and goals, divestment and start-up plans, and associated project plans as well as technology advances, including in the timing and outcome of projects to capture, transport and store CO2, produce hydrogen and ammonia, produce lower-emission fuels, produce ProxximaTM systems, produce carbon materials, produce lithium, and use plastic waste as feedstock for advanced recycling; future debt levels and credit ratings; business and project plans, timing, costs, capacities and profitability; resource recoveries and production rates; planned Denbury and Pioneer integrated benefits; obtain data on detection, measurement and quantification of emissions including reporting of that data or updates to previous estimates and progress in sustainability focus areas could vary depending on a number of factors, including global or regional changes in oil, gas, petrochemicals, or feedstock prices, differentials, seasonal fluctuations, or other market or economic conditions affecting the oil, gas, and petrochemical industries and the demand for our products; new market products and services; future cash flows; our ability to execute operational objectives on a timely and successful basis; the ability to realize efficiencies within and across our business lines; new or changing government policies for lower carbon and new market investment opportunities, or policies limiting the attractiveness of investments such as European taxes on energy and unequal support for different methods of carbon capture; developments or changes in local, national, or international treaties, laws, regulations, taxes, trade sanctions, trade tariffs, and incentives affecting our business, including those related to greenhouse gas emissions, plastics, carbon storage and carbon costs; timely granting of governmental permits and certifications; uncertain impacts of deregulation on the legal and regulatory environment; evolving reporting standards for these topics and evolving measurement standards for reported data; trade patterns and the development and enforcement of local, national and regional mandates; unforeseen technical or operational difficulties; the outcome of research efforts and future technology developments, including the ability to scale projects and technologies such as electrification of operations, advanced recycling, carbon capture and storage, hydrogen and ammonia production, ProxximaTM systems, carbon materials or direct lithium extraction on a commercially competitive basis; the development and competitiveness of alternative energy and emission reduction technologies; unforeseen technical or operating difficulties, including the need for unplanned maintenance; availability of feedstocks for lower-emission fuels, hydrogen, or advanced recycling; changes in the relative energy mix across activities and geographies; the actions of co-venturers competitors; changes in regional and global economic growth rates and consumer preferences including willingness and ability to pay for reduced emissions products; actions taken by governments and consumers resulting from a pandemic; changes in population growth, economic development or migration patterns; timely completion of construction projects; war, civil unrest, attacks against the Company or industry, and other political or security disturbances, including disruption of land or sea transportation routes; decoupling of economies, realignment of global trade and supply chain networks, and disruptions in military alliances; and other factors discussed here and in Item 1A. Risk Factors of our Annual Report on Form 10-K and under the heading “Factors affecting future results” available under the “Earnings” tab through the “Investors” page of our website at www.exxonmobil.com. The Advancing Climate Solutions Report includes 2024 greenhouse gas emissions performance data as of March 1, 2025, and Scope 3 Category 11 estimates for full year 2024 as of February 19, 2025. The greenhouse gas intensity and greenhouse gas emission estimates include Scope 2 market-based emissions. The Sustainability Report, the Advancing Climate Solutions Report, and corresponding Executive Summaries were issued on April 30, 2025. The content and data referenced in these publications focus primarily on our operations from Jan. 1, 2024 – Dec. 31, 2024, unless otherwise indicated. Tables on our “Metrics and data” page were updated to reflect full year 2024 data. Information regarding some known events or activities in 2025 and historical initiatives from prior years are also included. No party should place undue reliance on these forward-looking statements, which speak only as of the dates of these publications. All forward-looking statements are based on management’s knowledge and reasonable expectations at the time of publication. ExxonMobil assumes no duty to update these statements or materials as of any future date, and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of these figures or statements as of any future date. Any future update will be provided only through a public disclosure indicating that fact.

See “ABOUT THE ADVANCING CLIMATE SOLUTIONS AND SUSTAINABILITY REPORTS” at the end of this document for additional information on these reports and the use of non-GAAP and other financial measures.

ABOUT THE ADVANCING CLIMATE SOLUTIONS AND SUSTAINABILITY REPORTS

The Advancing Climate Solutions Report contains terms used by the TCFD, as well as information about how the disclosures in this report are consistent with the recommendations of the TCFD. In doing so, ExxonMobil is not obligating itself to use any terms in the way defined by the TCFD or any other party, nor is it obligating itself to comply with any specific recommendation of the TCFD or to provide any specific disclosure. For example, with respect to the term “material,” individual companies are best suited to determine what information is material, under the long-standing U.S. Supreme Court definition, and whether to include this information in U.S. Securities and Exchange Act filings. In addition, the ISSB is evaluating standards that provide their interpretation of TCFD which may or may not be consistent with the current TCFD recommendations. The Sustainability Report and Advancing Climate Solutions Report are each a voluntary disclosure and are not designed to fulfill any U.S., foreign, or third-party required reporting framework.

