4 min read

•India: The next global manufacturing hub for energy equipment?

- India is emerging as a new, preferred destination for making our energy equipment.

- We’re boosting demand for Indian products, services, skilled engineers, and semi-skilled labor.

- Our initiative could speed up India’s integration into the global value chain for energy infrastructure.

4 min read

•Navigate to:

A rising tide lifts all boats.

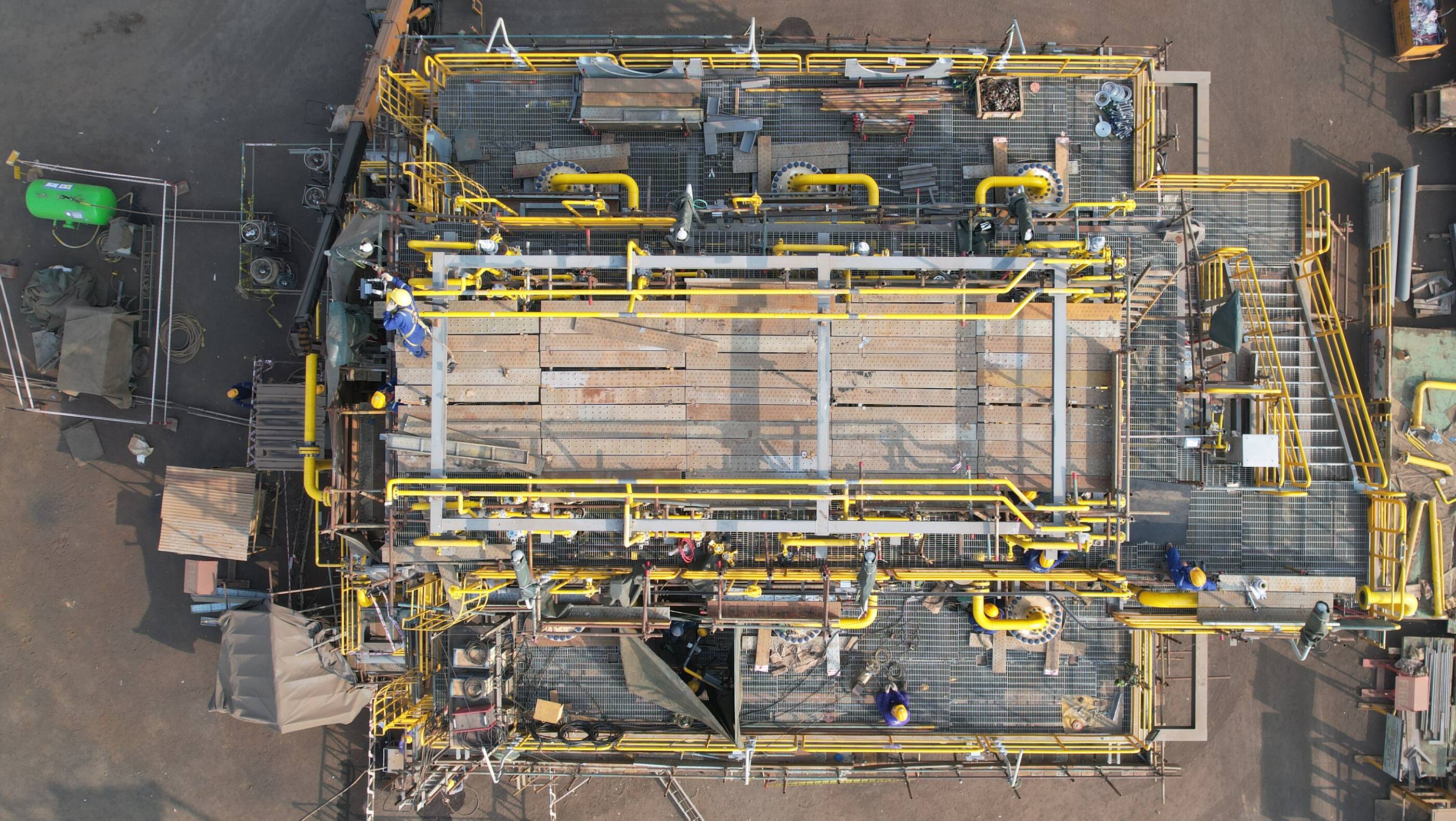

ExxonMobil is utilizing India’s engineering and manufacturing skills to the same effect. We’re increasingly designing, buying products and services for, and building our energy equipment in India before it’s shipped out to its project destination.

