selected item

Article

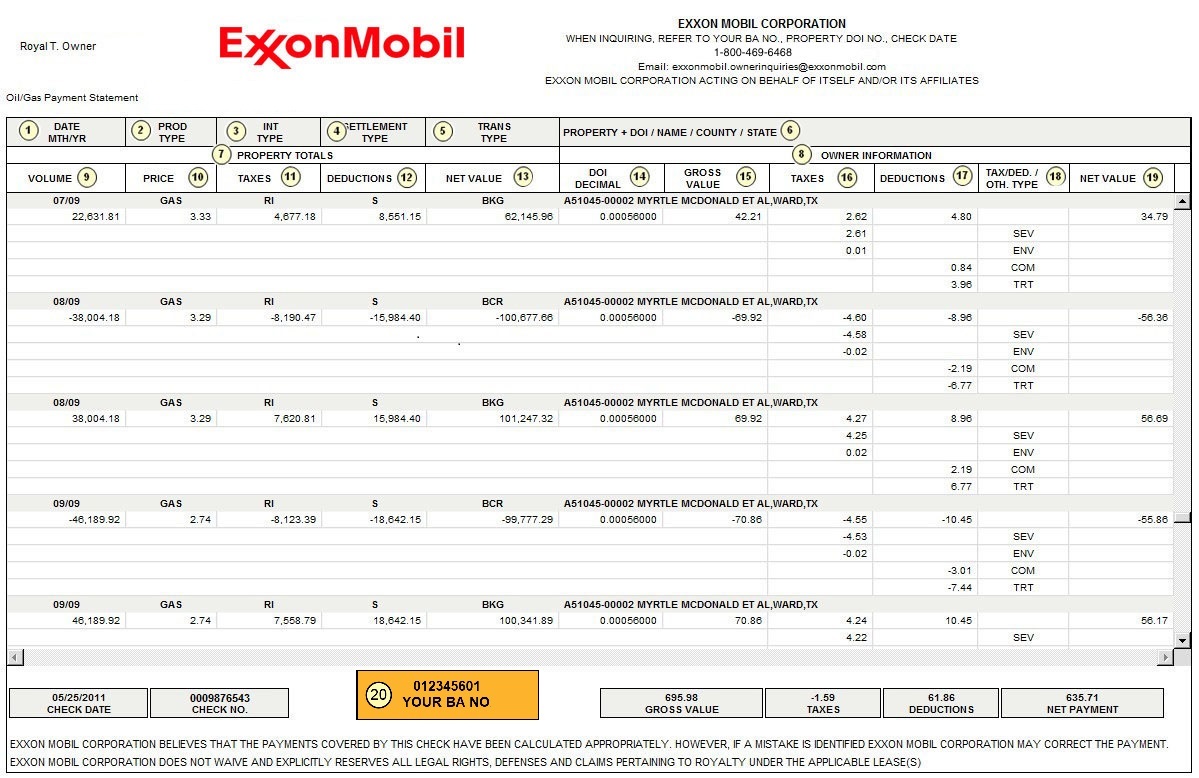

How to read your CheckStub

Check detail explanation

Article

- (1) DATE MTH/YR: The date shows the month and year in which the product was produced.

- (2) PROD TYPE: The product type which is being reported; legend is accessed by clicking "Display download codes list".

- (3) INT TYPE: The interest type which is being reported; legend is accessed by clicking "Display download codes list".

- (4) SETTLEMENT TYPE: Settlement type "E" indicates payment for a specific property is based on entitlement which equals your share of production. "S" indicates payment for a specific property is based on sales made or production taken by the party selling or taking the production that is covered by your interest.

- (5) TRANS TYPE: The transaction type indicates whether entry is an initial or revised payment, a reversal of a previous entry, a net adjustment for a prior month, or a release and/or transfer of suspended funds. See legend on back of check stub.

- (6) PROPERTY + DOI / NAME / COUNTY / STATE: The property + DOI number (also known as Division Order #), is used to identify the producing property. The property name, county or parish, and state follow.

- (7) PROPERTY TOTALS: If Settlement type is 'E' (col 4) the property totals (cols 9-13) represent 100 percent of the products produced from the property. If Settlement type is 'S' (col 4), the Property totals (cols 9-13) represent the amounts of products sold or taken by the party selling or taking the production that is covered by your interest divided by the percentage that the party is entitled to sell.

- (8) OWNER INFORMATION: The owner information includes the Division of Interest (DOI) decimal (col 14), values related to your decimal of interest in the property (cols 15-17 and 19), and identifies the type (col 18) for the amounts shown in cols 16-17.

- (9) VOLUME: The volume shows the quantity of product allocated to the total property.

- (10) PRICE: The price is determined by dividing the amount of the Property Total Gross Value (sum of cols 11, 12 and 13) by the volume (col 9).

- (11) TAXES: The taxes column shows severance and other state or federal tax deductions for the property.

- (12) DEDUCTIONS: The Property deductions column shows property costs incurred between the point of production and the sales point.

- (13) NET VALUE: The Property Totals net value column shows the value after state or federal tax and other deductions for the total property. This provides the basis for computing payments to royalty and other interest owners.

- (14) DOI DECIMAL: Your decimal of interest as it appears on your Division of Interest (DOI decimal) or division order.

- (15) GROSS VALUE: The Owner Total gross value column is determined by multiplying your Division of Interest (DOI) or division order decimal (col 14) by the amount of Property Total Gross Value (the sum of cols 11, 12, and 13).

- (16) TAXES: The Owner taxes column shows your share of applicable taxes.

- (17) DEDUCTIONS: Your share of property deductions used in arriving at your payment is shown in column 17. See Column 18 for types of property Deductions or Other Payment Types (you have access to the legend by clicking on the link 'Display/Download Codes List').

- (18) TAX/DED./OTH.TYPE: TAX/DED/OTH TYPE is an ExxonMobil code used to identify the Tax, Deductions or Other Payment Types (you have access to the legend by clicking on the link 'Display/Download Codes List').

- (19) NET VALUE: The Owner net value column shows the amount payable to you and is determined by taking the Owner Gross less Owner deductions less Owner Taxes.

- (20) YOUR BA NO.: Your BA NO. is your exclusive identification number with ExxonMobil and should be included in all correspondence you have with us regarding your payments.