selected item

4 min read

•LNG to power commercial trucks in India? An idea whose time has come

Key takeaways:

- Liquefied natural gas (LNG) is a lower-emission fuel for heavy-duty commercial trucks.

- A broader LNG switch can also help lower India’s oil-import bill.

- Incentives such as tax cuts and priority lanes for LNG trucks could enable faster adoption of this fuel.

4 min read

•When it comes to meeting India’s energy needs, there’s no one-size-fits-all solution.

As the country grows and people move more, it’ll pursue a combination of diverse energy sources that provide security, affordability, and accessibility while reducing emissions.

Which is why I, and many industry analysts, believe natural gas will remain one of India’s go-to energy sources for decades ahead. Available, abundant, and accessible, gas can help meet India’s growing need for lower-emission energy.

Be it industry, power, or transportation, gas delivers wherever it’s put to work. This makes India’s goal of growing gas’ share in the primary energy mix to 15% by 2030 achievable. One area where we can see gas making a major impact in India is transport.

Get going with gas

Gas is already building on its potential in transportation, eyeing a bigger role in powering passenger, utility, and heavy-duty commercial vehicles. In fact, vehicles powered by compressed natural gas (CNG) continue to grow dramatically: CNG vehicle sales in 2023 reached 1.8 lakh, growing 53% compared to the previous year.

Lower running and maintenance costs, coupled with increasing accessibility to CNG stations, are key to driving this growth. This is especially true for urban India where gas growth in transportation can also help improve air quality.

Currently, India has more than 6,200 CNG stations, with aggressive plans to extend the network to 10,000 by 2030. But while CNG can power a variety of vehicles, it’s not as effective at fuelling heavy-duty vehicles. Liquefied natural gas (LNG) can fill this gap.

LNG for heavy duty

As India’s trucking market expands from 4 million trucks in 2022 to an expected 17 million trucks by 2050, LNG is emerging as a viable alternative fuel for its commercial trucking fleets that are currently powered by diesel.

So, what sets LNG apart?

While both LNG and CNG are natural gas, they are in different states of energy density. Super-chilled and liquid, LNG takes up to three times less space than CNG, providing higher energy density and vehicle range with a similar size of fuel tank.

This means you can go further with less fuel.

Then there are the environmental benefits. India’s transportation sector accounts for about 13.5% of its carbon emissions and studies show that the heavy-duty transport segment is the biggest contributor to urban air pollution.

Compared to diesel, LNG vehicles have up to 30% lower carbon emissions, 90% lower nitrogen and PM emissions, and almost no sulphur emissions. They even have quieter engines.

A large-scale LNG switch can also help reduce India’s oil-import bill. A recent report by government think-tank Niti Aayog says that even if only 10% of new diesel vehicles switch to LNG by 2032, India’s oil-import bill could lower by USD 1.5B over this period.

But how expensive will this switch be? Let’s consider the total cost of ownership (TCO), which includes capital, fuel, and annual maintenance costs. Data from the Niti Aayog report shows that TCO for heavy-duty diesel and LNG vehicles is comparable (but significantly higher for electric vehicles).

Creating a smooth runway for LNG

India is taking the early steps to help LNG replace diesel in commercial transportation.

This includes plans to set up LNG-dispensing stations along the major national highways and increasing LNG-import capacity. Picking up the cue, the state of Maharashtra recently announced plans to convert 5,000 diesel vehicles to LNG over the next three years.

But if LNG is to be for commercial trucks tomorrow what CNG is for passenger vehicles today, India will need to do more.

Incentives recommended by the Niti Aayog include tax cuts on LNG heavy vehicles as well as providing priority lane access in major cities and main roads. It has also defined a target of nearly 800 fuelling stations by 2030 to enable a large-scale LNG switch.

Proposed policies like these can make the switch to LNG economic and aligned with long-term climate targets. If the Niti Aayog recommendations are actioned, India can expect significant LNG adoption in commercial trucking as well as demand growth.

As India’s trusted energy partner, we can help meet India’s growing demand for LNG. We’re on track to double our global LNG portfolio by 2030 and well positioned to deliver natural gas from our large, high-quality resources and facilities.

With India setting strong emission-reduction targets for 2030 and reaching net-zero by 2070, natural gas can do part of the heavy lifting in advancing lower-emission growth for the country.

We’re looking forward to doing our part.

