selected item

Why Windfall Taxes Are no Solution to Europe’s Energy Crisis

3 min read

•During this past year we have seen enormous disruption in the energy markets in Europe and we recognize that this is weighing heavily on families and businesses. Reducing the high energy prices paid by European consumers and businesses while avoiding dependence on Russian energy supplies has to be one of the biggest challenges facing European leaders today.

Part of the solution is to reduce demand. Throughout 2022, Europe made good progress through various means, such as increased energy efficiency and switching to alternative fuels including renewables. This past year, our refineries in Europe reduced their natural gas consumption by 65%.

Equally important, though, is to increase the supplies of energy – both renewable and conventional. To meet its energy demand, Europe needs to grow local production and ensure it has access to reliable international supply sources.

Our industry has a critical role to play in producing and delivering these additional supplies. Substantial investments are needed across all energy sectors if prices are to return to more affordable levels.

ExxonMobil continued to invest in Europe to sustain reliable supplies despite an unfavourable economic environment. In the past 10 years, ExxonMobil has invested no less than €20 billion in our European businesses. Just a few years ago, we completed two upgrades to our refineries in Rotterdam and Antwerp that significantly increased our diesel production and firmly put these facilities in the top 10% of the most energy-efficient refineries in Europe. These recent investments are now directly helping to reduce reliance on Russian supplies.

Looking forward, ExxonMobil is planning to invest $17 billion in lower carbon emissions opportunities around the globe. Major projects under consideration in Europe include green hydrogen production and renewable fuels in Norway, blue hydrogen in the UK, and various CCS opportunities across the EU.

Governments need to help, not hinder those investments. They should give businesses confidence that Europe offers an investment environment that is stable and predictable, especially at a stage where Europe is looking to attract billions in investments to support the transition to a net zero economy.

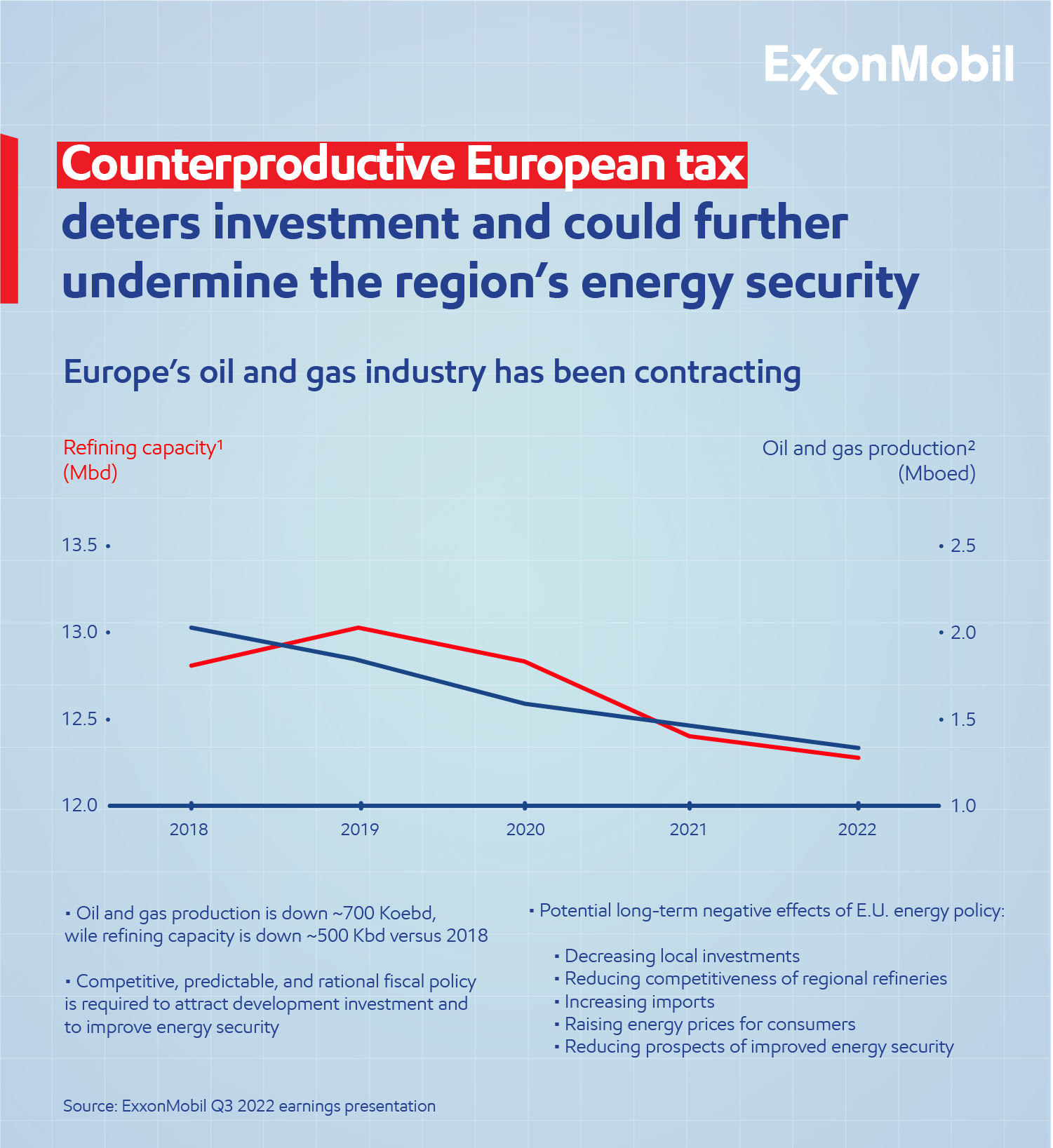

By imposing new and retroactive ‘windfall’ taxes on the profits of energy companies, European governments simply deter companies from investing. This further threatens the competitiveness of a European manufacturing industry already burdened by higher costs and taxes than international competitors. Ultimately, this may lead to greater reliance on imports from countries less committed to climate targets.

The oil and gas industry, for example, was already among the highest tax-paying industries in Europe, with some countries taxing as much as 75% of the industry’s profits. Profits have risen recently, as commodity prices have responded to disruptions in global energy markets and years of under-investment. However, this follows a period of much lower earnings. Our earnings in 2022 help recover losses well in excess of €1 billion in our European fuel and natural gas business in the years before.

Windfall profits taxes may look politically attractive for the short-term, but the unintended longer-term consequence is likely to be sustained high energy prices, lower energy security and less competitive European industry. It may also cause investors to delay investments needed to reach Europe’s net zero goals. If the goal is lower consumer prices and an affordable energy transition, windfall taxes are likely to have the opposite effect.

Delivering industrial solutions

Explore more

Saving Europe’s Core Industries: Cut the Red Tape

3 min read

•

The Sci-Tech Challenge: Shaping the future of STEM in Europe

5 min read

•

Europe’s industrial future is under threat – but policy reform can change that

3 min read

•

Chemical Recycling

A bone-crushing burden: Darren Woods discusses CSDDD

2 min read

•