From the US and Europe to the Asia Pacific, our refineries, oil and gas sites, and petrochemical plants are beginning to use some made-in-India equipment. This could include a range of different pieces of equipment, from heat exchangers for liquified natural gas to massive machinery like lubricant blenders.

And it gets better: we’re even “making in India for India.” Nearly all equipment for our upcoming lubricant plant in Maharashtra is being made in India. This plant, our first greenfield investment in the country, is expected to start up by year-end 2025.

Developing the ecosystem

ExxonMobil’s projects spread around the world are multibillion-dollar facilities. This infrastructure buildout represents a large part of our annual capital spend of $23–25 billion.

Of this, a significant portion tends to be spent in a few select locations, where we engineer and build equipment for our facilities. In fact, the most complex, elaborate pieces of our equipment are worth many millions of dollars each.

India has another strong advantage: a growing base of suppliers and vendors that underpins the supply chain for energy infrastructure. This is enabling many raw materials and components for our equipment to be procured from Indian businesses.

So, the ground is ripe for us to help develop this ecosystem further and create more benefits for India.

Opportunities for higher domestic value add

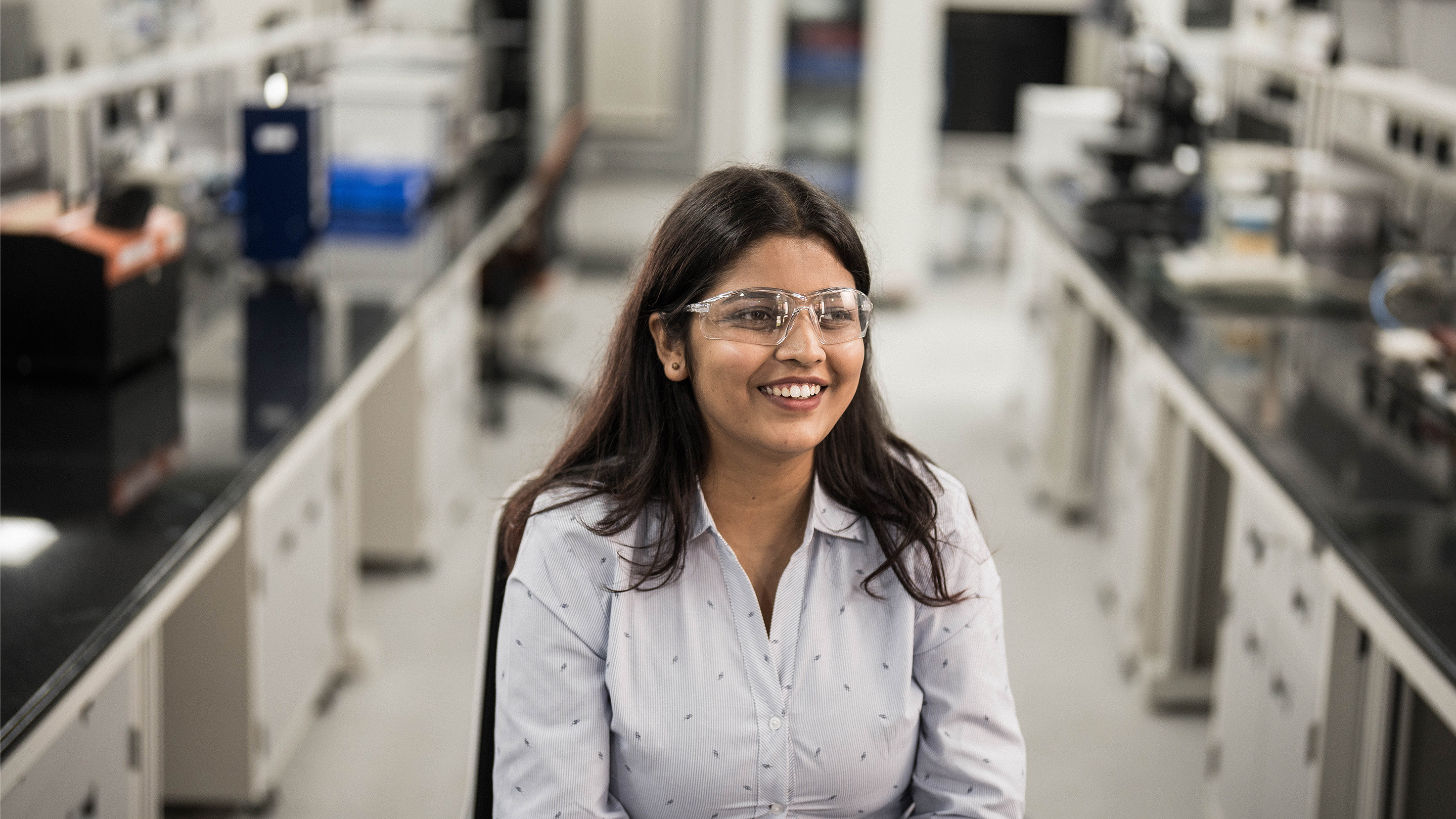

We’re collaborating closely and sharing our expertise with Indian suppliers of products and services on quality upgrades that can help them become a trusted supplier.

We believe Indian manufacturers can produce high-quality parts and components for energy equipment at leading prices. As they meet these expectations, our local procurement will increase and so will the domestic value add.

In the long run, this can create a robust and localized supply chain, which would serve not only our manufacturers but even other industrial-manufacturing ecosystems that rely on similar components for their equipment, such as the overhead crane, which is a staple across many different factory floors.