Energy supply

Explore more

Meet our STEM talent: Their mission is to drive meaningful change

2 min read

•

Our People and AI: Making the magic happen

2 min read

•

Taking Indian talent to the world stage

2 min read

•

Pragmatic and empowering: The force behind India’s energy story

2 min read

•

A to B: Turning Artificial Intelligence into Business Intelligence

3 min read

•

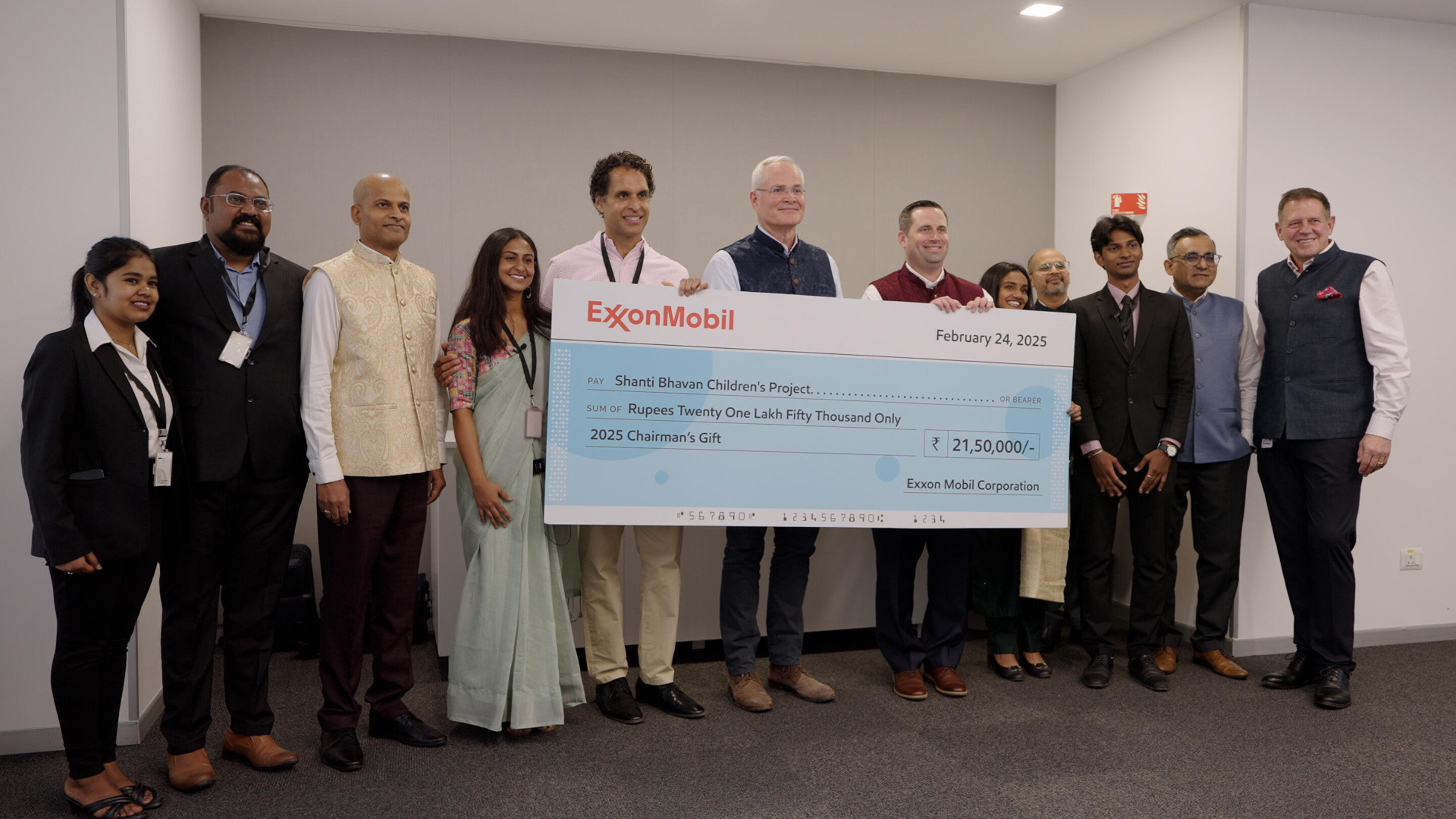

Changing lives with the power of education

5 min read

•