selected item

India: Rapid growth, emissions and a net-zero future

India aims to become a US$ 5 trillion economy by 2025, up from US$ 3.7 trillion today. Its construction sector is expected to reach US$ 1.4 trillion by 2025 and it plans to double its steel-production capacity to 300 million tonnes per annum by 2030. It has also announced a slew of production-linked incentives to grow manufacturing’s share of the GDP. Growth at this scale will inevitably lead to a rise in GHG emissions.

Yet, India is the only G20 nation on track to meet its Paris climate commitments. In 2022, India updated its climate targets: it’s now committed to reducing the emissions intensity of its GDP by 45%, compared to 2005 levels, by 2030. It’s clear that India means business.

A pragmatic transition with natural gas

ExxonMobil has been India’s reliable energy partner for more than three decades. We have witnessed India’s economic transformation first hand and see the nation’s energy-transition challenge for what it is. That’s why we support India’s well-grounded “all of the above” energy strategy.

India is making pragmatic energy choices in accelerating the diversification of its energy mix. This means deploying a combination of lower-carbon energy sources such as natural gas, wind, solar, hydrogen, and others. But for a country of 1.4 billion, scale is critical.

That’s where natural gas has advantages over evolving energy sources. It’s available at scale today, and can make a difference now while other lower-emission technologies are perfected and scaled up. Not surprising then that the International Energy Agency (IEA) expects India’s gas consumption to grow by 2% in 2023, with city gas and industrial sectors driving demand.

Two decades ago, ExxonMobil played a pioneering role in opening the doors for liquefied natural gas (LNG) to energize the India growth story. As the country’s long-term LNG partner, we can help meet its growing demand for gas-based energy. We are planning to nearly double our LNG supply portfolio by 2030 and are well-positioned to deliver LNG from our large high-quality resources and facilities around the world.

Affordability is important globally, but particularly for a growing India whose per capita energy use is still half the global average. As global energy markets have continued to adapt to recent geopolitical changes, buyers with long-term LNG contracts from reliable suppliers have had more predictable pricing.

This period of uncertainty demonstrates the value of long-term relationships between producers and buyers like we have in India. To shield itself from price volatility and enable a steady transition to a gas-based economy, India should secure more long-term supply arrangements and accelerate the development of competitive, transparent gas markets.

As India plans for net zero, the growing role of natural gas as an enabler of lower-carbon technologies could deliver long-term dividends. ExxonMobil is advancing climate solutions such as carbon capture and storage (CCS) technology, hydrogen and biofuels. This includes producing hydrogen from natural gas and deploying CCS to capture the CO2 generated.

Its compatibility with CCS is yet another reason gas can punch way above its weight in the energy transition. At ExxonMobil, we see great potential in combining natural gas value chains with CCS to decarbonize high-emitting industrial sectors and commercial transportation.

Carbon pricing to incentivize lower-carbon technologies

India has pledged to reach net zero by 2070. The country’s decarbonization strategy includes growing non-fossil sources in the power mix, transition to a gas-based economy and incentivizing green hydrogen.

At the same time, India recognizes the criticality of CCS for decarbonizing hard-to-abate sectors. Like all emerging climate technologies, supportive policies and economic incentives are key to jumpstarting CCS. An effective way to do that is to put a price on carbon emissions.

India is already taking the early steps towards establishing a national carbon market that will, essentially, introduce carbon pricing. Based on a carbon credit trading scheme, India’s carbon pricing will initially focus on energy-intensive industries such as power, steel, and cement, and eventually expand to include other industries.

This could help make CCS economically viable, allowing both individual businesses and entire sectors to deliver cost-effective emission reductions. We are already seeing this happening in the US, enabled by incentives for CCS and hydrogen under the Inflation Reduction Act (IRA). The policy incentivizes low-carbon projects through tax credits and played a vital role in commercializing our large-scale CCS project in Louisiana.

ExxonMobil is planning to invest nearly US$ 20 billion in lower-carbon solutions such as CCS through 2027. Like other companies, our early investment choices require supportive policies and we are actively working with governments globally to frame policies that can help them bag these investments. We are ready to leverage our long-standing presence and strong collaborations in India to help craft the enabling policies that could unleash India’s potential to attract CCS investments.

The world’s future is tied to India’s, and how the country navigates its energy transition could provide a roadmap for emerging economies with similar energy challenges. So how does the world’s fastest-growing major economy with a population of more than 1.4 billion build an energy system that eventually leads to net zero? By pragmatically deploying energy solutions that work today while preparing for what works tomorrow.

Explore more

Meet our STEM talent: Their mission is to drive meaningful change

- Our STEM problem solvers are delivering value for India and the world.

- We look for people from diverse backgrounds to bring different ways of thinking and new ideas together.

- Our teams aim higher and create meaningful impact that lasts.

2 min read

•

Our People and AI: Making the magic happen

- We’re using AI to advance energy security while lowering emissions.

- AI is allowing us to bring together sources of data like sensors and pictures, and even combine data with VR.

- Our deep domain expertise, when combined with AI, enables faster decisions.