The cascading benefits for India are many. We’re boosting demand for Indian products, services, and semi-skilled labor. Since energy equipment often requires complex design and engineering, we’re also creating a whole host of indirect jobs for skilled Indian engineers.

A growing market and diversifying supply chains: Advantage India?

Let’s also look at the size of the pie.

The market for equipment needed to extract oil and gas is growing fast in response to increasing global energy demand. It’s expected to grow to USD $185 billion by 2032.

Additionally, more low-carbon projects are coming online, such as for hydrogen and carbon capture and storage (CCS). The good news is that large parts of the same supply chain will be leveraged to make equipment for these new facilities.

We’ve already begun trials with Indian manufacturers to supply materials for carbon fuel cells for our upcoming CCS projects. It’s early-stage work, but we’re optimistic about India’s ability to deliver.

Making India key to the GVC for energy infrastructure

India has many of the ingredients needed to claim a sizeable share of the growing energy-equipment market. Improved connectivity, abundant skilled labour, lower operating costs, and growing supply-chain resilience are deepening India’s appeal as a manufacturing destination.

At the same time, global value chains (GVCs) are diversifying fast. These shifts can work to India’s advantage, especially as it puts more policy focus on achieving greater integration into GVCs.

We’re excited that India’s improving manufacturing capabilities and supply chains are emerging as a strategic match for ExxonMobil. Our global scale and India’s growing manufacturing clout will see us look to India more than ever to help serve the world.

Ultimately, bringing Indian manufacturing into our global orbit could help accelerate its integration into the GVC for energy infrastructure. So, we’re working hard to create opportunities that could put India on the path to become a global manufacturing hub for energy equipment.

Isn’t this a win-win for India and ExxonMobil!

Exxonmobil India

Newsroom

Stay up to date with the latest news and information.