Forward-looking and other statements regarding environmental and other sustainability efforts and aspirations are not intended to communicate any material investment information under the laws of the United States or represent that these are required disclosures. These publications are not intended to imply that ExxonMobil has access to any significant non-public insights on future events that the reader could not independently research. In addition, historical, current, and forward-looking environmental and other sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future, including future laws and rulemaking. Forward-looking and other statements regarding environmental and other sustainability efforts and aspirations are for informational purposes only and are not intended as an advertisement for ExxonMobil’s equity, debt, businesses, products, or services and the reader is specifically notified that any investor-requested disclosure or future required disclosure is not and should not be construed as an inducement for the reader to purchase any product or services. The statements and analysis in these publications represent a good faith effort by the Company to address these investor requests despite significant unknown variables and, at times, inconsistent market data, government policy signals, and calculation, methodologies, or reporting standards.

Actions needed to advance ExxonMobil’s 2030 greenhouse gas emission-reductions plans are incorporated into its medium-term business plans, which are updated annually. The reference case for planning beyond 2030 is based on the Company’s Global Outlook research and publication. The Global Outlook is reflective of the existing global policy environment and an assumption of increasing policy stringency and technology improvement to 2050. However, the Global Outlook does not attempt to project the degree of required future policy and technology advancement and deployment for the world, or ExxonMobil, to meet net zero by 2050. As future policies and technology advancements emerge, they will be incorporated into the GIobal Outlook, and the Company’s business plans will be updated as appropriate. References to projects or opportunities may not reflect investment decisions made by the corporation or its affiliates. Individual projects or opportunities may advance based on a number of factors, including availability of stable and supportive policy, permitting, technological advancement for cost-effective abatement, insights from the Company planning process, and alignment with our partners and other stakeholders. Capital investment guidance in lower-emission and other new investments is based on our corporate plan; however, actual investment levels will be subject to the availability of the opportunity set, stable public policy support, other factors, and focused on returns.

Energy demand modeling aims to replicate system dynamics of the global energy system, requiring simplifications. The reference to any scenario or any pathway for an energy transition, including any potential net-zero scenario, does not imply ExxonMobil views any particular scenario as likely to occur. In addition, energy demand scenarios require assumptions on a variety of parameters. As such, the outcome of any given scenario using an energy demand model comes with a high degree of uncertainty. For example, the IEA describes its NZE scenario as extremely challenging, requiring unprecedented innovation, unprecedented international cooperation, and sustained support and participation from consumers, with steeper reductions required each year since the scenario’s initial release. Third-party scenarios discussed in these reports reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use or inclusion herein is not an endorsement by ExxonMobil of their underlying assumptions, likelihood, or probability. Investment decisions are made on the basis of ExxonMobil’s separate planning process but may be secondarily tested for robustness or resiliency against different assumptions, including against various scenarios. These reports contain information from third parties. ExxonMobil makes no representation or warranty as to the third-party information. Where necessary, ExxonMobil received permission to cite third-party sources, but the information and data remain under the control and direction of the third parties. ExxonMobil has also provided links in this report to third-party websites for ease of reference. ExxonMobil’s use of the third-party content is not an endorsement or adoption of such information.

ExxonMobil reported emissions, including reductions and avoidance performance data, are based on a combination of measured and estimated data. We assess our performance to support continuous improvement throughout the organization using our Environmental Performance Indicator (EPI) manual. The reporting guidelines and indicators in the Ipieca, the American Petroleum Institute (API), the International Association of Oil and Gas Producers Sustainability Reporting Guidance for the Oil and Gas Industry (4th edition, 2020, revised February 2023) and key chapters of the GHG Protocol inform the EPI and the selection of the data reported. Emissions reported are estimates only, and performance data depends on variations in processes and operations, the availability of sufficient data, the quality of those data and methodology used for measurement and estimation. Emissions data is subject to change as methods, data quality, and technology improvements occur, and changes to performance data may be updated. Emissions, reductions, abatements and enabled avoidance estimates for non-ExxonMobil operated facilities are included in the equity data and similarly may be updated as changes in the performance data are reported. ExxonMobil’s plans to reduce emissions are good-faith efforts based on current relevant data and methodology, which could be changed or refined. ExxonMobil works to continuously improve its approach to estimate, detect, measure, and address emissions. ExxonMobil actively engages with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates.