2 min read

•

Taking Indian talent to the world stage

- Our Indian talent provides vital support to our global operations.

- In Bangalore, our diverse teams come together to help drive innovation for our businesses.

- We are growing our capabilities in India and creating world-class opportunities for local talent.

2 min read

•

Pragmatic and empowering: The force behind India’s energy story

- India’s energy demand is growing rapidly, as it drives towards its Viksit Bharat 2047 goals.

- We’re investing in India’s people, industry and energy to support the nation’s next wave of growth.

- We’re getting ready for India Energy Week 2026, where energy experts gather to share ideas about the country’s energy future.

2 min read

•

A to B: Turning Artificial Intelligence into Business Intelligence

- Our digitally savvy engineers are the secret to our AI edge.

- We’re using AI to create insights that help us work faster and collaborate at scale.

- We’re partnering with top Indian universities to accelerate AI training for our people.

3 min read

•

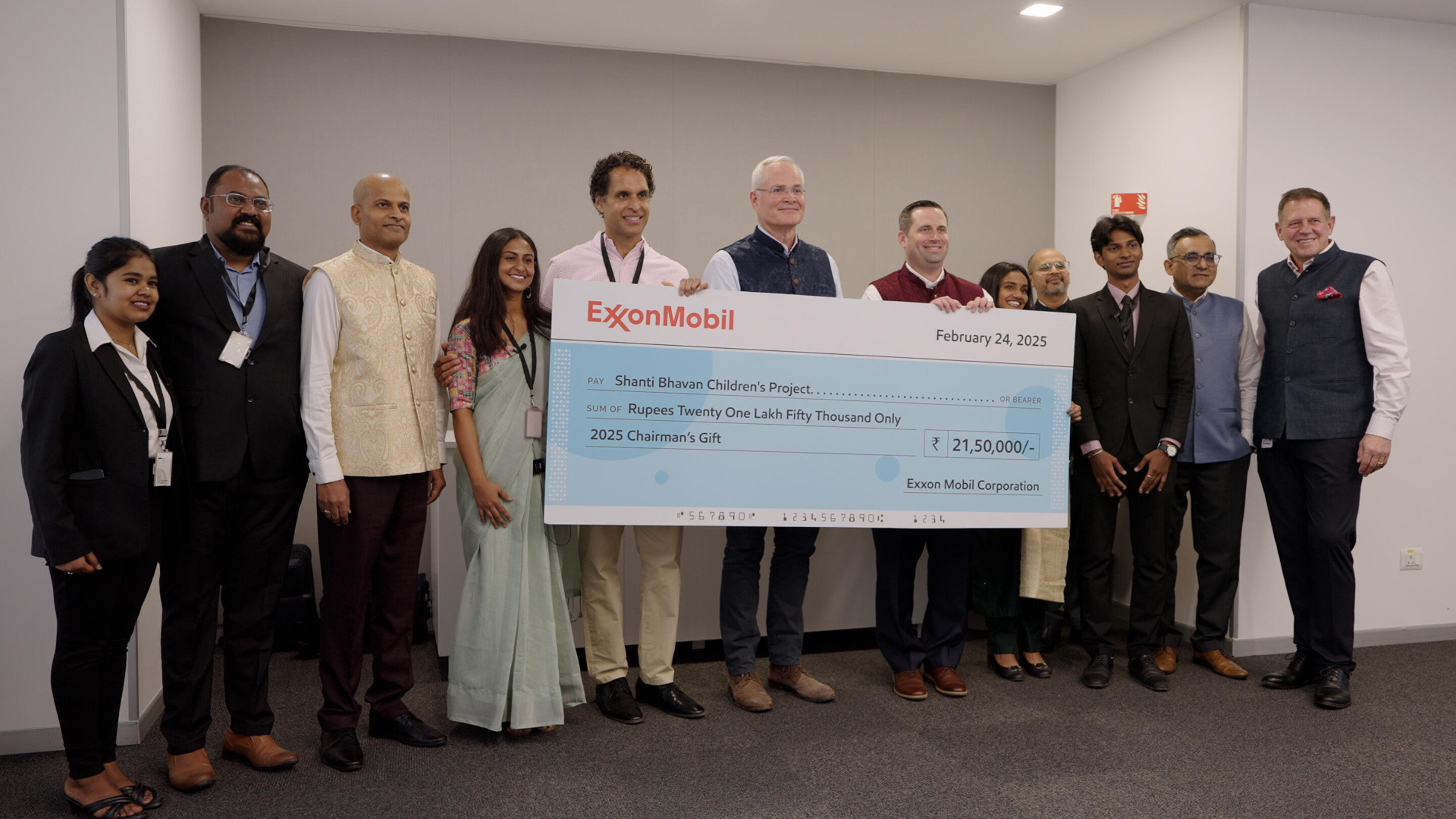

Changing lives with the power of education

- Everyone deserves the same opportunities to pursue education and improve their lives.

- We support Shanti Bhavan, a school helping Bangalore’s most underprivileged children.

- The school’s success stories include producing science, technology, engineering and mathematics (STEM) graduates who now work for ExxonMobil.

5 min read

•