Explore more

Meet our STEM talent: Their mission is to drive meaningful change

2 min read

•

Our People and AI: Making the magic happen

2 min read

•

Taking Indian talent to the world stage

2 min read

•

Pragmatic and empowering: The force behind India’s energy story

2 min read

•

A to B: Turning Artificial Intelligence into Business Intelligence

3 min read

•

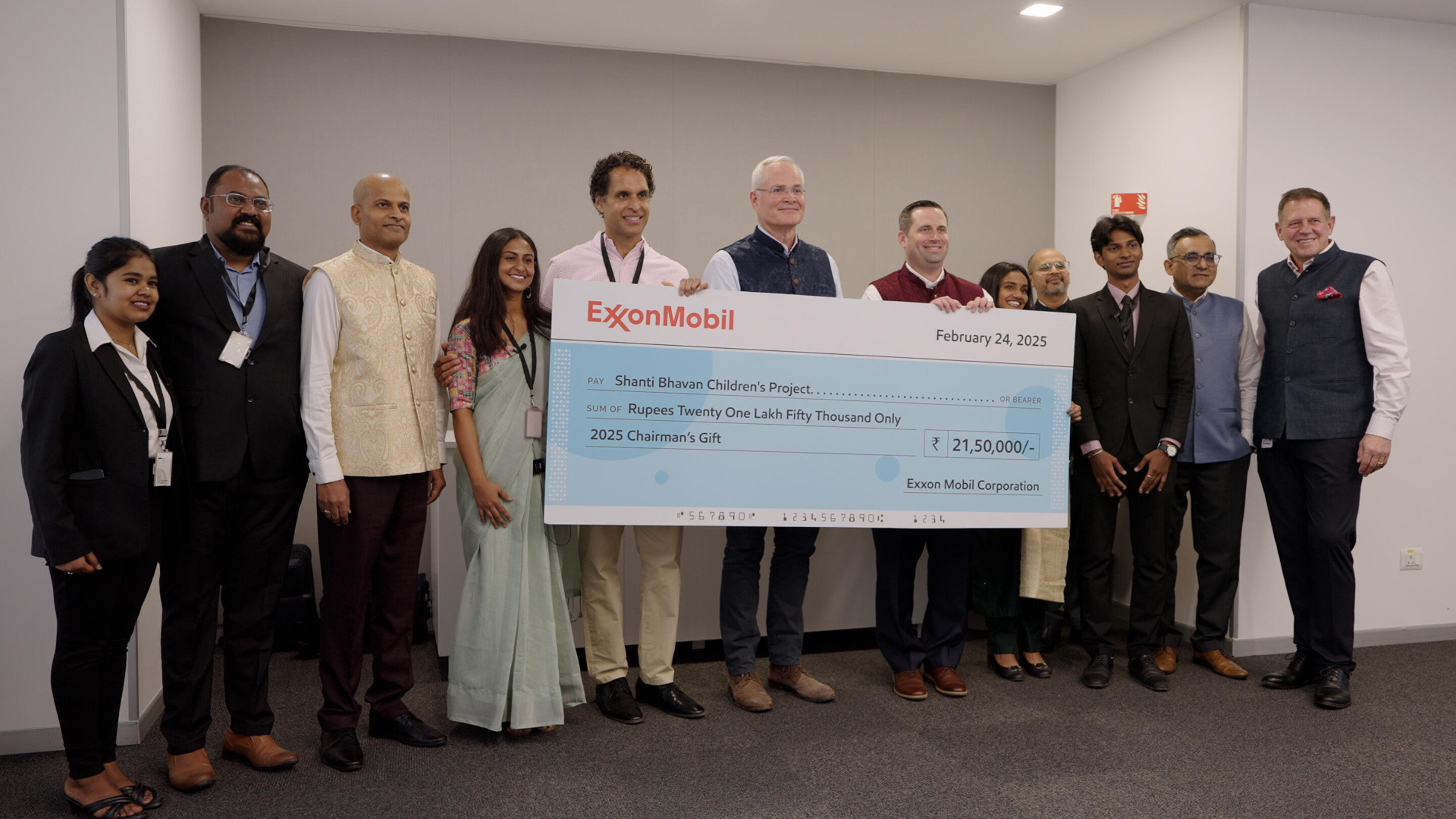

Changing lives with the power of education

5 min read

•