Any reference to ExxonMobil’s support of, work with, or collaboration with a third-party organization within these publications do not constitute or imply an endorsement by ExxonMobil of any or all of the positions or activities of such organization. ExxonMobil participates, along with other companies, institutes, universities and other organizations, in various initiatives, campaigns, projects, groups, trade organizations, and other collaborations among industry and through organizations like the United Nations that express various ambitions, aspirations and goals related to climate change, emissions, sustainability, and the energy transition. ExxonMobil’s participation or membership in such collaborations is not a promise or guarantee that ExxonMobil’s individual ambitions, future performance or policies will align with the collective ambitions of the organizations or the individual ambitions of other participants, all of which are subject to a variety of uncertainties and other factors, many of which may be beyond ExxonMobil’s control, including government regulation, availability and cost-effectiveness of technologies, and market forces and other risks and uncertainties. Such third parties’ statements of collaborative or individual ambitions and goals frequently diverge from ExxonMobil’s own ambitions, plans, goals, and commitments. ExxonMobil will continue to make independent decisions regarding the operation of its business, including its climate-related and sustainability-related ambitions, plans, goals, commitments, and investments. ExxonMobil’s future ambitions, goals and commitments reflect ExxonMobil’s current plans, and ExxonMobil may unilaterally change them for various reasons, including adoption of new reporting standards or practices, market conditions; changes in its portfolio; and financial, operational, regulatory, reputational, legal and other factors.

References to “resources,” “resource base,” “recoverable resources” and similar terms refer to the total remaining estimated quantities of oil and natural gas that are expected to be ultimately recoverable. The resource base includes quantities of oil and natural gas classified as proved reserves, as well as quantities that are not yet classified as proved reserves, but that are expected to be ultimately recoverable. The term “resource base” is not intended to correspond to SEC definitions such as “probable” or “possible” reserves. For additional information, see the “Frequently Used Terms” on the Investors page of the Company’s website at www.exxonmobil.com under the header “Modeling Toolkit.” References to “oil” and “gas” include crude, natural gas liquids, bitumen, synthetic oil, and natural gas. The term “project” as used in these publications can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

Exxon Mobil Corporation has numerous affiliates, many with names that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For convenience and simplicity, those terms and terms such as “Corporation,” “company,” “our,” “we,” and “its” are sometimes used as abbreviated references to one or more specific affiliates or affiliate groups. Abbreviated references describing global or regional operational organizations, and global or regional business lines are also sometimes used for convenience and simplicity. Nothing contained herein is intended to override the corporate separateness of affiliated companies. Exxon Mobil Corporation’s goals do not guarantee any action or future performance by its affiliates or Exxon Mobil Corporation’s responsibility for those affiliates’ actions and future performance, each affiliate of which manages its own affairs. For convenience and simplicity, words like venture, joint venture, partnership, co-venturer and partner are used to indicate business relationships involving common activities and interests, and those words may not indicate precise legal relationships. These publications cover Exxon Mobil Corporation’s owned and operated businesses and do not address the performance or operations of our suppliers, contractors or partners unless otherwise noted. In the case of certain joint ventures for which ExxonMobil is the operator, we often exercise influence but not control. Thus, the governance, processes, management and strategy of these joint ventures may differ from those in these reports. At the time of publication, ExxonMobil has completed the acquisitions of Denbury Inc. and Pioneer Natural Resources Company. These reports and the data therein do not speak of these companies’ pre-acquisition governance, risk management, strategy approaches, or emissions or sustainability performance unless specifically referenced.

These reports or any material therein are not to be used or reproduced without the permission of Exxon Mobil Corporation. All rights reserved.

SUPPLEMENTAL INFORMATION FOR NON-GAAP AND OTHER MEASURES

The Positioned for Growth in a Lower-Emission Future section of the Advancing Climate Solutions Report mentions modeled operating cash flow in comparing different businesses over time in a future scenario. Historic operating cash flow is defined as net income, plus depreciation, depletion and amortization for consolidated and equity companies, plus noncash adjustments related to asset retirement obligations plus proceeds from asset sales. The Company’s long-term portfolio modeling estimates operating cash flow as revenue or margins less cash expenses, taxes and abandonment expenditures plus proceeds from asset sales before portfolio capital expenditures. The Company believes this measure can be helpful in assessing the resiliency of the business to generate cash from different potential future markets. The performance data presented in the Advancing Climate Solutions Report and Sustainability Report, including on emissions, is not financial data and is not GAAP data.